Gone are those days when you were queuing up in a long line at your respective bank branches for cash withdrawals, deposits or simply checking monthly bank statements or transactions. Technology in the last few years has impressively launched mobile banking to us and millions of users are already into it. With this, customers can easily access their bank accounts and complete transactions through mobile banking apps. With its developmental process, various banks at different locations are making their visibility on these digital banking apps and generating innovative methods to integrate cutting-edge technology into their operations.

So how can you make a custom banking app? The overall cost of developing a banking app may range from $20,000 to $400,000. Depending on the features and overall complexity of the program, the price may go up or down. A few other elements that affect the price of banking apps are the design of the app, the developers’ location and hourly rates.

Find the best cost of developing a banking app based on complexity, developer prices, hourly rates, must- add features and some smart ways by which you can reduce the cost of developing a banking app!

Why Do You Need To Develop A Banking App?

Mobile Banking Apps have revolutionized the world, both for greater customer experience and simultaneously for banks. We need these apps for the following reasons below :

- Mobile apps give banks a chance to increase revenue by allowing them to sell goods and services directly from the app. Also, their affordability, enhanced processing capacity, and user-friendliness enable customers to handle their money with convenience.

- Through payment services, customers can enjoy quick and safe payment operations with digital, or mobile wallets. With widespread use of mobile payment systems, the banking industry has seen a major change where users can now easily and instantly access their accounts.

- Given the increasing focus on payment services, mobile applications offer a means of improving user experiences and achieving operational excellence. The palm of our hands will control banking in the future, giving us easy access to financial services.

Factual Data That Validates The Growing Need Of Banking Apps

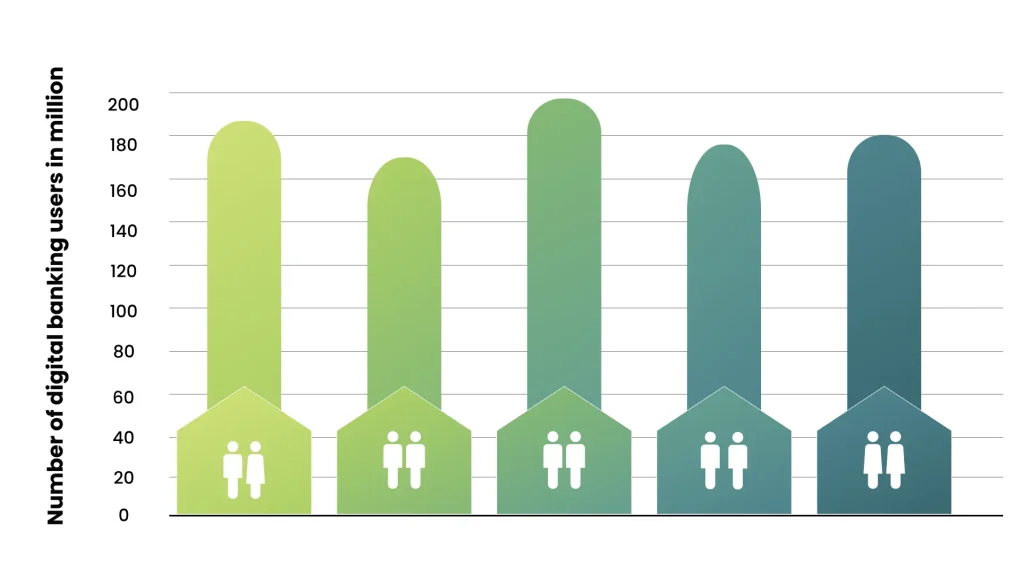

If we look through the facts and forecasted data, the number of digital banking users starting from 197 million in 2021 are predicted to reach almost 217 million by 2025 in the USA.

According to another survey conducted by Statista, more than 75 thousand customers worldwide specifically talking about bank customers, based on their satisfactory ratings gave positive and happy customer ratings between 4.28 – 4.21 respectively. (out of 5)

The above statistical data and the reasons pointed above validates that customers are highly satisfied with using mobile banking apps and users are highly dependent on these fintech apps for handling their finances with complete trust and support. So now moving on to some of the must have features you need to include in a mobile banking app.

Check them out..

Must Have Features To Include In A Mobile Banking App

Information About Accounts And App Access

A banking application begins with authorization and registration, just like most other applications. The banking application’s sign-in feature ought to be straightforward and extremely safe. Like other applications, a banking application starts with registration and authorization. The sign-in function of the banking application should be simple and very secure. Make every effort to facilitate user access.

Transfer And Payment Along With Transaction History

The capacity to perform payments and transfers in real-time is the next essential component of a banking app. The ability to add beneficiaries and examine account balances both before and after the transfer should be included in a separate area dedicated to the transfer activities.

Push Alerts

You must add push notifications or alerts for keeping your customers updated and raising higher application engagements. Thus, you must use push notifications to remind customers about offers, discounts, and bargains, or you can use them to submit documents or request password changes. Transaction-based push notifications can also be used to notify consumers of anything pertaining to their bank accounts.

Locations of Banks and ATMs

It is among the most practical features found in banking apps. The program could incorporate Apple or Google Maps to assist users in finding the closest ATMs and bank facilities.

Voice Commands In The App And Live Chat Feature

There are several ways in which chatbots improve banking. The first is enabling consumers to access banking around-the-clock. A safe chatbot can assist with monitoring their account information, verifying whether a certain amount was credited to their accounts, and more.

An increasing amount of voice technology is being embraced by the banking industry. By merely making a voice request, users will now be able to check their bank balance or send money to contacts.

App Security And AI Integration

The banking institutions will include AI and machine learning to a large degree, ranging from fraud detection to creating a 24×7 connection between people and banks.

The banking industry always ensures highest security in its database. Thus, you are required to integrate below elements to achieve best security solutions :

- System of multiple-factor authentication

- Complete encryption

- Verification of fingerprints

- Alerts in real time

- AI integration for the purpose of detecting fraud, etc.

Also Read:

Factors Determining The Cost Of Banking App Development

Based On Complexity

Other Factors That Determine The Cost of Developing A Banking App

As we discussed above are some of the crucial factors like features, complexity of your application design, and team of developers for designing the best banking application with respect to their associated hourly rates accordingly. There are some other driving factors like Wireframe or layout of your banking application, team size of your app development team, Tech-Stack integration, App Maintenance, and so on.

Let’s discuss about them in detail :

Wireframe Or Overall Layout Of Your Banking Application

Wireframing is regarded as one of the crucial steps in the design of a digital banking app that is not to be skipped. In essence, a wireframe is the banking application’s layout that is produced using state-of-the-art software like Photoshop. This layout must pass multiple testing processes until the most pertinent one that can offer a realistic picture of the app to be created is chosen. A wireframe design typically costs between $8K and $10K.

Also Read:

Team Size Of Your App Development Team

Depending on which expertise the developers choose to include in their app development team, the cost of developing a digital banking app may change. The decision made by business owners to either engage freelancers from a recognized organization or develop their digital app in-house owing to budgetary and resource constraints has a significant impact on the app development cost.

Depending on the total complexity of your project, the number of your app development team can change. A typical app development team should consist of one project manager, two to three backend developers, one or two designers, and one or two quality analysts. In this sense, the entire Cost Of Developing A Banking App is greatly influenced by the size of the app development team.

Tech Stack Integration

Choosing the appropriate technology stack is one of the most crucial considerations for business owners when they start a banking app development project. This is the case because making this choice is also one of the most important things you can do to make sure your digital banking app succeeds.

Here are the list of tech stack you can integrate while developing a Banking Application:

- Java

- Kotlin

- Swift

- Google Suite

- AWS- Amazon Web Services

- ReactJS

App Maintenance

It is also one of the most important elements influencing business owners’ budgets for developing digital banking apps. It is very important for the app’s launch and for keeping it operating continuously and updated. In general, the digital banking sector now relies heavily on application maintenance to handle customer data.

The total expenditure for app development may go up or down depending on the business owners’ decision to incorporate cutting-edge technology into the digital banking app. Additionally, the cost of developing a banking app is influenced by the need to maintain a competitive advantage in the market.

Also Read:

How Can You Reduce The Cost Of Developing A Banking App

Check Any Unimportant Features

Insufficient space in mobile apps with unnecessary features will result in larger applications, longer development times, and unpredictably high software development costs. Just concentrate on including the user-friendly and necessary functionality that the application needs. When creating a banking application, it is imperative to provide vital features such as secure login, bill payment, money transfers, statement requests, and balance checks to minimize additional expenses.

Development Costs Can Be Reduced by Simple UI/UX

Having a straightforward user interface and user experience for your application is one of the best ways to lower the overall cost of developing a mobile application. Yes, choose designs that are straightforward, appealing, and easy to use. Simple app designs require less resources than sophisticated ones because they are quick to produce and easy to understand.

Install Templates That Are Ready to Use

The best way to save app development expenses is also to employ ready-to-use templates. Deploy pre-built templates that meet your app’s needs to expedite the development process rather than starting from scratch while creating application pieces.

Once a free template has been deployed, you can alter the application’s layout and style to suit the requirements of your project. As a result, it will shorten the time needed for software development overall and save expenditures.

Also Read:

Testing Needs to Be Done at Every Stage

One of the most important stages of developing any app is testing. It assists in locating issues and resolving them to enhance the functionality and quality of the program. As soon as elements are generated, top custom mobile app development companies test them. Reducing the workload of testing large amounts of code is a smart move because testing at the end of the app development process increases expenses.

Conclusion

If you are planning to develop a banking application, make sure to read all the features it should include and the cost associated with it. Based on the complexity of your mobile banking application, the time may differ. It may take 2-6 months for adding all the basic features, 5- 9 months or more than that for developing an intermediate to complex banking app with advanced features. So make sure to decide accordingly and check out the above tips by which you can reduce the overall Cost Of Developing A Banking App.

Ready To Develop Your Own Banking App!

Working with the correct development team is essential if you want to create a mobile banking app.

We at Echoinnovate IT are experts in realizing fintech concepts by careful research, calculated planning, and strong engineering.

We’ve successfully launched numerous applications at affordable prices over the last ten years, all while keeping an eye on market viability from the outset. Our full-cycle teams provide comprehensive solutions under one roof, handling everything from branding and research to coding and deployment.

Get in touch with us to find out more about how we can assist you in developing your mobile banking concept into a successful solution.

Also Read:

FAQs- Cost Of Developing A Banking App

How much does it cost to develop a banking app?

Basic banking app can start from $50,000 to $100,000. More complex features and customization can increase the cost significantly.

How long does it take to develop a banking app?

simple app may take 3-6 months, while a more feature-rich one can take a year or more.

How does app design affect costs?

Custom designs and intricate user interfaces can increase costs, while using standardized designs or templates may reduce expenses.