The fintech business is undergoing a major revolution, fueled mostly by the incorporation of artificial intelligence (AI). AI-powered fintech solutions are making considerable progress in the banking business, speeding up processes, improving intelligence, and strengthening security. AI’s footprint is seen throughout the industry, from automating processes that used to take a long time to provide individualized advice to clients.

AI is paving the path for revolutionary business models that were previously impossible. From personalized banking to advanced fraud detection, AI is allowing fintech companies to innovate at unprecedented speed. As a result, AI in financial services is transforming customer service, improving payment procedures, and increasing the efficiency and growth of financial services.

This revolution is about more than just increasing efficiency and lowering costs; it is about fundamentally altering how financial services are offered and perceived.

Looking ahead to 2025 and beyond, AI in FinTech is causing a significant shift in how we manage, invest, and interact with money.

Role of AI In Fintech Industry

The role of AI in financial firms goes beyond convenience, ensuring that customer involvement is both cautious and meaningful. This technology breakthrough enables financial services to address the changing needs of its consumers, ensuring customer loyalty and providing a competitive advantage in a packed field. Machine learning in finance addresses critical areas like security, investment, productivity, and customer service.

These breakthroughs demonstrate AI’s critical position in fintech, enabling advancements that not only increase operational efficiency and security but also redefine client engagement, demonstrating the technology’s vital contribution to the industry’s progress. Here are some of the significant areas where fintech and artificial intelligence work together:

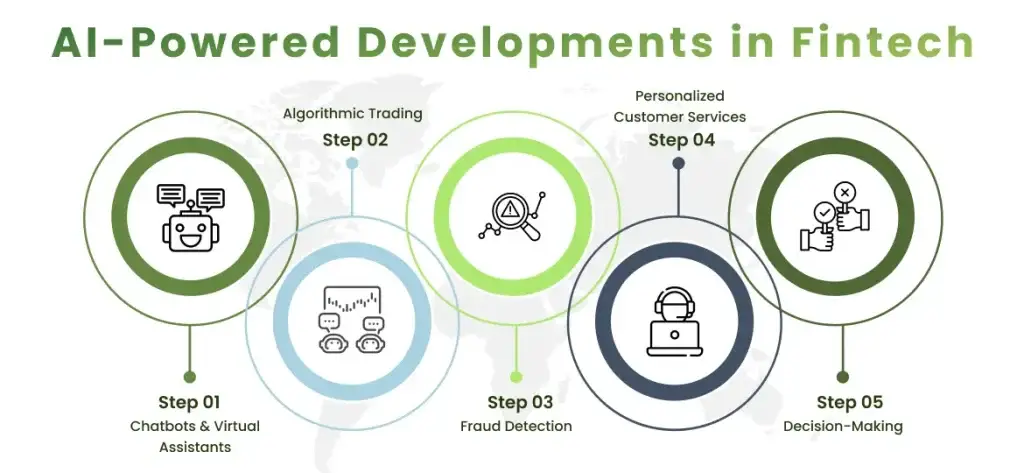

Chatbots & Virtual Assistants

AI-powered chatbots and virtual assistants have transformed customer service in fintech, providing personalized and immediate assistance. These tools not only handle routine requests effectively, but they also engage customers in more meaningful ways, increasing access to financial guidance.

By evaluating consumer data, AI enables these assistants to provide individualized recommendations, ultimately improving the customer experience and increasing loyalty.

AI-powered chatbots offer 24-hour customer service, answer basic questions, help with account inquiries, and even assist consumers with simple operations such as checking balances and moving payments. These AI-powered assistants improve the user experience by enabling quick and easy access to financial services.

Algorithmic Trading

Algorithmic trading, or algo-trading, uses complicated algorithms and advanced mathematical models to conduct transactions automatically. AI plays an important part in these algorithms, analyzing massive volumes of market data in real-time to discover trading opportunities, forecast price moves, and execute trades at optimal moments. This technology makes trading faster and more efficient while reducing human intervention and associated biases.

AI has transformed credit scoring by allowing for more complex and dynamic assessments of credit risk. Unlike traditional models, AI-driven algorithms may forecast an applicant’s creditworthiness based on a broader range of data sources, including non-traditional data such as social media activity or mobile phone usage habits.

Fraud Detection

AI integration into fraud detection methods dramatically improves banking security. Financial organizations may identify and mitigate risks far more quickly than previous techniques by using machine learning algorithms capable of detecting patterns suggestive of fraudulent conduct. This capacity is especially useful in real-time transaction processing when speed and accuracy are essential for avoiding fraudulent transactions and minimizing financial losses.

Machine learning models evaluate transaction patterns in real time to detect anomalies that could suggest fraudulent behaviour. This proactive approach helps to avoid fraud before it occurs, which benefits both customers and financial institutions. For example, AI-powered fraud detection systems can spot anomalous transactions immediately, triggering additional inquiry and lowering the chance of monetary loss.

Personalized Customer Services

One of the most significant effects of AI on fintech is the potential to give highly tailored financial services. AI systems examine massive volumes of data to better understand individual customer behaviour, preferences, and demands. This allows fintech companies to provide individualized financial advice, personalized investment suggestions, and customized financial products.

Beyond answering basic questions, these AI systems may perform complex activities like facilitating transactions or delivering specialized financial advice, converting customer support from a cost centre to a value-added service. This not only improves customer pleasure but also allows human agents to concentrate on more complicated issues, increasing staff efficiency.

Decision-Making

AI enables data-driven decision-making, allowing financial organizations to use massive volumes of data to improve strategic planning and operational efficiency. AI helps businesses make better decisions by extracting insights from complicated datasets, hence improving performance in areas such as marketing, customer segmentation, and product creation.

This not only streamlines processes but also promotes innovation and growth in the industry. The capacity to use big data is another major changer for fintech companies. AI systems can process and analyze enormous datasets far faster and more precisely than humans, resulting in actionable insights that drive strategic decision-making.

Benefits of AI In Fintech

Artificial intelligence has emerged as a transformative force in the financial sector. It provides a variety of advantages that improve business operations and the consumer experience. From advanced data analysis to tailored service delivery, this powerful technology is driving growth and shaping the future of banking.

The use of Artificial Intelligence (AI) in the Fintech sector has numerous important benefits, transforming the way financial services are offered and experienced. Here is a detailed look:

Provides Personalized Customer Experience

AI helps organizations understand individual client preferences and behaviours through data analysis. This enables more personalized interactions, such as product recommendations, targeted marketing efforts, and tailored service offerings. Modern financial technology can monitor client opinions and purchasing habits to detect potential service gaps.

Based on these findings, fintech companies can provide relevant, pre-approved products and personalized financial advice, making interactions more meaningful and focused.

Protects Sensitive Financial Information

AI algorithms can detect and prevent fraudulent actions, including credit card fraud, identity theft, and cyberattacks. Artificial intelligence can detect suspicious conduct in real-time by evaluating transaction patterns, recognizing anomalies, and learning from previous instances.

AI systems constantly monitor network activity, detecting and flagging anomalies in user behaviour, such as strange login habits or questionable data requests. This proactive approach helps companies avoid data breaches and leaks, protect critical financial information, and maintain consumer trust.

Data Analytics

Data analytics can help to establish more efficient procedures and operations. For example, banks can utilize it to respond to regulatory inquiries more quickly and accurately. Advanced analytics can help improve cash management at ATMs and simplify routing, leading to significant cost savings.

AI can forecast future trends and customer behaviour, allowing organizations to plan ahead of time and solve prospective difficulties. This enables more effective planning and provides a competitive advantage.

Enable Sales & Digital Transformation

AI conducts in-depth analysis of customer data to predict consumer preferences and product creation. This data enables organizations to optimize inventory, distribute resources effectively, and meet sales targets.

AI speeds the digitization process by offering insights that help to design new products and services. This technology also allows companies to automate back-office activities, which improves operational efficiency and lowers clerical expenses.

24/7 Availability

AI-powered systems work around every minute, ensuring that clients have access to services and assistance at all times. This avoids downtime and guarantees that firms can respond to client demands quickly. AI may greatly enhance productivity and efficiency throughout a company’s departments by automating jobs and offering 24/7 support.

Popular Use Cases of AI In Fintech

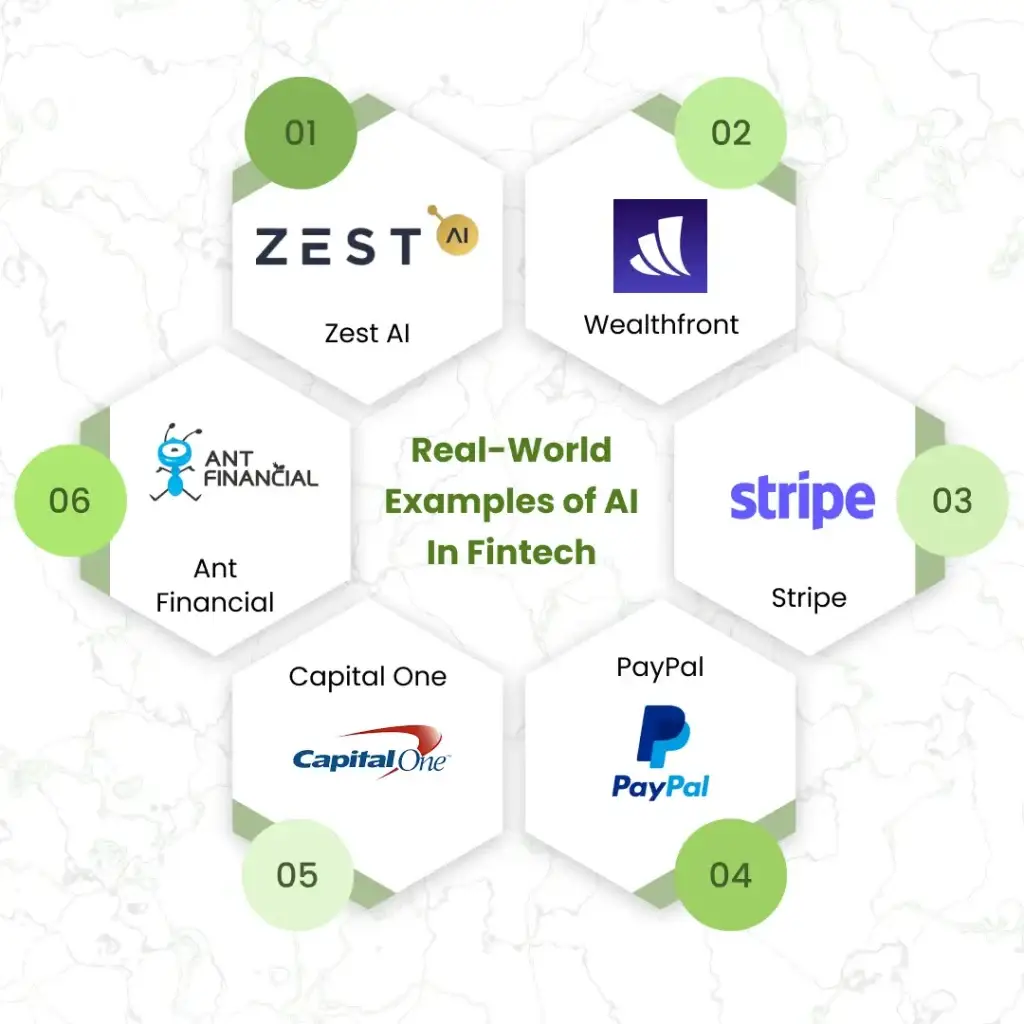

Zest AI

Zest AI focuses on AI-powered credit risk assessment. They use machine learning algorithms to assess a variety of data, including standard credit bureau information and other data sources (such as rental history, utility payments, and online conduct).

Wealthfront

Wealthfront is a robo-advisor that offers automated portfolio management and investment recommendations. Algorithms dynamically alter investment portfolios based on individual risk tolerance, investment objectives, and market trends.

Stripe

Stripe is a multinational technology business that creates economic infrastructure for the Internet. Stripe’s AI-powered fraud detection algorithms monitor billions of transactions in real-time to detect and prevent fraudulent activity, including credit card fraud and identity theft.

PayPal

PayPal is a popular online payment platform. PayPal uses machine learning to detect and prevent fraudulent transactions, including illegal account access and fraudulent payments. PayPal uses AI to assess and manage the risk associated with various transactions, such as high-risk merchants and potential money laundering operations.

Capital One

Capital One is a diverse bank and financial services provider. Capital One uses AI to create more accurate and comprehensive credit risk models, allowing them to make better loan decisions.

Ant Financial

Ant Financial is one of China’s biggest financial technology companies. Ant Financial’s credit rating system, Sesame Credit, uses artificial intelligence to measure individual creditworthiness based on a variety of factors such as online behaviour, social connections, and financial history.

Conclusion - The Future of AI In Fintech

The future of fintech with AI is promising and will likely improve the delivery of financial services. The influence of AI is regarded as a long-term shift in financial institutions’ operational portfolio management, analytical, and engagement operations.

AI enables fintech companies to provide their consumers with more efficient, secure, and customizable solutions, ranging from personalized financial advice to advanced fraud detection and streamlined customer care. As AI advances, its impact on the fintech industry will only increase, resulting in even more exciting advancements and opportunities.

Want to implement artificial intelligence and create change? Echoinnovate IT creates and implements high-powered AI solutions to demonstrate the potential usefulness and viability of AI initiatives.

FAQs: AI in Fintech: Transforming the Future of Finance

How is AI transforming the financial industry?

AI is revolutionizing finance by enabling automated trading, personalized financial advice, fraud detection, and improved customer service through chatbots and virtual assistants.

What are some common applications of AI in Fintech?

AI is used for risk assessment, credit scoring, robo-advisors for investment, predictive analytics, and enhancing security in digital transactions.

How does AI improve fraud detection in finance?

AI uses machine learning algorithms to detect unusual patterns in transactions, flagging potential fraudulent activities in real time.