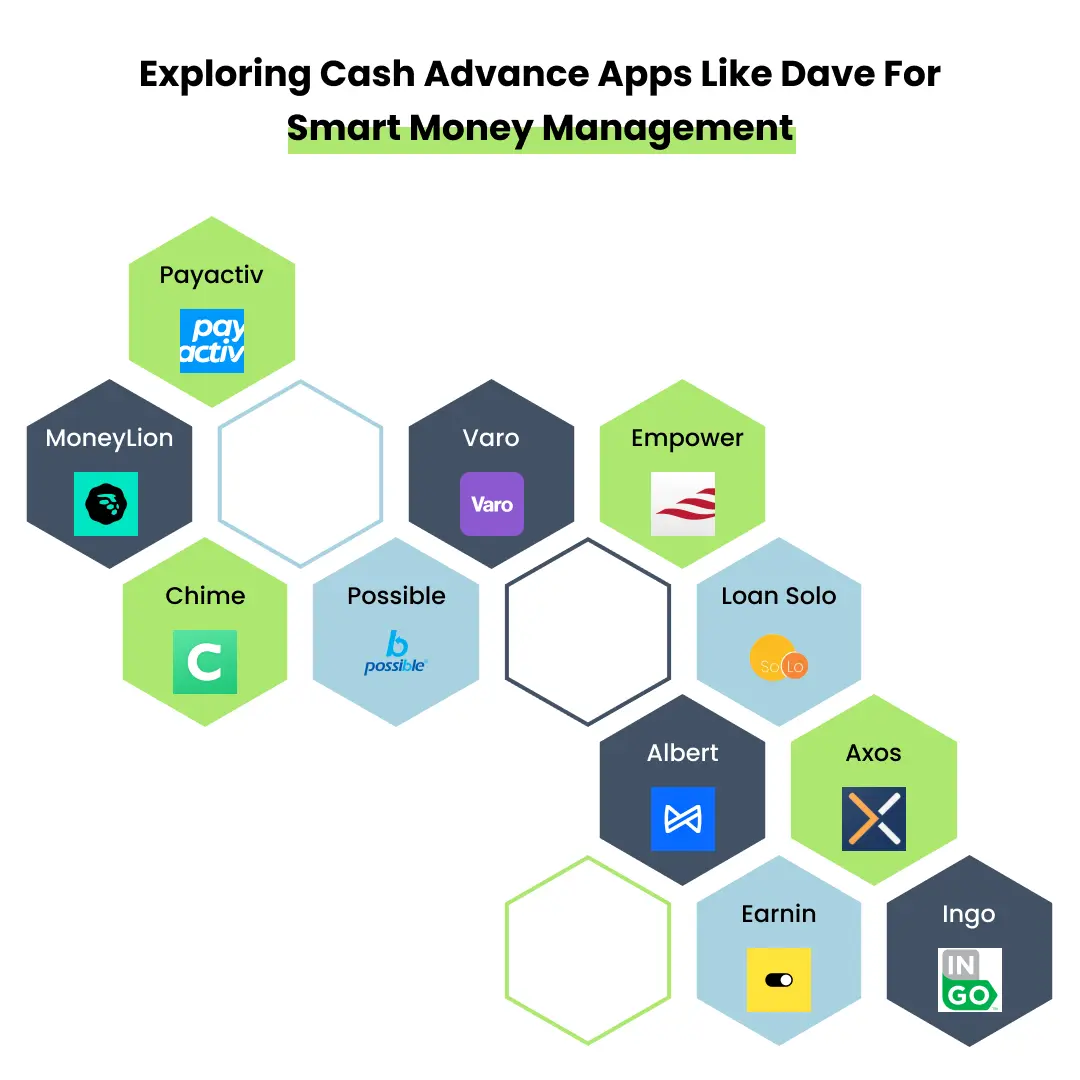

Apps like Dave are leading the charge when it comes to cash advance solutions. These money apps, including alternatives such as Earnin, Albert, and FloatMe, have proven to be lifesavers for many individuals facing financial challenges. One standout feature of the app is that users can avoid worrying about high-interest rates, making it a popular choice among cash advance apps like Dave. However, it’s worth noting that the maximum payday advance available through Dave is $100. Below, we’ve compiled a list of apps similar to Dave that can help you navigate your financial needs.

If you need instant cash to cover a short-term expense and can repay it quickly, cash advance apps like Dave can be a convenient solution. These apps allow you to access funds before your next paycheck without relying on traditional personal loans.

However, when used frequently or irresponsibly, they can lead to financial strain. High subscription fees and potential overdrafts can affect your checking account balance, making it crucial to borrow only what you can repay.

Among the best cash advance apps, Empower stands out for its flexible borrowing options. But before you choose, it’s essential to compare different cash advance loans to find the right fit for your needs.

What Is The Dave App?

If you’re curious about your financial options, apps like Earnin and other apps like Dave can help you manage your finances effectively. The Dave loan app stands out among the best cash advance apps 2025, offering users a convenient way to avoid overdraft fees and enhance their financial well-being.

Apps similar to Dave, such as apps like Floatme and apps like Empower, provide innovative features tailored to modern banking needs. Dave connects to users’ bank accounts, sending real-time alerts to help prevent overdrafts. Users can access cash advances of up to $100, alongside budgeting tools, automatic savings, and credit-building features. This app like Dave is ideal for individuals seeking forward-thinking money management solutions.

For those exploring alternatives, sites like Dave and other loan apps like Dave offer a range of tools to improve financial health. Whether it’s budgeting, saving, or avoiding overdrafts, these platforms deliver effective money management. Beyond Dave, platforms offering loans like Dave or money apps like Dave provide comprehensive solutions to suit diverse financial needs.

With options ranging from apps.like Dave to innovative tools similar to websites like Pinterest for financial organization, you can find solutions that align perfectly with your goals. Explore these alternatives to discover the best tools for financial success.

About Cash Advance Apps Like Dave App

A cash advance app is a financial tool that allows users to borrow money against their upcoming paychecks or other income sources. These apps, including other apps like Dave, apps like Empower and Dave, and advance apps like Dave, are typically designed to help people cover unexpected expenses or bridge the gap between paychecks. Unlike traditional loans, cash advance apps often have minimal credit requirements and can provide quick access to funds.

Users can apply for a cash advance using a mobile app or website. The funds are usually deposited directly into their bank accounts within a few hours or days if approved. Some cash advances like Dave charge interest on the amount borrowed, while others may operate on a flat fee or subscription model. Money borrowing apps like Dave have become increasingly popular as they offer a more convenient and accessible alternative to traditional loans.

However, users should exercise caution when using these apps, as they can be associated with high interest rates and fees. It’s essential to read the terms and conditions carefully and only use these cash advance apps for emergencies. For those seeking options, sites like Dave and apps like FloatMe can provide additional financial support.

When to Use Cash Advance Apps

Life can bring unexpected expenses, from emergency bills to overdraft concerns. Like Dave, cash advance apps near me are designed to help you bridge the gap until your next paycheck. People often use online payday loans for minor expenses like groceries or to cover small rent shortfalls.

However, these apps should not be used as a long-term financial solution. If you’re uncertain about repayment, relying on payday loans online or other online loans can lead to financial strain. Think of them as a cash-on-advance safety net rather than a regular source of income.

How Cash Advance Apps Like Dave Work

Cash advance apps like Dave allow users to access money they know is coming but haven’t yet been deposited. These money apps like Dave require users to set up their accounts within the application. To create an account, users must follow a procedure involving identification and verification. For example, while setting up your account on apps similar to Dave, you may be asked for the following information:

- Identification (name, SSN, date of birth, etc.)

- Contact information (address, phone, email)

- Place of employment and employer

After verification, you can connect the app to your bank accounts. The app will then track your account’s deposit activity and frequency. The amount the user can request is determined based on information gathered by the application by some scans.

Unlike payday loans, instalment loans, or even (sometimes) paycheck advances offered by your bank, cash advance apps rarely charge fees for individual loans. They charge a monthly fee to use their service.

Pros And Cons Of Using Apps Like Dave App

After verification, users can connect apps like Dave and earning to their bank accounts. The app will then track your account’s deposit activity and frequency. The amount the user can request is determined based on information gathered by the application through various scans.

Unlike payday loans, installment loans, or even (sometimes) paycheck advances offered by your bank, cash advance apps like Dave, as well as other apps like Dave, rarely charge fees for individual loans. Instead, they typically charge a monthly fee to use their service. This makes them a more affordable option compared to loans like Dave and provides users with flexibility in managing their finances. Apps like Earnin and Dave, along with apps like FloatMe and Empower, also offer similar benefits for those in need of quick cash.

Pros

One of the significant pros of Dave is that it gathers information regarding your spending habits. This might sound a little interfering to you, but the primary purpose of doing so is to keep track of your money.

This is done by informing you when your account gets below a certain amount or when you have an automatic upcoming payment but don’t have enough in your account currently to cover it.

Dave’s banking feature is also offered by Dave, which is very similar to an online checking account.

Dave banking offers several other benefits, like it provides Visa debit cards and access to a network of fee-free ATMs. Also, no minimum deposit account is required to open a Dave Banking account.

Cons

The major drawback of using a Dave Banking account is precisely the same as its most significant benefit.

As we know, Dave keeps track of your money and spending habits, and only some people like to share this sort of personal information.

Best Apps Like Dave That Work With Prepaid Cards

- Earnin

- Moneylion

- Brigit

- DailyPay

- FlexWage

- Rainy day lending

- Loan Solo

- PockBox

- Ingo

- Empower App

- Possible App

Thankfully, Dave is one of many choices for those looking for such cash apps.

There are lots of other apps that help with similar purposes. Do you know more about apps that loan you money?

Here is the list of apps you should know and seek help whenever needed.

If you want to develop a finance app like Dave, contact us. We provide the best app development services.

Also Read:

1. Earnin

If you are looking for the best alternative for the Dave app, Earnin is another excellent option among apps like Dave and Earnin. This app is specifically designed to address emergency financial needs, making it ideal for full-time workers who want access to the money they’ve already earned.

Similar to Dave, apps like Earnin and Dave provide features that allow users to get pay advances during emergencies. Furthermore, payday apps like Dave do not impose changing interest rates or fees, making them a budget-friendly choice. Earnin also has no membership charges, which enhances its appeal to users looking for accessible financial solutions.

For those exploring options beyond Earnin, apps like Dave and Albert, cash advance apps like Dave, and apps like FloatMe are great alternatives. The PockBox app offers additional features for cash advances, while loans like Dave and apps like Empower and Dave provide further avenues for managing your finances. Users can opt to leave tips voluntarily, which can help increase their cash advance limit to $500 if they use the platform consistently.

2. Moneylion

Moneylion is also one of the vital apps among advanced apps for handling cash. It has two different kinds of membership called plus and core.

The core membership does not cost much, but it offers services like free checking accounts for various rewards and additional user options.

When it comes to plus membership, the users need to pay $28 per month, and it comes with several benefits. It provides 5.99% of the APR designs to construct the user’s credit. Further, the platform does not ask for a credit check, so the customers will have poor credit ratings and can deal with the app.

3. Brigit

It is one of the leading services and preferable among lots of users. If you are looking for Apps Like Dave, it is the best choice and suitable for many reasons.

It is also a popular online tool that will help people to have additional cash and stay financially afloat until the next payout arises. This app will check the customers’ accounts and track their spending for different purposes.

When the person is spending an overdraft, the app will send a special notification to denote the expense as a warning sign. It offers email support, and the users can discuss it with the team via mail.

4. DailyPay

Rather than marketing to the consumers, DailyPay is the app that starts with marketing to the employees in different ways. However, the app will work similarly to Dave and offer all the benefits people enjoy.

The employees build a balance with others through the great help and support they do for each other. They can also tap into the balance before the payday to access their cash.

The app will put the money in the bank, and the users can take the amount through payday whenever needed.

It offers the charge fee to transfer from your hours to balance the bank and the amount they spend. The app also says that it is $1.25 per transfer.

Also Read:

5. FlexWage

Like the other payday loan alternatives, it also helps the employees to access the wages based on their demands. This app provides instant cash advances online.

One of the reasons these apps for cash loans are gaining more fame is that they do not need to worry considering the administration hassles that will come with the same payroll advances.

This app also provides reloadable payroll debit cards for the employees who usually get as per the clicks. It can be helpful for unbanked workers who cannot accept direct deposits from the employer.

Some fees like $5 for on-demand wage transfer and using a debit card can also lead to the cost, but it is relatively inexpensive compared to some other apps.

6. Rainy Day Lending

Rainy day is not a lender, and it does not offer wage advances, but the app for cash loans offers you the chance to have a personal loan quickly based on certain conditions.

Here, all the credit types are accepted, and you can have the money deposited directly into the account immediately on the next business day. It will vary based on the loan that you are matching up. However, there are specific considerations when you need more fees, overdraft charges, and loans with a particular interest rate.

7. Loan Solo

It is also the app to connect with the lenders willing to work with the users. It is possible to get the cash quickly, which will be credited directly into the bank account without any additional expenses or hassles.

Here, the user can have up to $1,000 for payday cash advances and up to $3,000 for personal loans. These are the variables based on the lender and based on your credits. Besides, if you bridge the gap or get ahead, it can still become cheaper when compared to paying more charges associated with the apps.

8. PockBox

It is the other notable online app that will help connect with short-term lenders and offer even up to $2,500 in quick and fast cash. You must fill out the forms take a few minutes, and match them with the account the next business day.

You should still pay the amount online and offline based on the credit situation. Being efficient in all these ways makes the app a market leader.

8. Branch

It is more like one of the advance apps like Dave, providing a pay-for-cash process that allows users to manage their work more efficiently. This includes features like switching shifts, chatting with co-workers, and tracking the hours employees work within the organization. Additionally, users can access cash advances like Dave, with the potential to receive up to $5,000 per pay period or $150 per day based on the hours worked. This app is similar to Dave in terms of flexibility and speed, but it does not charge a membership fee. Users can withdraw the amount they’ve earned as an advance for that particular day.

The only catch is that your employer must also have an account in this app. You can easily register and upload your work hours, enjoying all the other benefits of the app, similar to money borrowing apps like Dave, sites like Dave, and apps like Albert and Dave.

9. Ingo

The Ingo app is much handier than other apps like branches available in the marketPeopleaPeople don’t like payingthe fees charged by most check-cashing places. With the help of the Ingo app, you can take a photo of the check, and then you can deposit the check’s amount whenever you feel like it. You can deposit into your bank account, PayPal, a prepaid card, etc.

The deposit is free if you can wait for 10 days. It will charge you a fee if you immediately want the money. The charges are somewhere between $5 and 5% of the check. The amount you will be entirely based on the type of check you are cashing and the amount.

10. Empower App

The Empower app is more like a bank manager than a lender. These apps, like Dave and Earnin, are best for the new generation. If you are the type of person who likes to manage their money, then Empower is an excellent application. It is an equally good app like Cash.

It connects all your existing accounts and lets you track your money spent and savings from a single location.

You must open an account if you’re interested in the cash advance. Here are some essential key points mentioned:

- Credit check: No

- Minimum credit score: N/A

- Maximum advance: up to $250

Other Empower offers:

- Checking account: Yes

- Debit/ATM card: Yes

- Credit builder loan: No

- Overdraft/Returned Payment fees: No

- Other perks: Cashback (up to 10%), budgeting tools, etc.

11. Possible App

Possible Finance is a better alternative to payday and instalment loans. Apart from apps like Albert Cash Advance or Float, the possible app is another fantastic application available in the market. Possible loans are only offered in small amounts with very high interest rates, the same as payday and instalment loans.

The approval for first-time borrowers is up to $500, and the interest rates are 150% to 200% based on your location, the amount you borrow, and more. This is much lower than what you would pay a payday lender but much higher than other apps on our list.

Final Thoughts !!

Dave’s app is one of many that can save the day when you are stuck in financial emergencies. This is the list of other similar apps that will extend their help for tackling the issues quickly.

All these are best on their terms. However, you may expect that only some of the apps will be suitable for your needs. So, understand more about the apps and look for the best one for the correct output. Developing an app like Dave becomes more accessible with the right team and consulting experts. Echoinnovate IT is one such app development company in the Bay Area, Toronto, Malaysia and many other parts of the world that will assist you throughout the development process. You can hire top mobile app developers from them.

FAQs

What Is Dave App?

Dave apps provide users with cash advances. Dave doesn’t charge interest but just asks for tips. But in order to access the application, members need to pay a small monthly subscription fee and the overall cash advance limit is limited in order to save money.

What Are The Unique Features Of The Dave App?

Signup Profile verification Request a cash-out Direct deposits Tip yourself Repayment option Credit score building Quick alerts Live chat support

What Are The Best Alternatives To Money Lending Apps Like Dave?

- Earnin

- MoneyLion

- Brigit

- DailyPay

- FlexWage