Stripe vs Braintree vs PayPal

As more businesses establish their online presence, selecting the right payment gateway becomes a crucial decision. When comparing options like Stripe vs PayPal vs Braintree, it’s easy to feel overwhelmed. Choosing between Stripe alternatives or alternatives to Stripe and PayPal is essential to finding a solution that fits your business needs. A reliable eCommerce payment gateway ensures seamless payment integration and facilitates online credit card payment systems on your website.

A payment gateway is a secure service that bridges the gap between your website, the acquiring bank, and the customer’s credit card issuer. This system ensures that sensitive payment information is transferred securely and efficiently.

With a range of Stripe competitors and other online payment gateways available, businesses have myriad options to choose from, each offering unique features and benefits. From merchant accounts to all-in-one payment processors, these options can vary significantly, so understanding your needs is key.

The popularity of online payment gateways is driven by their ability to simplify how to set up payment on a website, making it easy for businesses to accept payments without disruptions. Selecting the right gateway ensures smooth transactions and enhances customer trust.

- The transfer of payment is convenient

- Security by encryption provides good security

- All transactions are guaranteed for customers

Types of Payment Gateways

- Cash cards

- Credit card/debit card

- Net-banking

However, the choice of a payment gateway is the most important part of online payment. Nonetheless, the online payment gateways make your transaction hassle-free.

With this in mind compare online payment systems Stripe vs Braintree vs Paypal, and choose the one that best suits your business goals and your user’s demands.

What are payment gateways: Stripe vs Braintree vs PayPal

Stripe is a US-based payment service that provides a seamless solution for online credit card payment processing. It enables businesses of all sizes, from startups to large corporations, to accept card payments effortlessly. Recognized as one of the best payment processors for small businesses, Stripe simplifies transactions for both individual users and organizations. Companies like Shopify, Dribble, Amazon, and Foursquare rely on the Stripe pay app for its reliability and efficiency.

For businesses seeking an alternative, Braintree payment gateway software is a strong contender, particularly for eCommerce companies. It is designed to handle payment processing for small businesses and works seamlessly on both web and mobile platforms.

Whether you’re looking to take card payments online, discover how to receive payments online for free, or find the best payment processing for small businesses, solutions like Stripe and Braintree are leading choices in the industry, making payments simple and secure.

Quick History

Launched in 2007, this eCommerce gateway supports every type of card for online paying and provides seamless international payment processing. Trusted by global brands like Airbnb, GitHub, Twilio, Uber, and more, this best online payment system continues to power smooth transactions across industries.

Notably, Braintree payment gateway software acquired Venmo, enhancing its appeal in the mobile payments market. Later, PayPal acquired Braintree, significantly expanding its market share and solidifying its position as a leader in money payments and mobile credit card processing.

PayPal stands out for enabling users to send and request money online quickly and securely. Its services also include sending money abroad, making it an excellent choice for international payment processing and peer-to-peer transactions. PayPal is widely accepted by companies such as Pandora, eBay, Expedia, and Booking.com, making it one of the best online payment systems.

According to Google Trends, PayPal garners more interest globally compared to Stripe and Braintree. Countries like South Korea, Denmark, and Ireland lead in searches related to the PayPal payment gateway. For businesses or individuals wondering how to accept credit cards on your phone or looking for a robust cell phone payment system, PayPal remains a top choice.

How do Payment Gateways Work?

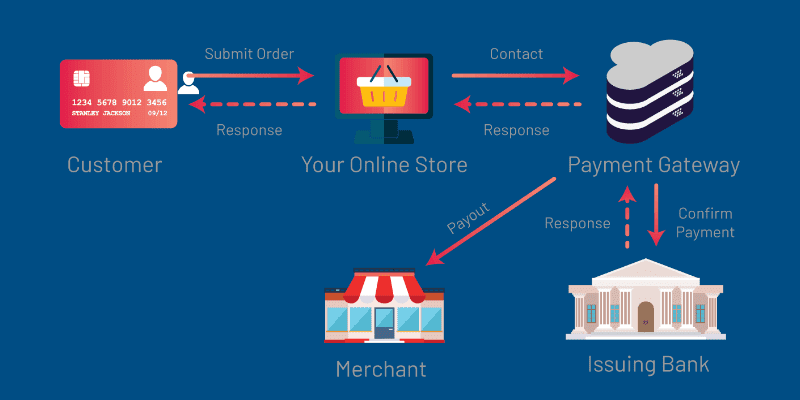

A payment gateway focuses on securing sensitive information and ensures the funds are available and eventually enables merchants to get paid. It ensures a secure connection between the client, an online platform, and a bank account.

At the same time, in real-time, the gateway authorizes electronic payments. If you want to purchase something online, a payment gateway easily completes the transaction in a few core tasks.

The workflow – Stripe vs Braintree vs PayPal

The workflow of these payment gateways is almost similar. In addition, to make the transaction, the customer chooses the type of payment method and enters the necessary details.

The customer-chosen payment gateway encrypts the credit card data and sends it to the client’s bank for authorization. Equally, important the bank processes the request to approve or decline and sends a response back to the payment gateway.

Furthermore, immediately the payment gateway sends the response to your website and the customer.

The greatest advantage of this system is that it secures data. Comparing the three payment gateways, PayPal is the fastest one to make the transactions. PayPal reflects foreign transactions in a period of only 2 days.

Stripe vs Braintree vs PayPal – Pricing

What are the fees for stripe accounts?

The pricing of these three payment gateways is pretty similar. However, the pricing will depend on your country.

Let us see the pricing for three, one by one.

For stripe, they charge an amount of 2.9% plus $0.30 each time you receive a credit or debit card payment.

There are no hidden charges, monthly, or set-up fees. There is an additional 1% conversion fee for international cards. For the refund process, stripe does not charge any type of fee.

The payment process of the stripe is transparent. In the documentation, users can see stripes pricing wherein the Stripe Dashboard can also see the fees charged for each payment.

- 2.90% + $0.30 per transaction

- 1% transaction currency conversation

- No monthly fee

- $15 chargeback

- 0.80% ACH processing

What are the fees for Braintree accounts?

Braintree, charge 2.9% for every transaction done from the card or digital wallet. There will be no hidden cost, but for the multicurrency, they will charge a 1% fee as well as international transactions.

Except for USD, this fee applies to any other currency. 0.30% of charges will be taken for the refund. On the company’s website, you can find all these fees in the pricing details. It enables you to know the pricing in a different country.

- 2.90% + $0.30 per transaction

- 1% transaction currency conversation

- No monthly fee

- $15 chargeback

- 0.75% ACH processing

What are the fees for PayPal accounts?

PayPal charges are the Similarly to Stripe’s, 2.9% plus $0.30 per transaction. For charities, PayPal offers a discount rate of 2.2% plus $0.30 per transaction. PayPal takes 4.4% per transaction for international sales, plus a fixed fee based on the currency received.

- 2.90% + $0.30 per transaction

- Payments Pro Plan – $30.00 a month

- Standard Plan – no monthly fee

- 1-4% transaction currency conversion

- $20 chargeback

Which Countries Support Online Payment Gateway?

The providers offer services in many countries, you should check if they cover the country you are targeting.

Stripe payment gateway is active in 26 countries, which includes the US, the UK, New Zealand, Canada, Sweden, and Spain.

Braintree serves 46 countries in North America, Australia, Europe, and Asia.

PayPal services are available in more than 200 countries worldwide.

Everything You Should Know About Payment Security

Paypal Payment Security

In PayPal, it is easy to store the credit cards of the user in a secure vault rather than getting them stored on your servers. Some vendors think that there is no defense against PayPal fraud where you can get your hands on an advanced anti-scamming toolkit for @10/month + $.05/transaction.

Stripe Payment Security

Strips online transactions support safe development, where it protects against potential data breaches.

Braintree Payment Security

Braintree fraud protection involves 3D Secure and advanced anti-scam choices. Based on particular warning signs, you can adjust the parameters to automatically discard transactions.

Supported Payment Types & Methods

Once you know your target audience, manage your payment methods. Here is the list of the payment methods that each service processes.

What types of credit cards are accepted by PayPal?

PayPal accepts Visa, Mastercard, Maestro, JCB, American Express, Discover, and Diners Club credit cards. Users can pay using PayPal accounts.

However, the payment does not accept any other payment method such as Bitcoin.

Which types of credit cards are accepted by PayPal?

Stripe accepts Visa, American Express, Maestro, Mastercard, Discover, and Diners Club cards as well as Apple Pay, Android Pay, Amex Express Checkout, AliPay, Pay with Google, Bitcoin, and ACH transfer.

Types of credit cards are accepted by Braintree

Braintree accepts Visa, Maestro, Mastercard, JCB, American Express, Discover, Diners Club, Apple Pay, MasterPass, Android Pay, Union Pay, Visa Checkout, Amex Express Checkout, Pay with Google, ACH transfer, PayPal, Venmo, and Bitcoin are also supported.

What are the payment gateways responsible for?

Manages the merchant’s switch configurations:

Each merchant payment configuration defines a sub-merchant ID. They communicate with the payment switch using this ID and validate transactions.

Merchants transaction roles

There are the minimum and maximum limitations for merchant transactions from a card in a day.

Manages the merchant’s 3D secure configuration

With the help of a payment switch, the payment gateway communicates with the card network and checks if the cardholder is enrolled for the 3DS. The related MPI lookup in Card’s directory services returns a response to the payment gateway.

Process payments

It processes payments by making a request to the payment switch and receives results and returns to the customers.

Sends payment records

Sends confirmation and receipts to merchants and customers.

Encryption and security

Ensures that your financial data is extremely sensitive.

Payment Gateway Steps in the Regular Transaction

Encryption

A payment gateway encodes the data or information exchanged between merchants and customers securely.

Request

Getting approval from the bank to issue the credit card while the payment process.

Fulfillment

The bank authorizes the transaction to carry on and move to the next phase.

In conclusion

Technology has progressed that allows you to transfer payments online, transparently, and safely.

We have mentioned above all the factors of payment gateways but the success of an online business can be ensured with customer satisfaction, so carefully choose a reliable and suitable payment gateway.

The three online platforms have their specialty. The choice of your payment gateway should be completely based on your needs.

Look at your personal business needs and choose the platform which best suits you.

FAQs Of Payment App Development

What is the difference between PayPal and Braintree?

PayPal and Braintree do provide different pricing models. One of the bigger differences between the two services is that, where Braintree offers individual accounts, PayPal is a third-party processor. Thus, PayPal aggregates all of its customers into a single merchant account.

What app is similar to PayPal?

- Skrill

- Payoneer

- Google Pay

- Stripe

And this blog has some similar apps to PayPal.

How much does it cost to develop an app like PayPal?

An application like PayPal is a complex entity, especially with its set of security measures. Other parameters that come into play are team constitution, third-party integrations, location of the development team, list of features, etc. Based on the features development cost may vary.

How do I create an online payment app?

A software development project to build an online payment app like PayPal would involve the following steps:

- Project scoping

- Select the right SDLC model

- Formulate a development approach

- Build a ‘scrum team’

- Sign up for managed cloud services platforms for the web and mobile app infrastructure

- Get an online payment solution

- Procure an ID verification solution

- Sign up for a CRM solution

- Buy a bulk SMS solution

- Download and setup IDEs

- Get a browser and mobile device lab on the cloud for testing

- Develop your web app

- Design the UI for the mobile app

- Code, test, and deploy the android app

- Developing the iOS app

- Use effective tools to manage the project

Which Company is Developing Apps like PayPal & Stripe?

- There are many great companies that are developing apps like PayPal and Stripe and Echoinnovate IT is one of them. We provide the best services as per your requirements. Look at your personal business needs and choose the platform which best suits you.