Managing money as a couple is more collaborative than ever—thanks to powerful mobile budgeting apps designed specifically for partners. Whether you’re sharing expenses, saving for your future, or just trying to stay financially organized, choosing the right app can make a world of difference. With the rise of digital finance, Android apps and iOS apps now provide seamless syncing, personalized insights, and real-time updates—tailored for couples in every stage of their financial journey.

Why Couples Need Budgeting Apps

Budgeting apps for couples have evolved far beyond spreadsheets or basic calculators. Today’s top tools come with mobile-first interfaces, built-in financial automation, and smart categorization features to help couples manage shared accounts or maintain individual ones while working toward common goals.

Essential Features for Couples:

Real-time syncing across both partners’ devices

Shared financial goals (like saving for a vacation or home)

Custom budget categories tailored to couple spending

Integration with bank, credit, and investment accounts

Spending alerts, bill reminders, and insights into trends

High-level data security, including biometric and 2FA options

Top 8 Budgeting Apps for Couples

1. You Need A Budget (YNAB)

YNAB uses a zero-based budgeting method where every dollar is assigned a job. It’s perfect for couples who want full transparency and control over their money. With cross-device syncing and proactive goal tracking, it helps couples eliminate overspending and build savings together.

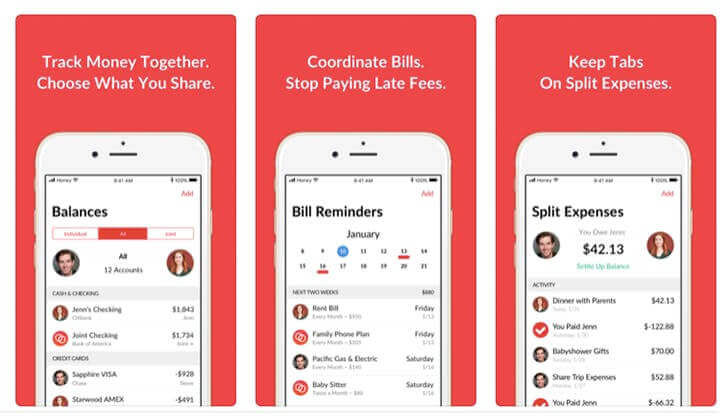

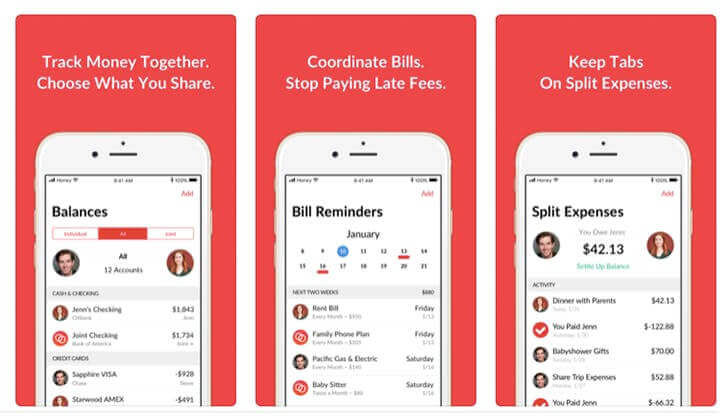

2. Honeydue

Specifically designed for couples, Honeydue offers shared account linking, expense categorization, bill tracking, and the ability to chat directly within the app. It’s user-friendly and ideal for couples who want basic financial transparency without needing full account merging.

3. Monarch Money

Monarch Money gives couples a unified dashboard to manage income, expenses, investments, and goals. With multi-user access, it’s excellent for joint financial planning while still offering flexibility for personal finances.

4. Empower (formerly Personal Capital)

Empower combines budgeting tools with investment tracking, offering a clear overview of net worth and spending. Ideal for couples interested in long-term wealth building, it includes retirement planning and portfolio analysis.

5. PocketGuard

PocketGuard makes budgeting simple with a “safe to spend” feature that shows how much is left after bills, goals, and essentials. It’s great for busy couples who need quick snapshots of their finances without heavy data input.

6. Goodbudget

Goodbudget follows the envelope method digitally. Couples can set spending limits in each category and sync across devices. It’s ideal for partners who like structured planning and intentional spending.

7. Splitwise

Splitwise helps couples who split expenses without combining accounts. It tracks shared spending and who owes what, making it ideal for roommates, dating partners, or married couples who maintain separate finances.

8. Twine and Betterment

Twine helps couples save together with shared goals, while Betterment combines smart budgeting with robo-investing. Both are perfect for couples aiming to build joint savings or start investing in their future together.

Choosing the Right App for Your Relationship

Newly dating or managing separate finances: Try Splitwise or Honeydue

Married couples with shared accounts: Use YNAB or Monarch Money

Couples planning long-term investments: Consider Empower or Betterment

Budgeters who prefer structure: Goodbudget is ideal

Busy professionals needing simplicity: PocketGuard keeps things fast and efficient

Budget Apps For Couples

You really have an endless selection of financial planning apps to choose from. However, not all budgeting apps for couples are made equal, particularly when it comes to joint financial management. We’ve compiled a list of the top couple money management apps so that you can easily manage your finances jointly and find the ideal financial monitoring tools for couples.

One of the most upsetting pieces of being in a relationship has to do with money and how we oversee it. Here is when budget apps for couples come into the picture.

An examination led to see how couples took care of money found that the main source for strains in any relationship was – MONEY!

Furthermore, there are several apps like Dave that can help couples manage their finances better. Of course, the review likewise found that talking and sharing considerations about money, and using apps like Dave, made couples state they had an “incredible” relationship. These apps can help couples set budgets, track expenses, and save money together, leading to a more harmonious and financially stable partnership.

While relationship-building has to do with something beyond money the executives, unmistakably profiting choices alone, without counseling one’s companion or accomplice, can deleteriously affect the association. There are apps for strong relationship building. Similarly, there are app that help couples to figure out their budget.

Cooperating as a group to meet your monetary objectives can go about as relationship-reinforcing treatment.

What’s more, here’s progressively uplifting news: By encouraging joint money-the executives, spending plan applications can assist you with hitting your money objectives.

Notwithstanding, that is just conceivable in the event that you pick the best application that accommodates your particular needs.

Best Apps For Couples

In our highly digitalized world, everything seems to have been transformed into an app. Managing a relationship while leading a busy life can be challenging, but fear not—several of the best apps for couples in 2024 are designed to help. From budget apps for Android to innovative solutions for maintaining connections, these apps can enhance your relationship and simplify financial management. For instance, if you’re seeking an app similar to Splitwise for managing shared expenses, or the best budget app for couples to track finances together, you’re in luck.

The leading dating app development companies are continually crafting new ways for couples to stay engaged and strengthen their bonds. The top couple apps available today are highly recommended by users around the globe for their effectiveness in fostering relationships.

It’s important to remember that maintaining a relationship requires ongoing effort and attention. Getting started is just the beginning; the real work begins with continuous commitment. With millions of people connecting through apps, and numerous dating apps similar to Tinder available, there are plenty of opportunities to explore and nurture your relationship. For those interested in iOS app development, there are also many tools available to create customized solutions that can further enhance your relationship experience.

- Sort your expenditures and even make custom classes for your costs

- You can also set alerts and reminders that notify you and your partner so that you never miss out on a bill that’s due, or forget an upcoming expense

- If you share responsibility for bill payment, you can also tag bills and invoices as paid, so you both know who has paid which bill and when

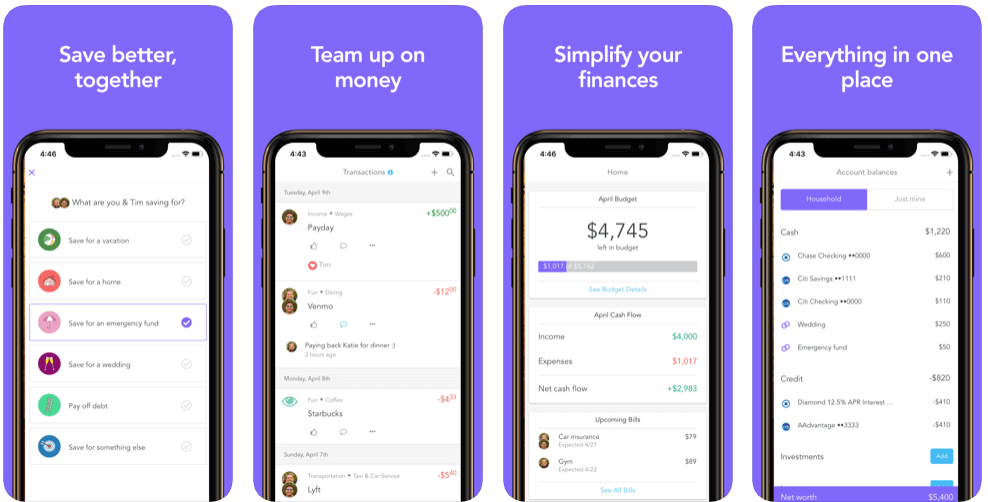

Monarch Money

There are several great budget tracking apps for couples available in the Monarch Money app. It’s perfect for keeping track of both broader savings objectives and daily expenses. Benefit from simple controls, insightful information, and a clear dashboard to manage your finances.

Principal attributes:

You and your spouse will have separate login credentials, but you can both access the same account on this couple money management app. A comprehensive dashboard displays all of your financial information, including bank accounts, credit cards, loans, and more. Monarch offers motivating goal timeframes and useful data insights, such as an analysis of the preceding month’s expenses, making it one of the best budgeting apps for young couples. Syncing with more than 11,000 financial institutions using Monarch gives you a current picture of your spending and savings, helping you and your partner stay connected through apps for couples to connect.

Possible negatives:

The premium subscription is the best choice if you want to get the most out of this finance app that is ideal for couples. Nevertheless, the monthly cost will be $10 (or $90 if you choose to pay annually). Fortunately, you can join up for a trial that lasts seven days before committing. You and your significant other can still work together with a free account, but it only allows for two bank connections and lacks certain services like tracking investments and cryptocurrency.

- Sort your expenditures and even make custom classes for your costs

- You can also set alerts and reminders that notify you and your partner so that you never miss out on a bill that’s due, or forget an upcoming expense

- If you share responsibility for bill payment, you can also tag bills and invoices as paid, so you both know who has paid which bill and when

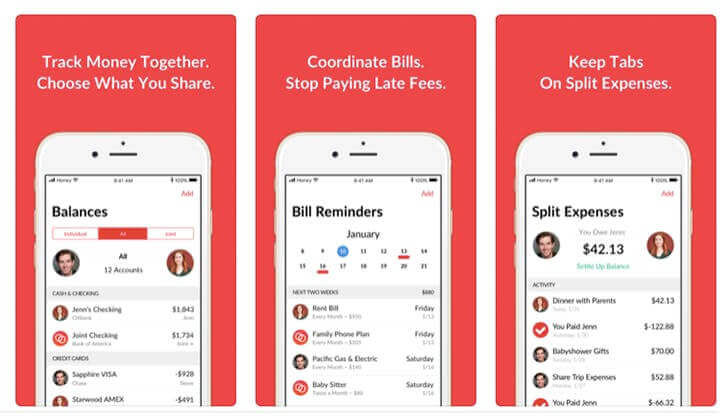

Honeydue – Custom Budgeting App

Honeydue is a flawless budgeting app that couples can use to co-share the family’s money-the board duty. It enables you to associate every one of your records – Bank, Credit Card, Loans – to the app.

You can label every one of these records as either individual or joint – so you and your partner know initially where you remain with “proprietorship”.

- Sort your expenditures and even make custom classes for your costs

- You can also set alerts and reminders that notify you and your partner so that you never miss out on a bill that’s due, or forget an upcoming expense

- If you share responsibility for bill payment, you can also tag bills and invoices as paid, so you both know who has paid which bill and when

BetterHaves – Enveloping App

BetterHaves is a budgeting app that is explicitly intended for couples, yet it additionally helps people in budgeting and following their money.

The app works utilizing one of the most established and the best budgeting frameworks: The envelope framework.

- Couples can utilize virtual envelopes to appropriate their salary and costs into discrete classifications.

- This enables you to have a spending plan for explicit occasions, for example, entertainment, utilities, contract, dental specialist’s bills, and staple goods

- At the point when you go through the money against each cost, the app pulls back the sum from its individual envelope, permitting you perceivability into what’s left

- You can outwardly follow where the money from every envelope is going

- This framework strengthens great budgeting conduct since you’re compelled to quit spending on explicit optional things – like eating out or shopping – when that envelope is vacant

- You can likewise utilize the app to change your spending limit to redirect more money into the “saving envelope”

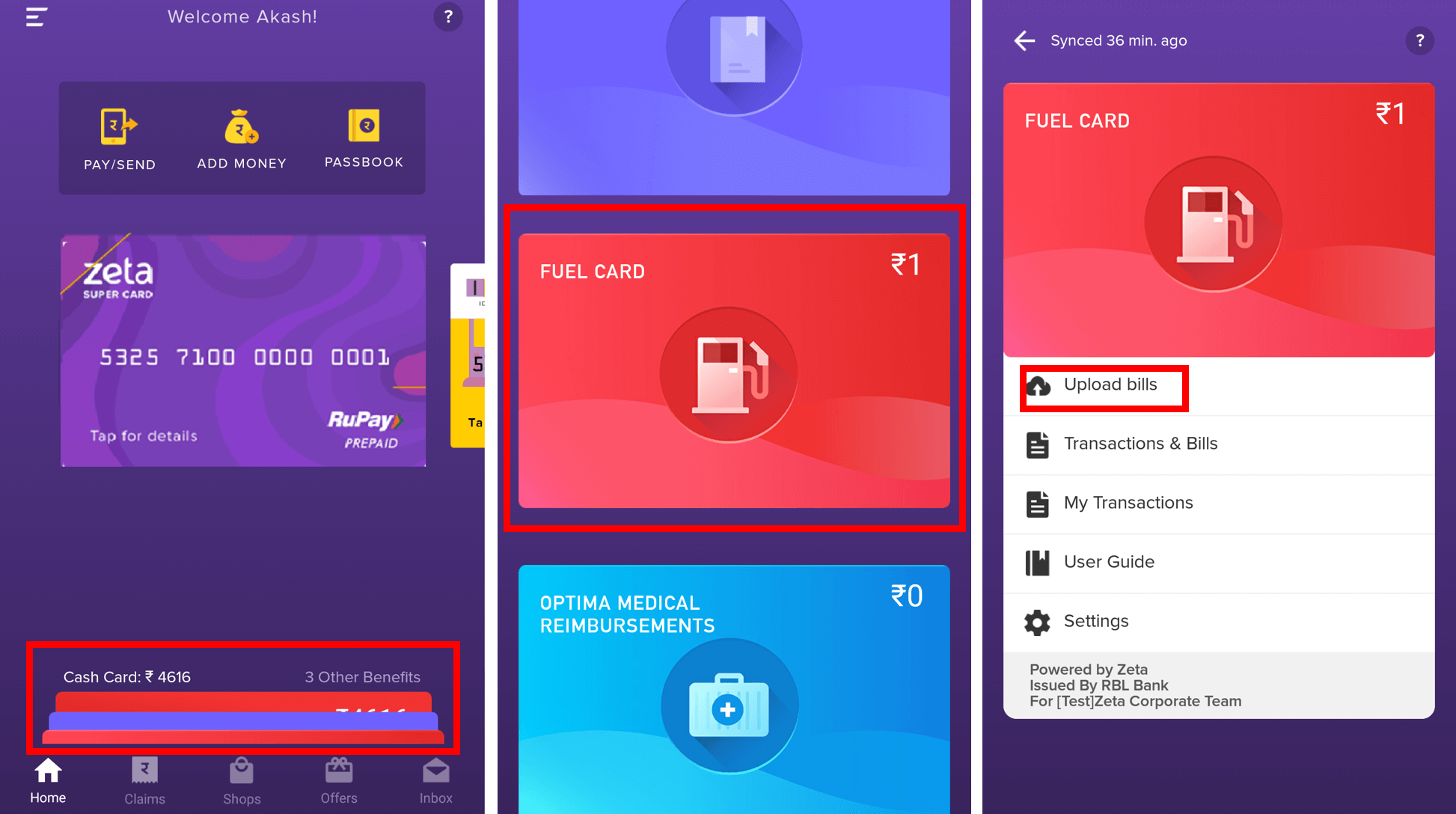

Zeta – App For Tracking Finances Together

Like other money management apps, Zeta connects with your bank accounts and other financial institutions.

What makes Zeta different from similar tools is the fact that you sign up with your significant other, and you can track your finances together.

The web app allows you to share your finances with your sweetheart, track your overall net worth, review your monthly spending, and get targeted advice on how to improve your joint finances.

Image Credits : doc.zetaapps

- To start, you can create shared and individual budgets to stay on top of your finances

- Zeta then breaks down your finances across those shared and individual pools of money

- You get to customize what you track in your budgets, rather than have to use a cookie-cutter budget

- Zeta also lets you tag your partner on specific transactions or split a purchase to keep a tally

- The memo function in the app allows you to ask questions or keep notes about specific transactions

- Speaking of bills, the app also helps you keep tabs on your bills and will send you reminders to pay, ending those inevitable “I thought you were going to pay that bill!” arguments

HoneyFi – Family Expenditure Tracking

For couples that aren’t excessively acquainted with the budgeting procedure or those that simply need a flying beginning on dealing with their funds, HoneyFi is most likely for you.

The best piece of this app is the across-the-board system of money-related foundations it underpins – presently 10,000+ and developing!

Image Credits : mymillenialguide

- It automatically matches up the family unit and individual financial balances, Visas, credits, and venture records to the app, sparing you tones of time and exertion from physically doing that

- The app adjusts exchanges between your bank and your gadget 3 to multiple times every day, or at least daily

- The app takes a gander at your ways of managing money and dependent on what and how you’ve spent beforehand, it naturally prescribes a family unit spending plan

- You would then be able to alter the financial limit and start following your spending right away

- You can view and look through your exchanges over every single connected record. Furthermore, since speaking with your accomplice is the foundation of joint budgeting, the app enables you to do only that! Rapidly include notes, remarks or tips, and bits of knowledge to exchange and offer it with your significant other

- The app gives alarms and warnings on new exchange action, just as banners up-and-coming bill installments and different costs

- To ensure your touchy information the app uses bank-level security and doesn’t approach your financial certifications. Accessible as a free download, HoneyFi supports Apple and Android devices

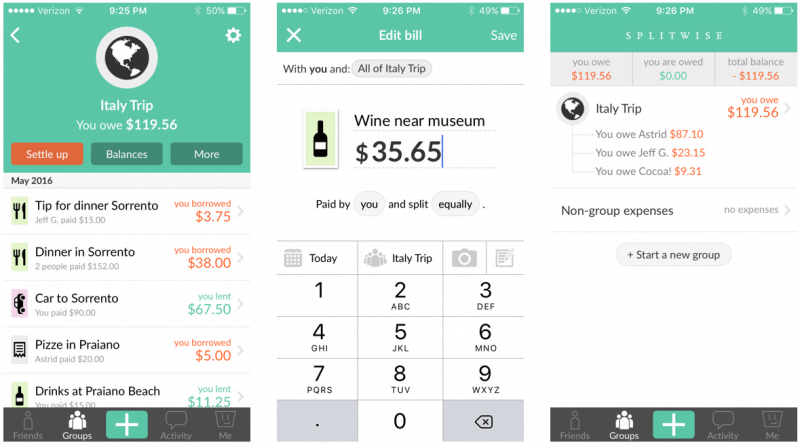

Splitwise – Budgeting App For New Couples

Various couples have various needs and objectives. This is one of the best budget apps for couples.

This is for couples who are new in their relationship and need to part their bills similarly regardless of the event.

A well-known app that is likewise utilized by groups or companions to part their bills similarly.

Image Credits : go.forrester

- Join with Google, and you would then be able to utilize it for occasions, lease, supper, shopping, and different events where you figure the bill ought to be part

- It will monitor adjusts so you realize who owes who how much!

- Join with Google, and you would then be able to utilize it for occasions, lease, supper, shopping, and different events where you figure the bill ought to be part. It will monitor adjusts so you realize who owes who how much!

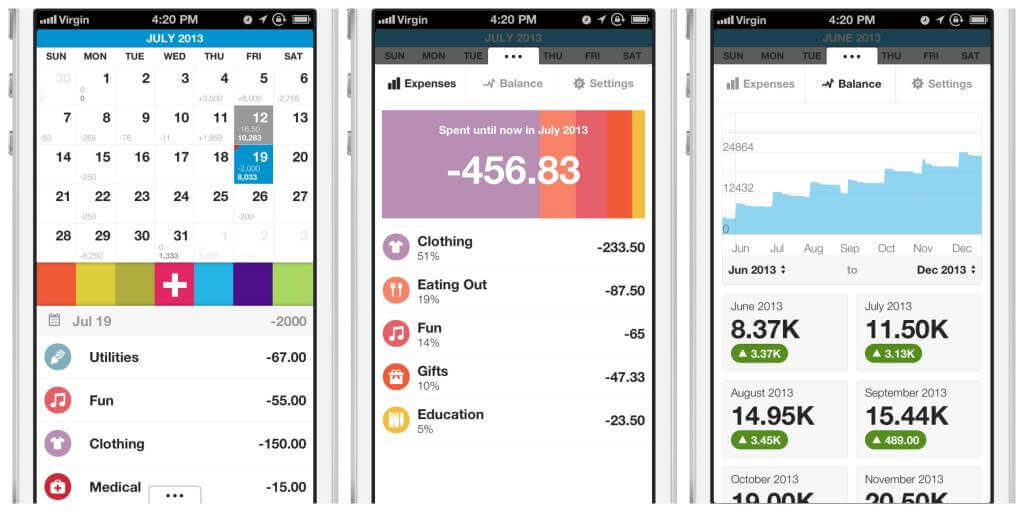

DollarBird – Finance Tracking App

Dollarbird app is perfectly suitable for managing the personal finance issues of couples. It lets you control your budget using a calendar, like an interface by making you add the events for every single transaction occurring throughout the day.

You get a crystal clear categorization of the transaction for the whole day.

Image Credits : coolmomtech

- The app will automatically calculate the expenses for the entire day, making you aware of the exact expenditure by the specific individual

- A calendar-like interface is exceptionally beneficial for you. You can even share the expenses with other family members in the calendar format

- You have access to use the app for free. However, a yearly subscription is also available with added sets of features and without any ads

- The compatibility of the application is available both for Android and iOS platforms

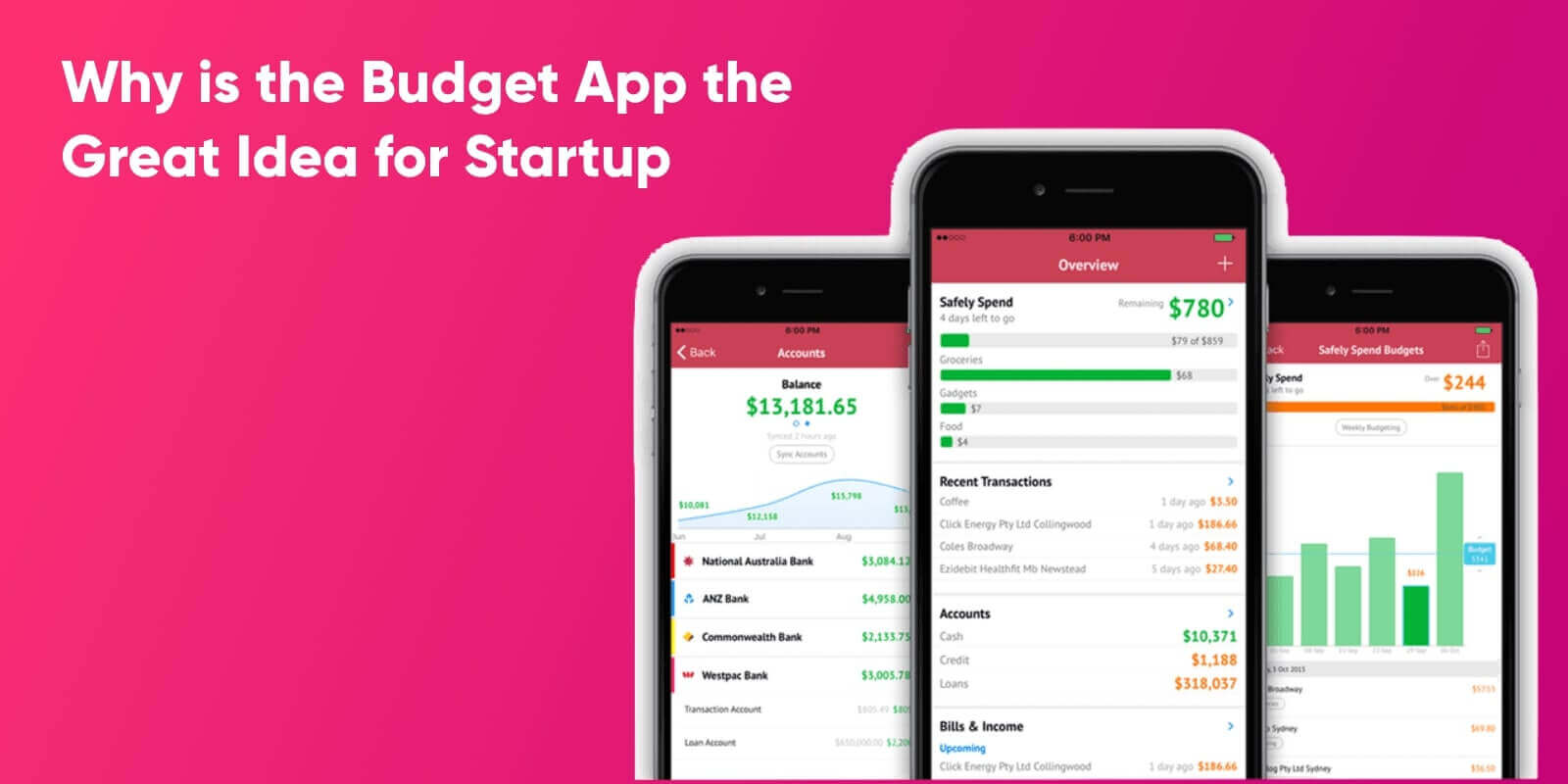

Budget App: Top Startup Idea For 2025

The Best Free Apps for Couples to Connect in 2024 due to the following reasons-

- Easy to set up Signing up for a budgeting app is as simple as verifying your email address and linking your financial accounts

- Accessible- Any online budget tool comes with a mobile app, so you are never more than a few taps from checking your financial health

- Real-Time Notifications and Bill Reminders- Most budget tools alert users of possible fraudulent activity as well as reminders for credit card due dates

- Long-Term Visibility- Budgeting apps break down your overall net worth, debts, savings goals, and other metrics that let you know where you stand at all times

Also Read:

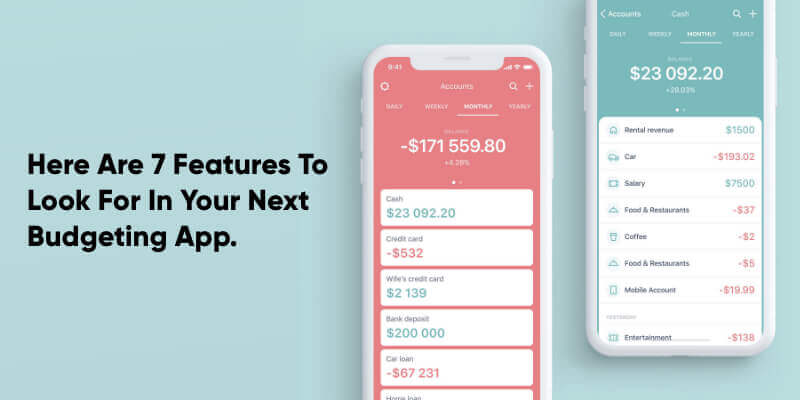

Top 7 Budget App Features

Unlike general purpose accounting or finance software, couples should look for some specific “shared” features in the budget apps for couples they choose to help them co-manage their finances.

1. Synchronization

Key among those highlights is the capacity to match up planning information between gadgets possessed by life partners. This enables the two accomplices to know precisely what’s happening – in a perfect world continuously – with their funds.

2. Multi-Device Support

The requirement for multi-gadget support is additionally a decent component to have. That way, if the two accomplices don’t possess a similar kind of gadget (iPhone or Android), despite everything you’ll have the option to utilize the planning application viably.

3. Desktop Support

Desktop support is also nice to have, especially if you like sitting at a desk and analyzing your transactions at leisure on a large screen.

4. Customization

Look for an app that allows you to customize your income and expense categories.

5. Bank Account Linking

Many couples would like the app to link to their external bank accounts and automatically download transactions. But if you aren’t comfortable with that, the app should at a very minimum allow you to enter the account, payee, and institution details while capturing transactions and use that data to track account balances.

6. Graphics

It’s always nice to see your budget and spending patterns illustrated graphically – either in pie-chart or bar chart form.

7. Easy Backup

Additionally, if your app doesn’t store your data in the cloud (some couples might prefer local storage of data on their laptop/smartphone), then look for convenient features that make it easy to backup/restore your data.

Also Visit:

How Much Does It Cost To Build Budget App Development?

The cost to develop a budget app varies depending on various factors. The cost of developing a simple app for one platform is approx $60,000. Budget app development for complex features varies from $60,000-$150,000 per platform. It is quite challenging to provide the exact cost of a budget app development because it may vary depending on the features, the complexity of an app, platform, developer’s cost, development hours, location of the company.

Conclusion

So these were the best budget apps for couples looking forward to sharing a budget or reduce expenses and save up a little bit.

At Echoinnovate IT, we have a team of developers that can help you with your web and app development. Contact us! Today.

FAQs of Budget App for Couples

How can I contact the best Fintech App Development company, if I have a Finance App Idea?

Echoinnovate IT Fintech Development Company provides top-notch solutions to enable intelligent automation for modern problems in financial ecosystems right from managing risks to fulfilling compliance obligations we serve you right from envisioning to designing and implementing custom fintech applications tailored to unique business requirements. Our company holds the expertise of top Fintech app developers to provide you with deep tech custom Fintech solutions for industry-specific challenges to shape your digital transformation.

Want to Make a Finance App like Mint and YNAB?

This is the perfect time to make a finance app like Mint and YNAB, contact us now. At Echo innovate IT, you will get top-notch developers and will deliver our best to you. Echo innovate IT is one of the best companies in developing finance apps like Mint and YNAB. We have 12+ years of work experience. Our team excels in offering a wide range of services and our products are engineered to improve your business revenue. Our goal is to serve the client’s satisfaction and user engagement without compromising on quality and time. Feel free to reach us for your app development project.