FinTech or we can say financial technology had a long and steady rise in the U.S. After years of innovations, financial leaders and influencers have developed a worldwide financial technology infrastructure that people use every day without even realizing it. In our latest blog, “Future of Fintech” you will get to know about FinTech innovations technologies, the future of FinTech industry, and much more.

What Is Fintech?

FinTech is referred to as “financial technology.” It is quite a new concept for several consumers. FinTech can be referred to as technological innovations that relate to concepts such as financial education, stock investment, cybersecurity, blockchain technology, crypto-currencies, e-wallets and other innovations. FinTech has been a rising, fast-developing sector within the financial services industry for many years. People working with innovating new technologies have established to modify the traditional operating way of financial markets. A large disruption was created for banks and financial intuitions by FinTech. One great example of this disruption could be seen in several mobile applications that provide services like stock trading without charging any fees from users per trade.

Fintech Business Model

FinTech business models influence technology and digital services to enhance the services of the financial industry. Such business models apply tech to several financial services. As we know, future of Fintech has become one of the hottest industries nowadays.

So, if you are an aspiring business owner and looking forward to venturing into the world of FinTech, you need to understand some basic statistics in the industry. Let’s have a look at some of the stats of future of Fintech industry:

- 66.7% share of bank executives believe that FinTech will have an impact on wallets and mobile payments all across the globe.

- The FinTech market is estimated to reach $309.98 billion at a CAGR of 24.8% by 2022 and a 38% share of U.S. personal loans were granted by FinTech.

- Latin America’s fintech market could increase by $150bn in 2021.

- The percentage of Americans who use digital banking is expected to rise by 65.3% by 2022.

Types Of Finance Technology Companies

Banking Company

- (Chime, Varo, Nationwide)

- Users can manage their bank accounts using e-banking apps instead of visiting a physical bank branch.

- It provides the majority of services found in a traditional physical bank, such as account opening, balance checking, funds transfer, payment processing, and loans, among others.

- These apps provide users with access to their bank accounts 24 hours a day, seven days a week. Furthermore, regular app notifications keep users up to date.

- N26 is an excellent example of a digital bank that provides consumers with totally digital accounts. The N26 mobile application can be used to manage these accounts.

- Users can make secure online purchases thanks to N26 fingerprint recognition and powerful 3D secure technology.

- N26 also enables users to link their accounts to only one smartphone at a time. A PIN is required for all N26 transactions.

Investment Company

- (Fidelity, Schwab, Vanguard) Examples of investment companies include Fidelity company, Schwab company, and Vanguard company.

- Fidelity Company offers the best work-life balance with great benefits. Fidelity Investments operates a brokerage firm and provides many services like funds, investment advice, cryptocurrency, and much more.

Investment Course Selling Business

- (Day Trading Academy, TRADE PRO Academy, Warrior Trading) These are the best examples of investment course selling businesses i.e. Day Trading Academy, TRADE

- PRO Academy, and Warrior Trading. TRADE PRO Academy is well-established in the professional trading industry. Warrior Trading provides structured trading methods and has a large community of traders.

Blockchain & Cryptocurrency Company

- (Coinbase, Paxful, Chronicled)

- Companies such as Coinbase, Paxful, and Chronicled are the best companies to invest in. Coinbase is a very secure platform. This platform makes it easier to buy, sell, and store cryptocurrencies like Bitcoin and more.

Manage Personal Finance with App

- (PocketGuard, Charlie, YNAB)

- Here are the examples of the most useful apps to manage your personal finance: PocketGuard, Charlie, and YNAB. YNAB or we can say You Need A Budget is useful for users who wish to set strict financial aims.

- This app allows you to set your priorities. This app is available for both users i.e. Android and iOS. Other Types of Finance Technology Companies for your fintech startup ideas are:

Digital payment

- One of the most significant aspects of the fintech business is digital payment.

- It allows for cashless payments to be made swiftly and securely. These are fintech apps that allow users to make digital payments to transfer money using online payment systems, e-wallets, and digital currencies.

- Businesses in a variety of industries are using innovative fintech solutions that enable users to send payments in real-time and at a reasonable cost.

- PayPal is an example of a digital payment processing service. This allows customers and sellers to make safe money transactions without providing personal financial information.

- PayPal is extremely popular because it allows users to register a variety of debit and credit cards with their PayPal accounts.

- The goal of digital insurance solutions is to lessen the likelihood of fraud during insurance claims by speeding up policy administration and claims processing.

- As a result, such apps provide a better user experience while also enhancing claim accuracy.

- Take some tips from Insurify, an auto insurance application that employs artificial intelligence to give precise and accurate auto insurance rates to its users.

How Will Fintech Change Traditional Banking?

In the future of Fintech, evolution had a huge impact on traditional banking. The banks were compelled to adjust and keep up because of a great competitor. As per Citibank, the bank states that users may switch from traditional banks to FinTech services and that will ultimately decrease jobs in the banking sector by 30%. But, future of Fintech might create new jobs since banks remain trusted financial institutions.

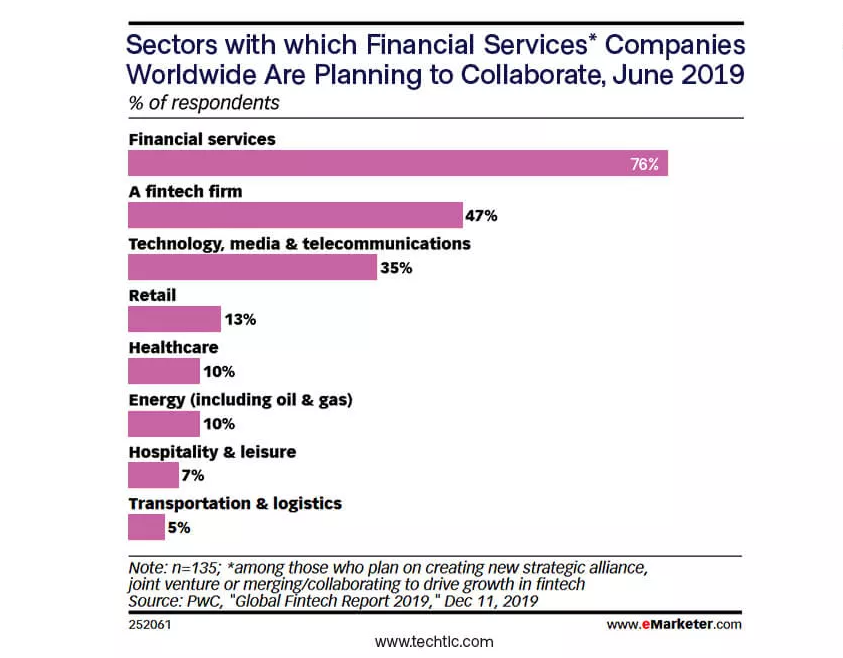

Several banks have developed their services and are collaborating with FinTech companies in response. As per the current scenario, FinTech had a huge impact and will continue to have but financial analysts are unable to predict the fall of traditional banking. Banks were considered untouchable institutions that have never undergone any competition.

One thing that can save them from lagging is that they need to compete with the entire ecosystem and become innovators themselves. In this entire process, the only customer has the freedom and flexibility to choose the financial services as per their requirement without making any sacrifices.

Top 3 Fintech Innovations Technologies

Mobile Banking

In 1999, from the first appearance of SMS Banking to today’s smartphone banking apps that offer multiple services, mobile banking has come a long way. In today’s smartphones, Mobile Banking enables mobile payment and management of all banking and financial services. Mobile banking has every financial service that customers may access on their smartphones. It reduces operation costs and location dependency on financial services. Mobile banking includes various forms such as mobile wallets, mobile internet banking, etc. Mobile Banking also provides an end-user interface for the expansion of this platform.

Artificial Intelligence (AI)

AI has a list of uses in the FinTech industry as well as the wider finance world. Artificial Intelligence plays a major role in accurate decision-making by analyzing the whole data and will come up with the best-recommended results. It saves time and money for the companies through machine learning. AI lets the industry deliver better customer services and a great environment for the customer. Artificial Intelligence also helps in fraud detection and prevention. Another use of AI includes automated customer support. We see AI bots while browsing the internet, they help customers by answering their queries.

Biometrics

Biometrics plays an essential role in data security and safety. With the use of biometric technology, we get the most secure methods to authenticate users. Biometric technologies use physically unique features of a person, including fingerprints, face, voice, retina, and other forms of recognition to increase security and identity verification. Biometric technology is also expedites payments and transactions in FinTech. Due to the availability of better sensors in smart devices these days, it has become easier for banks to safeguard their users, and prevent cybercrimes, and identity theft easily.

What Is The Future Of Fintech And How It Is Shaping The Future Of Payment?

Python for Web Development:

The advancement in technologies such as open banking, blockchain, and Artificial Intelligence has driven Fintech and will continue to drive the innovation of the future. FinTech has become the future of all things be it investing or trading.

The influencers or leaders in the industry are developing a vast range of financial products and services with the latest technology and designed in such a way that money management becomes more accessible, more efficient, and quicker.

Due to the evolution in technology companies can serve their customers in a better way by delivering more efficient or smooth and transparent experiences.

Since we know how rapidly things are changing and life is constantly accelerating due to the advancement in technology, FinTech helps us to cope with these rapid changes by being more organized, productive, and informed.

Finances are an integral part of all of our lives and the thing that helps us manage money in a better and organized way is something we all can use.

Fintech is clearly changing the financial services industry. Businesses in this industry have begun to explore new and innovative strategies to influence the future of banking and finance.

Impact Of Innovations On Financial Sector:

- Fintech products and services are gaining traction across industries and sectors. High adoption rate no longer limits the products and services to the finance sector.

- Paying using a contactless card is no longer an option. They’ve risen to the top of the list of most popular payment options.

- Businesses are discovering new methods to give customer care as fintech rediscovers client delight. Everything revolves around customer happiness, from 24-hour access to safe payments.

- Banking has become a non-physical client experience due to the widespread use of mobile phones and access to technology.

- Cryptocurrency is gaining global legitimacy as a digital asset, and the world of fintech is changing to give appropriate support.

Why Is Fintech Growing So Fast?

You must be hearing a lot about financial technology these days due to its enormous increase rate worldwide. In the last 5 years, there has been a huge rise in FinTech with so many changes and innovations in such a short period. 2022 can be predicted as “the year of Fintech” as it is constantly growing. It has largely expanded access to capital to small business owners under-served before the advancement in technology.

The FinTech industry handles digital finances worldwide. The FinTech industry has come a long way and has successfully implemented digital services in our daily lives. The implementation of technological innovations such as mobile payments, Artificial Intelligence, and Banking Sectors had a huge impact on the revolution of this industry. The transactions and online payment services offered by the FinTech industry have been playing an active role.

Artificial Intelligence(AI) is rapidly becoming an integral part of the growth of the sector. This has boosted economic growth by approximately 17%. The financial industry has made life easier for various businesses and users by implementing innovations each time. FinTech will grow in the upcoming years. FinTech will continue to provide a better life to people worldwide with all its unique features and life-changing technologies.

As per the reports, economic sectors for example security, insurance, and online finance will be experiencing significant growth in efficiency and productivity in the upcoming years. That will ultimately improve the world’s economy.

Also Read:

Wrapped Up

Due to evolution in the past few years and the changes or innovations that will be made in the next couple of years will have a huge impact on the FinTech Application industry. The FinTech industry will enhance the user experience for finance by making it more efficient, enjoyable, and Secure.

We will see a new generation in the upcoming years who will be able to enjoy all the perks offered, transparency, and hassle-free experience driven by the fintech revolution.

This is the right time to start your FinTech business and for that, you need an excellent FinTech app to start your business. We at Echo Innovate IT, deliver the best app services and we are one of the leading companies with more than 12 years of experience. Contact us now to get the best app development services at the most affordable prices