As digital payments become the new normal, digital wallet app development is emerging as a top priority for businesses aiming to meet consumer demand for fast, secure, and contactless payments. In 2025, more than half of online purchases in the U.S. are completed using mobile wallets. Whether you’re a fintech startup or an enterprise looking to digitize payment operations, building a digital wallet app for Android and iOS is a high-ROI investment that aligns with user behavior, mobile-first innovation, and financial regulations.

Why Invest in a Mobile Wallet App in 2025?

Consumers are shifting toward mobile payment solutions due to their ease, speed, and security. Businesses adopting digital wallet apps improve transaction flow, reduce cart abandonment, and offer features like tap-to-pay, QR code payments, and biometric login. Whether it’s P2P transfers, in-app purchases, or crypto integration, wallets offer a comprehensive mobile payment experience. With rising smartphone penetration and contactless adoption in the U.S., wallets are replacing traditional banking for a growing segment of users.

Must-Have Features for a Successful Digital Wallet App

To stay competitive, wallet apps in 2025 should include:

NFC and QR Code Integration for seamless tap-to-pay and scan-to-pay functions across retail and e-commerce platforms.

Biometric Authentication such as fingerprint or facial recognition for fast, secure logins and payments.

Multi-Currency and Crypto Support to allow users to store and exchange digital assets securely.

AI-Powered Fraud Detection that identifies unusual patterns and enhances payment security.

Loyalty Programs and Cashback Offers to retain users and incentivize repeat transactions.

Voice-Enabled Payments and Navigation to improve app accessibility.

Real-Time Transaction History and Analytics for greater transparency.

Cross-Platform Compatibility (Android/iOS) to reach the widest possible audience.

The Technology Stack Behind Mobile Wallet Apps

Building a digital wallet app requires a robust tech stack that includes:

Frontend Frameworks: Flutter or React Native for cross-platform development.

Backend Technologies: Node.js, Python, or Java for scalable architecture.

Databases: PostgreSQL or MongoDB for secure and flexible data storage.

APIs & SDKs: Payment gateways, biometric authentication, and crypto wallets.

Cloud Integration: AWS or Google Cloud for secure hosting and auto-scaling.

Security Protocols: PCI-DSS compliance, encryption, and tokenization for financial safety.

2025 Trends Shaping Digital Wallet Development

Tap-to-Pay Expansion: iOS now allows third-party apps to access NFC functionality, opening the door to more wallet apps in the Apple ecosystem.

Crypto Wallet Growth: Users increasingly want wallets that can store, convert, and transfer cryptocurrency.

Regulatory Oversight: Digital wallets are now under similar scrutiny as banks, especially regarding privacy and fraud prevention.

Super App Evolution: Wallets are becoming multi-functional platforms, integrating services like bill pay, ticketing, and insurance.

Voice and AI Integration: Voice commands and AI-powered finance insights enhance personalization and usability.

Planning to start Digital Wallet App Development?

The growing dependency of users on smartphones for various daily tasks has increased. Need to buy your favorite outfit…there are multiple shopping platforms to get one. Planning a holiday trip for these summers… book flight/train tickets from the convenience of your home by making hotel reservations at ease. And of course; need to pay at general stores or marketplaces, just simply use digital wallets. How bookings, buying products, and making reservations have become so easy today? Simply because of digital wallet apps.

With this digital wallets have extensively been used today. Most users love using it because it eliminates the need to carry a physical wallet by storing all the user’s payment information securely and compactly. Some of the popular digital wallets include Google Pay and Apple Pay. Both services enable you to access your financial products and make purchases from your devices.

Also Check:

What Are Digital Wallets?

A digital wallet (also known as an electronic wallet) is a financial transaction application that may be used on any connected device. It securely stores your payment details and passwords in the cloud. Digital wallets can be accessed via a computer; mobile wallets, a subset, are largely used on mobile devices.

How Does It Work?

Digital wallets are programs that leverage the capabilities of mobile devices to facilitate access to financial products and services. Digital wallets reduce the need for a physical wallet by securely and compactly storing all of a consumer’s payment information.

Digital wallets use a mobile device’s wireless capabilities, such as Bluetooth, WiFi, and magnetic signals, to securely communicate payment data from your smartphone to a point of sale that is programmed to read and connect to these signals. Current technologies used by digital wallets are QR codes, NFCs (Near Field Communication), and MSTs (Magnetic Secure Transformation) subsequently.

Types Of Digital Wallet Apps?

There are various types of digital wallet apps. You can choose the one that best fits your business model, target user needs, location, and device operating system. Some of them are mentioned below:

Closed Wallets

Closed wallet apps are those that allow users to make payments via the app or website. However, these wallets are created by businesses that sell items or services and allow customers to pay using the wallet provided. In the event of a canceled transaction or refund, the entire amount is credited back to your wallet, which you cannot spend on another platform or with other businesses.

Semi-Closed Wallets

A semi-closed wallet, such as Apple Pay or Google Pay, can be created and utilized as an integrated payment system between a business and its customers. Semi-closed digital wallet app development allows you to serve as an integrated payment system for merchants and customers. Whereas businesses enter into a contract or agreement with you to use the application, customers must supply personal information such as their bank or debit card number, location, and other identification verification, such as creating pins, to ensure safe payment transactions.

Open Wallets

Open wallet apps are intended to support all types of transactions. These wallets allow you to transfer funds and receive payments both online and in-store. If you are creating an open wallet, be sure that transactions may be completed from anywhere in the world. These wallets need both the sender and the receiver to have accounts in the same application.

Crypto Wallets

Crypto wallet development entails creating mobile apps that store and transfer coins. These wallets contain the user’s public and private keys, also known as ownership certificates, to facilitate transactions through their application.

Also Read:

Essential Features To Add To Your Digital Wallet App Development

Now let’s understand the entire process of Digital Wallet App Development by knowing what features to add, the required technological stack, the security measures you must add, and understanding the whole developmental process. Below are some of the common features you need to add to your digital wallet app:

Create An Account

As with most apps, the user is required to register their account on a mandatory basis. Users are required to provide their email address and phone number. He will be given a verification code, and after entering it, the application will register his account. Some e-wallet apps use KYC (Know Your Customer) to ensure secure fund transfers.

Linking a Bank Account

The next step is to link your bank account information to the e-wallet, where you will conduct transactions and other payments. Furthermore, you must provide your card information, such as the CVV number and expiration date.

Deposit Money Into Your Account

You must provide an option to add extra money to the wallet. You can deposit funds into the wallet from the appropriate bank. After entering that amount, it will be reflected in the wallet.

Sending Or Receiving Funds

E-wallets allow you to send money to someone by either entering the recipient’s phone number or scanning a QR code. You can also utilize NFC or beacon technologies to transfer money. Payment can be received similarly.

The E-wallet Passbook

It becomes necessary to include an E-wallet passbook so that users can track their transaction history. You can also use the filter option to conduct a more focused search.

Send Money Back to Bank

Nowadays, the E-wallet program also has a feature that allows users to send money back to their bank accounts when they do not wish to keep extra cash in their wallet. Furthermore, each app has established a monthly limit for utilizing the wallet. If the amount exceeds the limit, you will be unable to complete any additional transactions.

Step-By-Step Guide To Digital Wallet App Development

Planning Stage

The first step is to identify the target audience and select a platform that they are likely to use. For example, if you know that your consumers would mostly utilize iOS devices with 4G internet access, an iPhone e-wallet app might be perfect.

Next, create a strategy outlining how the user will progress through the various stages of the e-wallet procedure, including information on where to tap next and what happens when they tap on specific screens.

Designing Stage

The Designing stage comes with choosing colors, fonts, navigation elements, and other layout options. Then you may start wireframing the UI design by making basic sketches of each screen and sketching interactions across panels to map out potential difficulties before implementing code later on.

Ensure that the application’s design team understands all of the e-wallet app development costs. They will collaborate closely with mobile developers, content developers, graphic designers, UX specialists, and QA analysts to ensure that everything functions as expected.

Coding Stage

This is a critical stage in which previously planned functionalities are eventually realized. The developer’s team will present you with a final prototype and specs document from your design team, at this point, you will start building out each screen of your e-wallet app development cost.

The app development businesses must offer you a timeline that outlines how long each stage of the process will take. These timetables can vary depending on several factors, such as the quantity of resources available, the cost of digital wallet app development, and time limitations.

Testing Stage

The quality assurance team collaborates closely with developers and designers to guarantee that each stage of the e-wallet app development cost is thoroughly examined. It is an important component of the e-wallet software development process since it guarantees that all functionality works as expected.

The testing stage usually includes unit testing which involves checking each unit or functionality individually. It is accompanied by system-level testing to verify the app functions running smoothly. Lastly, your digital wallet app is cross-checked through UAT (User Acceptance Testing) to validate the app based on its business requirements, standards, or required security system.

Launching Stage

The launching stage comprises deploying the E-wallet app development cost so that consumers may gain live access. Once the application is live, you will have a dashboard to monitor its success. The dashboard displays precise statistics about how many individuals downloaded and installed the app, what actions they took, and how much revenue was earned.

Required Technological Stacks For Digital Wallet App Development

Here are some of the popular tech stacks used for Digital Wallet App Development:

| Frontend Development | PHP, NodeJS, Python, Java, etc. |

| For Backend Development | Kotlin, Swift, CSS, Bootstrap, HTML 5, Vue.js, React.js, Angular, etc. |

| QR Code Scanning | ByteScout BarCode, ZBar Code Reader, etc. |

| Push Notifications | Amazon SNS, Google Firebase, etc. |

| For Real-Time Analytics | Hadoop, Apache, and Spark |

| For Cloud Services | Salesforce, Google Cloud, AWS, and Azure |

| For Enabling Location | Google Maps API |

| For Cross-Platform Framework | Ionic, React Native, Flutter, Xmarian, etc |

| For Integrating Database | HBase, Cassandra, and MongoDB |

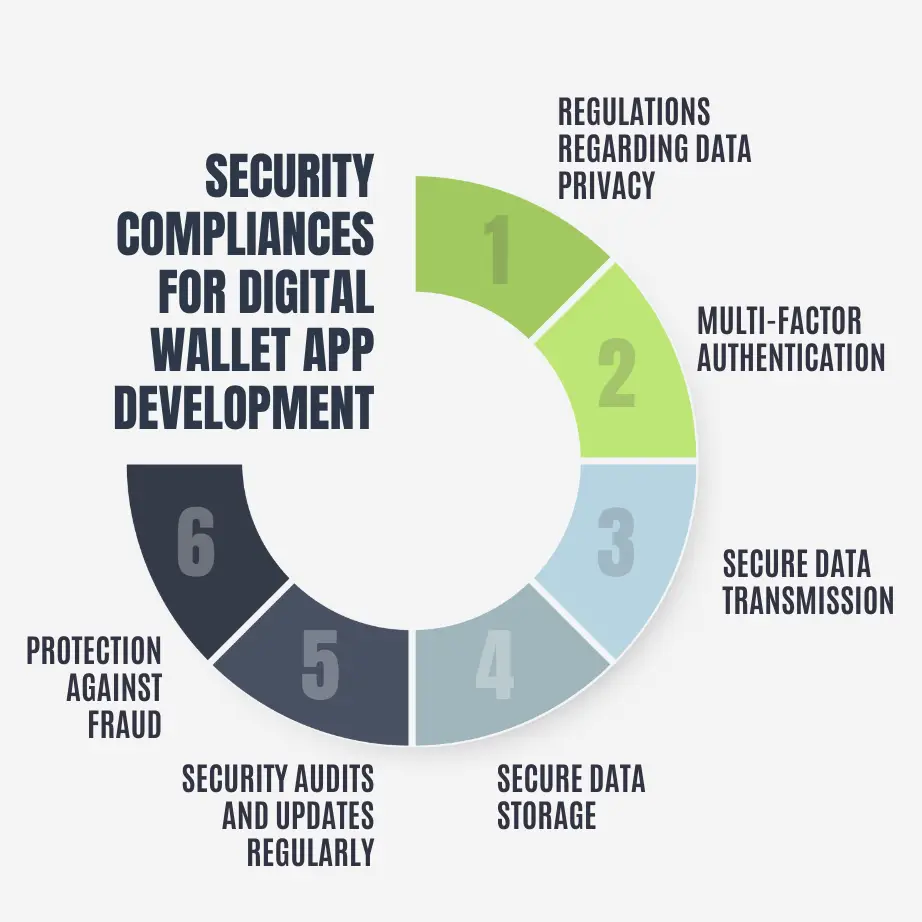

Security Compliance For Digital Wallet App Development

Regulations Regarding Data Privacy

You must follow the best practices for implementing data privacy rules in the state or region where you intend to run the application. Common rules and compliance requirements include the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA).

Multi-Factor Authentication

You must add an extra layer of security to your digital wallet software by enabling multi-factor authentication. For example, an iPhone application validates the user’s authentication using face recognition, pin, password, and device number.

Secure Data Transmission

In the digital age, it is necessary to secure data while in transit. To deliver a secure and speedier transaction experience on your mobile application, ensure that your developer has incorporated SSL/TLS/VPN encryption. These encryptions enable safe data transmission between the application and the server.

Secure Data Storage

You must also secure user data and financial information, such as credit card information, while at rest. Encryption, hashing, and other secure storage methods are employed to protect users’ sensitive information against fraud and unauthorized access.

Security Audits and Updates Regularly

With an increasing number of cybersecurity events and information leaks, there is a developing legislative and compliance framework for cybersecurity, as well as an evolving technology environment. Data breaches have far-reaching effects on the financial sector, resulting in increased fines and litigation. You must conduct frequent security audits on your mobile wallet application to uncover vulnerabilities and deploy timely security fixes.

Protection Against Fraud

Mobile wallet software development should contain tools that detect and prevent fraudulent behavior, such as illegal access, transaction monitoring, and suspicious activity reporting.

Also Read:

Some Famous Digital Wallet Apps You Must Know About

Apple Pay

It has emerged as a leader in the digital wallet industry for iPhones, iPads, and Apple Watches, with a user base that will grow from 521.4 million to 535.8 million by 2022. To make payments more easily and securely, use it online, in applications, and retail. Apple Pay’s user base climbed from 521.4 million to 535.8 million by 2022.

Google Pay

Google Pay (also known as Google Wallet in some places) has emerged as a leader in the digital wallet industry, with over a billion downloads and 4+ ratings on the Play Store. This eWallet, trusted by over 150 million people globally, facilitates in-app, online, and in-person purchases on mobile devices, allowing users to manage their funds using Android phones, tablets, or watches.

Paypal

With over 435 million users worldwide, PayPal is one of the most trusted and widely recognized digital wallets, allowing international transactions with practically any form of card. It is a faster and safer way to transmit and receive money, eliminating old paper methods like checks and money orders.

Conclusion

Reaching the end of our blog on Digital Wallet App Development, we must agree on this common fact that the everyday need for digital wallets is an undeniable fact to all of us. The current benefits of payment apps in multiple places have revolutionized the world more smartly and easily. With this, we can agree upon the evolution of digital payments very soon and so it’s faster developmental process. To differentiate yourself from other digital wallets and gain a greater market share, work with an experienced digital wallet app development business like Echoinnovate IT.

Design A Future-Ready Digital Wallet App With Echoinnovate IT!

Design a Future-Ready Digital Wallet App with Echoinnovate IT. We have provided clients with entire payment application development and integration support, and we can assist you in planning and strategizing every step of your product development and launch process. You may improve the user experience and expand your payment alternatives by leveraging our expertise and support throughout the development process.

Talk With Our Experts Today!

FAQs- Digital Wallet App Development

What is a digital wallet app?

A digital wallet app is a mobile application that allows users to store, manage, and transfer their digital assets, including money, loyalty cards, and payment information, securely on their mobile devices.

How do digital wallets work?

Digital wallets use encryption technology to store and secure user information. They enable transactions through various methods such as NFC, QR codes, or online transfers.

What features should a digital wallet app have?

Key features include secure user authentication, payment integration, transaction history, loyalty program support, and compatibility with various payment methods.

What technologies are commonly used in digital wallet app development?

Common technologies include mobile app development frameworks (e.g., React Native, Flutter), secure APIs, and integration with payment gateways and blockchain for added security.

How do digital wallets work on Android and iOS?

They use APIs and payment gateways to connect with banks and merchants. Android wallets often use Google Pay, while iOS wallets may integrate with Apple Pay or tap-to-pay functionality.

What are the benefits of digital wallet apps for businesses?

They reduce transaction time, increase customer loyalty, lower operational costs, and support contactless payments, which are preferred in post-pandemic economies.

Are digital wallets secure?

Yes. Most apps use multi-layered security, including encryption, tokenization, biometric verification, and AI-based fraud detection.

Can digital wallets support cryptocurrencies?

Absolutely. Modern wallets allow users to store, send, receive, and convert cryptocurrencies alongside traditional currencies.

How much does it cost to develop a digital wallet app?

Depending on features, platform (Android/iOS), and compliance needs, costs can range from $30,000 to over $150,000.

Is it necessary to develop for both Android and iOS?

Yes. For full market reach in the U.S., cross-platform compatibility ensures coverage across nearly all smartphone users.

What is a super wallet app?

It’s a digital wallet that includes multiple services like payments, budgeting tools, insurance, investments, and travel booking, all within one app.

What’s new in digital wallet trends for 2025?

Expect AI-powered recommendations, deeper crypto integrations, support for tap-to-pay on iOS, and government-driven regulations.

How do I monetize a digital wallet app?

Monetization strategies include transaction fees, ads, affiliate partnerships, premium features, and financial services upselling.