Planning to start Digital Wallet App Development?

The growing dependency of users on smartphones for various daily tasks has increased. Need to buy your favorite outfit…there are multiple shopping platforms to get one. Planning a holiday trip for these summers… book flight/train tickets from the convenience of your home by making hotel reservations at ease. And of course; need to pay at general stores or marketplaces, just simply use digital wallets. How bookings, buying products, and making reservations have become so easy today? Simply because of digital wallet apps.

With this digital wallets have extensively been used today. Most users love using it because it eliminates the need to carry a physical wallet by storing all the user’s payment information securely and compactly. Some of the popular digital wallets include Google Pay and Apple Pay. Both services enable you to access your financial products and make purchases from your devices.

Key Findings From The Market Research Of Digital Wallets Apps

- According to J.P. Morgan’s report on Digital Wallets, almost 50 percent of global shoppers are using digital wallets more than before the pandemic, particularly in the U.S.

- Global digital wallet sales are predicted to exceed $10 trillion by 2025; a remarkable 83% increase from the last two years respectively. With this merchants are strongly integrating digital wallets for a better shopping experience.

- The current Digital Payments Market has reached USD 11.55 trillion and is expected to show an annual growth rate of 9.52% resulting in a total estimated amount of USD 16.62 trillion by 2028.

- According to Market Research Future, the E-Wallet market industry is projected to grow from USD 105.5 Billion in 2023 to USD 567.2 Billion by 2032.

Also Check:

What Are Digital Wallets?

A digital wallet (also known as an electronic wallet) is a financial transaction application that may be used on any connected device. It securely stores your payment details and passwords in the cloud. Digital wallets can be accessed via a computer; mobile wallets, a subset, are largely used on mobile devices.

How Does It Work?

Digital wallets are programs that leverage the capabilities of mobile devices to facilitate access to financial products and services. Digital wallets reduce the need for a physical wallet by securely and compactly storing all of a consumer’s payment information.

Digital wallets use a mobile device’s wireless capabilities, such as Bluetooth, WiFi, and magnetic signals, to securely communicate payment data from your smartphone to a point of sale that is programmed to read and connect to these signals. Current technologies used by digital wallets are QR codes, NFCs (Near Field Communication), and MSTs (Magnetic Secure Transformation) subsequently.

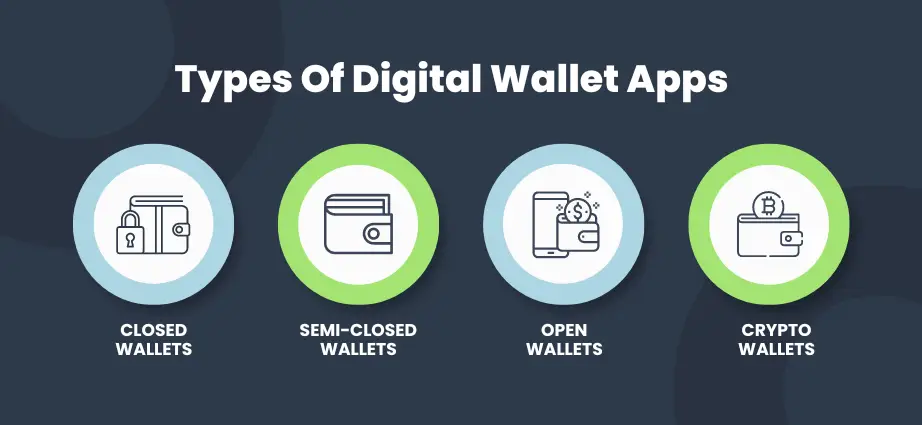

Types Of Digital Wallet Apps?

There are various types of digital wallet apps. You can choose the one that best fits your business model, target user needs, location, and device operating system. Some of them are mentioned below:

Closed Wallets

Closed wallet apps are those that allow users to make payments via the app or website. However, these wallets are created by businesses that sell items or services and allow customers to pay using the wallet provided. In the event of a canceled transaction or refund, the entire amount is credited back to your wallet, which you cannot spend on another platform or with other businesses.

Semi-Closed Wallets

A semi-closed wallet, such as Apple Pay or Google Pay, can be created and utilized as an integrated payment system between a business and its customers. Semi-closed digital wallet app development allows you to serve as an integrated payment system for merchants and customers. Whereas businesses enter into a contract or agreement with you to use the application, customers must supply personal information such as their bank or debit card number, location, and other identification verification, such as creating pins, to ensure safe payment transactions.

Open Wallets

Open wallet apps are intended to support all types of transactions. These wallets allow you to transfer funds and receive payments both online and in-store. If you are creating an open wallet, be sure that transactions may be completed from anywhere in the world. These wallets need both the sender and the receiver to have accounts in the same application.

Crypto Wallets

Crypto wallet development entails creating mobile apps that store and transfer coins. These wallets contain the user’s public and private keys, also known as ownership certificates, to facilitate transactions through their application.

Why Should You Invest In Digital Wallet App Development?

Are you still in a dilemma to either create a digital wallet app or not?

Well if you are; we have some awesome advantages you must read out before reaching any particular conclusion…

Common Benefits

Global Potential For Markets

Borders do not limit digital wallets. They may be accessed by anybody with a smartphone, regardless of location. This makes them a scalable investment opportunity with a global footprint.

Ease And Accessibility

Digital wallets allow users to easily make payments, move money, and manage their finances. They can be used anywhere, at any time, and do not require the user to carry cash or cards.

Transactions Are Secure

To protect users’ data, digital wallets employ several security measures, including encryption, biometric verification, and two-factor authentication. This makes them a more secure payment method than cash or credit cards.

Reduced Cash Dependency

Digital wallets aim to decrease the need for actual currency. This trend is being driven by the growing use of mobile payments and more awareness of the risks connected with cash.

Various Use Cases

Digital wallets can be used for various applications, including payment processing, financial transfers, ticket booking, and loyalty point storage. This makes them a versatile and useful tool for both enterprises and consumers.

Partnerships And Collaborations

Users can receive discounts, rewards, and other perks through digital wallet partnerships with businesses, shops, and service providers. This can help to enhance acceptance and the overall value of the digital wallet ecosystem.

Potential To Break Old Financial Services

Digital wallets can shake up the existing financial services industry. They may minimize the need for cash and credit cards by making payments easier and more convenient.

Also Read:

Consumer Benefits

Quick Payments

We live in an on-demand world. We expect to be able to conduct online research at any time, authorize invoices via email, and receive pizza delivery via smartphone at midnight. Many people carry their phones and digital wallets with them at all times. This includes their credit and debit cards.

Vital For Daily Needs

A competitive sales market requires the ability to offer. Providing a personalized payment experience can be a crucial differentiation. Improved functionality allows for peer-to-peer payments, meal sharing, and bill splitting among housemates.

Great Deals And Collaboration

Digital wallets enable seamless integration of reward programs like air miles and store loyalty programs, making deals more appealing to consumers. Google Pay operates with several firms, including Burger King, Panera, Etsy, and Warby Parker, to provide digital wallet-based deals and discounts.

Integrated Banking

Some payment apps, including Venmo and Google Pay, can integrate peer-to-peer payments. This allows users to split when splitting a restaurant or rideshare cost with pals, they can opt to pay with their bank account, debit, or credit card.

Instant And Secure Transactions

Most likely, you’ve already made this payment. Consider Uber or subscription wine or beer services that offer fast payments. Automatically, without the need for several authorizations. Customers want to shop securely, seamlessly, and with minimal transactions, therefore the checkout process is becoming less prominent.

Easily Accessible

Because a mobile wallet is built into your smartphone, it is constantly accessible and makes everyday transactions faster and easier.

Merchant’s Benefits

Insights into customer purchase habits

Digital wallets benefit businesses in ways other than financial transactions. It also offers real-time data analysis of clients’ shopping histories and preferences, allowing for better-focused marketing campaigns. Using the same method, a business may manage inventory and establish more realistic budgeting.

Improved Customer Experience

Mobile wallets make the checkout process easier by requiring fewer click-throughs and auto-fill forms. As a result, conversion rates rise, which benefits both businesses and customers.

Also Read:

Serve As An Alternative Payment Option

Mobile wallets can be utilized as an alternate payment method for clients because not all customers, particularly Generation Z, prefer carrying cards or cash. Having a contactless payment option in place helps you to accept payments from the younger generation, who are often on the go or prefer digital methods for everything. Digital wallets also allow you to accept payments such as Bitcoin and direct PayPal payments.

Secure Financial Information

Protecting cardholder information is critical for your organization, as any security breach can harm your reputation. Digital wallets give an extra degree of protection by utilizing biometrics such as fingerprint and facial recognition technology to protect users’ financial information.

Essential Features To Add To Your Digital Wallet App Development

Now let’s understand the entire process of Digital Wallet App Development by knowing what features to add, the required technological stack, the security measures you must add, and understanding the whole developmental process. Below are some of the common features you need to add to your digital wallet app:

Create An Account

As with most apps, the user is required to register their account on a mandatory basis. Users are required to provide their email address and phone number. He will be given a verification code, and after entering it, the application will register his account. Some e-wallet apps use KYC (Know Your Customer) to ensure secure fund transfers.

Linking a Bank Account

The next step is to link your bank account information to the e-wallet, where you will conduct transactions and other payments. Furthermore, you must provide your card information, such as the CVV number and expiration date.

Deposit Money Into Your Account

You must provide an option to add extra money to the wallet. You can deposit funds into the wallet from the appropriate bank. After entering that amount, it will be reflected in the wallet.

Sending Or Receiving Funds

E-wallets allow you to send money to someone by either entering the recipient’s phone number or scanning a QR code. You can also utilize NFC or beacon technologies to transfer money. Payment can be received similarly.

The E-wallet Passbook

It becomes necessary to include an E-wallet passbook so that users can track their transaction history. You can also use the filter option to conduct a more focused search.

Send Money Back to Bank

Nowadays, the E-wallet program also has a feature that allows users to send money back to their bank accounts when they do not wish to keep extra cash in their wallet. Furthermore, each app has established a monthly limit for utilizing the wallet. If the amount exceeds the limit, you will be unable to complete any additional transactions.

Purchasing Insurance

The software allows you to pay your insurance premiums on time. Furthermore, you can use an app to pay your income and sales taxes.

Reservations For Flights And Trains

Recently, e-wallet companies such as PayTm added the ability to make airplane, train, and bus bookings using the app. All you have to do is enter your travel information and complete the simple payment process.

Shopping for Grocery and Other Products

E-wallet apps are improving their user-friendly features. In this context, they provide online grocery shopping in addition to other product categories like accessories, apparel, home items, electronic appliances, mobile phones, and even vehicles and bikes.

Order History

The order history shows all of the orders a customer has placed using the E-wallet app, whether they be paying bills, booking movie tickets, or buying an item. In this situation, the user has bought an item. As a result, the app must provide the progress of his order as well as the delivery date. This is something that e-commerce apps do.

Step-By-Step Guide To Digital Wallet App Development

Planning Stage

The first step is to identify the target audience and select a platform that they are likely to use. For example, if you know that your consumers would mostly utilize iOS devices with 4G internet access, an iPhone e-wallet app might be perfect.

Next, create a strategy outlining how the user will progress through the various stages of the e-wallet procedure, including information on where to tap next and what happens when they tap on specific screens.

Designing Stage

The Designing stage comes with choosing colors, fonts, navigation elements, and other layout options. Then you may start wireframing the UI design by making basic sketches of each screen and sketching interactions across panels to map out potential difficulties before implementing code later on.

Ensure that the application’s design team understands all of the e-wallet app development costs. They will collaborate closely with mobile developers, content developers, graphic designers, UX specialists, and QA analysts to ensure that everything functions as expected.

Coding Stage

This is a critical stage in which previously planned functionalities are eventually realized. The developer’s team will present you with a final prototype and specs document from your design team, at this point, you will start building out each screen of your e-wallet app development cost.

The app development businesses must offer you a timeline that outlines how long each stage of the process will take. These timetables can vary depending on several factors, such as the quantity of resources available, the cost of digital wallet app development, and time limitations.

Testing Stage

The quality assurance team collaborates closely with developers and designers to guarantee that each stage of the e-wallet app development cost is thoroughly examined. It is an important component of the e-wallet software development process since it guarantees that all functionality works as expected.

The testing stage usually includes unit testing which involves checking each unit or functionality individually. It is accompanied by system-level testing to verify the app functions running smoothly. Lastly, your digital wallet app is cross-checked through UAT (User Acceptance Testing) to validate the app based on its business requirements, standards, or required security system.

Launching Stage

The launching stage comprises deploying the E-wallet app development cost so that consumers may gain live access. Once the application is live, you will have a dashboard to monitor its success. The dashboard displays precise statistics about how many individuals downloaded and installed the app, what actions they took, and how much revenue was earned.

Also Read:

Required Technological Stacks For Digital Wallet App Development

Here are some of the popular tech stacks used for Digital Wallet App Development:

| Frontend Development | PHP, NodeJS, Python, Java, etc. |

| For Backend Development | Kotlin, Swift, CSS, Bootstrap, HTML 5, Vue.js, React.js, Angular, etc. |

| QR Code Scanning | ByteScout BarCode, ZBar Code Reader, etc. |

| Push Notifications | Amazon SNS, Google Firebase, etc. |

| For Real-Time Analytics | Hadoop, Apache, and Spark |

| For Cloud Services | Salesforce, Google Cloud, AWS, and Azure |

| For Enabling Location | Google Maps API |

| For Cross-Platform Framework | Ionic, React Native, Flutter, Xmarian, etc |

| For Integrating Database | HBase, Cassandra, and MongoDB |

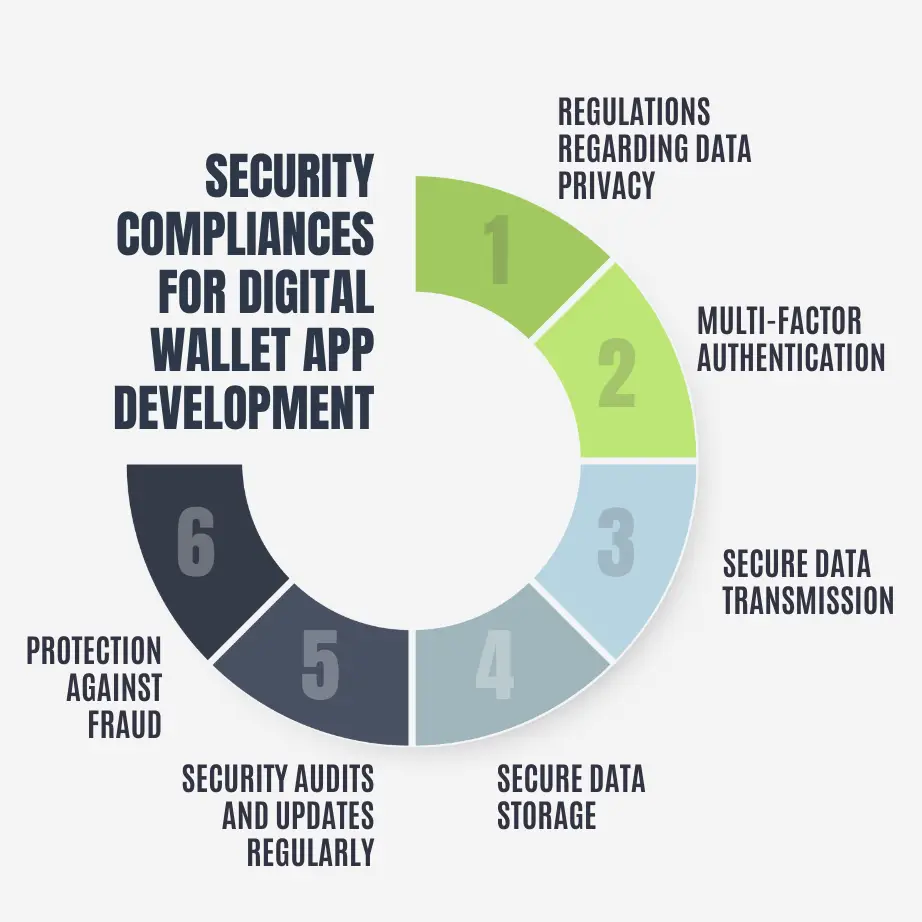

Security Compliance For Digital Wallet App Development

Regulations Regarding Data Privacy

You must follow the best practices for implementing data privacy rules in the state or region where you intend to run the application. Common rules and compliance requirements include the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA).

Multi-Factor Authentication

You must add an extra layer of security to your digital wallet software by enabling multi-factor authentication. For example, an iPhone application validates the user’s authentication using face recognition, pin, password, and device number.

Secure Data Transmission

In the digital age, it is necessary to secure data while in transit. To deliver a secure and speedier transaction experience on your mobile application, ensure that your developer has incorporated SSL/TLS/VPN encryption. These encryptions enable safe data transmission between the application and the server.

Secure Data Storage

You must also secure user data and financial information, such as credit card information, while at rest. Encryption, hashing, and other secure storage methods are employed to protect users’ sensitive information against fraud and unauthorized access.

Security Audits and Updates Regularly

With an increasing number of cybersecurity events and information leaks, there is a developing legislative and compliance framework for cybersecurity, as well as an evolving technology environment. Data breaches have far-reaching effects on the financial sector, resulting in increased fines and litigation. You must conduct frequent security audits on your mobile wallet application to uncover vulnerabilities and deploy timely security fixes.

Protection Against Fraud

Mobile wallet software development should contain tools that detect and prevent fraudulent behavior, such as illegal access, transaction monitoring, and suspicious activity reporting.

Also Read:

Some Famous Digital Wallet Apps You Must Know About

Apple Pay

It has emerged as a leader in the digital wallet industry for iPhones, iPads, and Apple Watches, with a user base that will grow from 521.4 million to 535.8 million by 2022. To make payments more easily and securely, use it online, in applications, and retail. Apple Pay’s user base climbed from 521.4 million to 535.8 million by 2022.

Google Pay

Google Pay (also known as Google Wallet in some places) has emerged as a leader in the digital wallet industry, with over a billion downloads and 4+ ratings on the Play Store. This eWallet, trusted by over 150 million people globally, facilitates in-app, online, and in-person purchases on mobile devices, allowing users to manage their funds using Android phones, tablets, or watches.

Paypal

With over 435 million users worldwide, PayPal is one of the most trusted and widely recognized digital wallets, allowing international transactions with practically any form of card. It is a faster and safer way to transmit and receive money, eliminating old paper methods like checks and money orders.

Conclusion

Reaching the end of our blog on Digital Wallet App Development, we must agree on this common fact that the everyday need for digital wallets is an undeniable fact to all of us. The current benefits of payment apps in multiple places have revolutionized the world more smartly and easily. With this, we can agree upon the evolution of digital payments very soon and so it’s faster developmental process. To differentiate yourself from other digital wallets and gain a greater market share, work with an experienced digital wallet app development business like Echoinnovate IT.

Design A Future-Ready Digital Wallet App With Echoinnovate IT!

Design a Future-Ready Digital Wallet App with Echoinnovate IT. We have provided clients with entire payment application development and integration support, and we can assist you in planning and strategizing every step of your product development and launch process. You may improve the user experience and expand your payment alternatives by leveraging our expertise and support throughout the development process.

Talk With Our Experts Today!

Also Read:

FAQs- Digital Wallet App Development

What is a digital wallet app?

A digital wallet app is a mobile application that allows users to store, manage, and transfer their digital assets, including money, loyalty cards, and payment information, securely on their mobile devices.

How do digital wallets work?

Digital wallets use encryption technology to store and secure user information. They enable transactions through various methods such as NFC, QR codes, or online transfers.

What features should a digital wallet app have?

Key features include secure user authentication, payment integration, transaction history, loyalty program support, and compatibility with various payment methods.

What technologies are commonly used in digital wallet app development?

Common technologies include mobile app development frameworks (e.g., React Native, Flutter), secure APIs, and integration with payment gateways and blockchain for added security.