How E-Wallet Technology Is Transforming the World in 2025

In 2025, e-wallet mobile apps – spanning Android, iOS, and cross-platform solutions—are at the forefront of a global financial revolution. These digital wallets provide fast, secure, and convenient payment solutions for everyday transactions, online shopping, peer-to-peer transfers, and even international remittances. By leveraging mobile-first design, intuitive user interfaces, NFC technology, biometric authentication, and QR code payments, e-wallets are redefining how both consumers and businesses handle money.

Explosive Market Growth and Financial Inclusion

The e-wallet market is expected to exceed $15 trillion in transaction volume by the end of 2025. This growth is driven by increased smartphone adoption, faster mobile internet, and the demand for cashless transactions. In the United States, e-wallets are no longer a luxury—they’re a necessity, enabling secure digital payments for people in both urban and rural areas, thus fostering greater financial inclusion.

AI-Powered Personalization and Enhanced Security

Artificial intelligence now plays a central role in e-wallet app development. AI-driven analytics track spending habits, suggest budgeting strategies, and provide tailored offers to enhance user engagement. Biometric security measures—such as fingerprint scanning, facial recognition, and voice authentication—offer a seamless yet highly secure way to authorize transactions, protecting users from fraud.

From E-Wallets to Super Apps

Modern e-wallets are evolving into “super apps” that go beyond payments. They now integrate loyalty rewards, travel bookings, bill payments, micro-loans, insurance, investment tools, and even digital IDs. For businesses, these super apps open new revenue streams and strengthen customer loyalty through in-app ecosystems.

Contactless, Fast, and Frictionless Payments

Contactless payments have become the preferred method for over half of U.S. consumers. NFC-enabled e-wallets can process payments in under a second, while tokenization and encryption technologies ensure sensitive financial data remains safe. This combination of speed and security has made e-wallets a dominant force in both retail and e-commerce sectors.

Blockchain, DeFi, and Regulatory Compliance

Blockchain integration enhances transaction transparency, reduces cross-border payment costs, and facilitates instant settlements. Some e-wallets are also incorporating decentralized finance (DeFi) features, allowing users to stake assets, earn interest, or trade cryptocurrencies directly within the app. At the same time, regulatory compliance—through KYC (Know Your Customer), AML (Anti-Money Laundering), and PCI-DSS standards—remains critical for building trust and meeting legal requirements.

CBDC Readiness and Global Connectivity

Central Bank Digital Currencies (CBDCs) are being actively explored by governments, and leading e-wallet platforms are preparing for seamless integration. This readiness positions them to enable instant, low-cost cross-border transactions that connect global economies more efficiently than ever before.

Building Trust Through E-E-A-T Principles

In 2025, the most successful e-wallet apps demonstrate Experience, Expertise, Authoritativeness, and Trustworthiness. This means transparent developer credentials, rigorous security protocols, user-friendly designs, positive customer reviews, and proven reliability. For both B2B and B2C markets, these qualities are essential for long-term adoption.

Conclusion: The Future of Digital Payments

E-wallet mobile app development in 2025 represents a convergence of advanced technology, financial innovation, and user-centric design. With AI personalization, blockchain integration, contactless transactions, and the emergence of super apps, e-wallets are not only transforming payments—they’re shaping the future of global finance. For consumers, this means convenience, security, and control. For businesses, it’s an opportunity to engage customers, reduce transaction costs, and expand into new digital marketplaces.

Smartphones have altered the world in numerous ways, including the ease with which we may purchase goods and services. Everything you need is only a touch away. Our licenses, credit and debit cards, and event tickets can all be carried without a wallet. Almost everything we use is being transformed into a digital format. And so our wallet has become an e-wallet.

This has affected not only the way we consume but also the way we think about consumption, notably our expectations of what constitutes a transaction process.

In this digital age, speed and efficiency are important, and the new digital wallets are just helping to speed up the process.

Also Read:

What Is A Digital Wallet?

Mobile apps that store credit card and bank account information are known as digital wallets. They are useful for making purchases both online and in-store. To make purchases, they eliminate the need to carry a wallet full of cash and credit cards. Digital wallets are becoming increasingly popular around the world. This is due to the fact that they are more user-friendly and secure than traditional payment options. Some believe that digital wallets will eventually replace cash and credit cards.

The History Of E-Wallet

Coca-Cola introduced a few vending machines in Helsinki in 1997 that allowed customers to buy a can using text messages. Despite the fact that it differs greatly from modern-day e-wallet transactions, this is claimed to be the genesis.

Mobile devices were soon being used to buy movie and airline tickets, book hotel rooms, and place food orders.

By 2003, over 95 million cell phone users had completed a transaction using their phones. Google was the first major corporation to provide a mobile wallet in 2011. NFC (near field communications) technology allows customers to pay, receive loyalty points, and redeem discounts. It was a great hit, despite the fact that it was only available on one phone model and was only accepted by a few retailers.

In 2012, Apple introduced Passbook, which could be used for boarding passes, tickets, and coupons but not for making mobile payments.

Apple Pay was launched two years later. It started in the US and quickly spread to the United Kingdom and China. In 2015, Android and Samsung Pay were released.

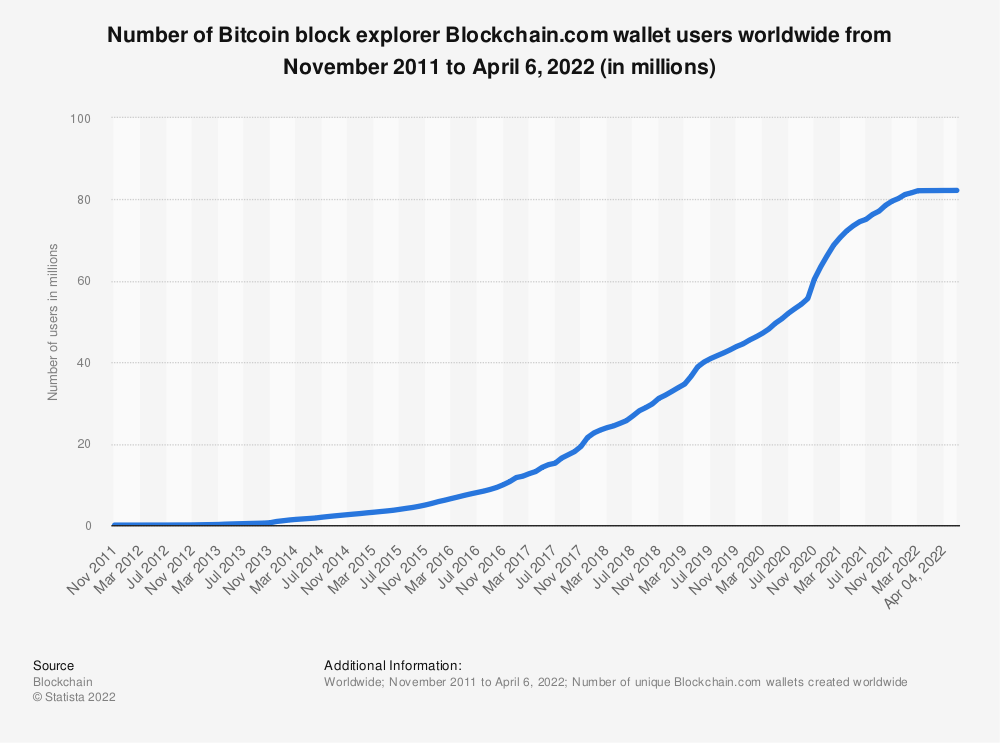

Since then, digital wallets such as GrabPay, Lazada Wallet, PayPal, Touch n Go, vcash, and others have aided in the widespread use of this electronic payment system. In 2019, over 2.1 billion people were using a mobile wallet to make a payment or send money, according to Juniper Research.

How Does A Digital Wallet Work?

How to use a digital wallet is the question that arises in people’s minds? Customers can make online payments using their e-wallet system by using the e-wallet System module. e-wallet Cash can be used at any time during the checkout process, and money will be deducted from the customer’s e-wallet Cash account. They can easily add money to their e-wallet. The administrator can put money into or take money out of the customer’s e-wallet. Credit rules for consumer repayment can also be created by the administrator. They can also process the refund to the customer’s e-wallet for the purchased order. At last, you can log in with your username and password into My Digital Wallet if you have an account and see your transaction details.

How Is The E-Wallet Transforming The World?

Consumers and retailers alike are becoming increasingly interested in digital wallets. Why are digital wallets gaining so much traction? What are some of the advantages of using a digital wallet?

Safe and Secure

For one reason, unlike regular wallets, digital wallets cannot be stolen or misplaced. The information in the wallet is protected by encryption. During a transaction, your real account numbers are not transmitted.

Instead, the retailer receives a unique identification, or “token.” This token serves as a reference to the sensitive information required to complete the transaction. These tokens lose their value after the money withdrawal.

Easier to Manage

We no longer need to carry cash or credit cards on, all thanks to digital wallets. A digital wallet has a number os uses. Users of some digital wallets can even withdraw cash from ATMs.

The app stores all of your financial information. You may see your account balances as well as your transaction history. You can use a digital wallet to hold money in addition to credit and debit cards.

- Driver.s license and other virtual IDs

- Insurance cards

- Cryptocurrency digital wallet

- E-coupons

- Gift cards

- Boarding passes

- Concert tickets

Better User Experience

Users enjoy a better shopping experience with digital wallets since they are so simple to use. Instead of remembering multiple passwords, users only have to remember one. Wallet apps allow you to conduct online and in-store purchases, pay bills, deposit money, and transfer money.

Merchants can benefit from digital wallets as well.

Transactions are more secure, and fraud is less likely. Checkout is simple and straightforward, resulting in increased sales and fewer abandoned carts.

Rewarding Shopping Experience

Clients will have a nice shopping experience on your website thanks to the simple payment option that requires no effort. They want to return to your site more frequently for online purchases, which contributes to customer retention.

Quick and Easy Payment

Along with checkout, the process is a complete blight for every customer; they must choose a method of payment each time they make a purchase, and a terrible internet connection makes the experience even worse. Payment failure has never been an issue for customers. There will be no abandoned carts visible to the business owners.

Protect Users from Fraud

Merchants are protected from fraud by using the e-wallet feature on eCommerce websites. In the event of last-minute cancellations, deception damage, or return claims, e-wallet transactions ensure that the consumer is genuine and that payment is completed at the time of purchase, avoiding payment problems.

How Mobile Technology Is Motivating Contactless Payment?

The use of contactless payments has increased in more places throughout the world thanks to mobile technology. Another factor for the increased use of contactless payments is the rapid growth of digital wallet apps.

at are some of the advantages of using a digital wallet?

How Does Technology Work?

An Android or iOS smartphone or tablet turns into a POS terminal using tap-to-phone technology. As a result, contactless payments are now possible at every location.

To accept payments, the merchant downloads an app and creates a bank account within it. Customers can then pay for their transactions by tapping their smartphone or smartwatch against the console. Customer information remains safe and secures using unique security codes to prevent fraud.

Future Of E-Wallets

E-wallets are becoming increasingly popular and are in more use in mainstream services. The majority of businesses now accept Apple Pay, Samsung Pay, Google Pay, PayPal, and Chase Pay.

E-wallets aren’t as popular as cash or credit cards, but they’re gaining traction in so many industries that some experts believe they’ll eventually overtake cash and credit cards as the preferred payment method.

Why Should You Invest In Digital Wallet Technology?

The advancement of the Internet of Things (IoT) and other technologies seems to be causing the payment transition to go much beyond what we imagined. The evolution of consumption does not end here, and purchases are expected to become faster and easier in the future.

Less paper money and cards, more digital payments, the development of digital wallets, improved payment security, and the application of artificial intelligence for biometric authentication are just a few of the market projections.

Help to build the economy in the future by becoming digitized; it aids in the transformation of payment without the use of actual cash. Investing in these methods of payment allows you to take the first steps toward the future, attracting and retaining potential clients.

Echoinnovate IT is the top mobile app development company with over 12+ years of experience. Our skilled technical analysts assist in the selection of the best solution to fit the client’s business goals, and Echo Innovate IT has considerable experience in eCommerce app development. We have a team of talented developers who can build a scalable e-wallet module for any platform. Get the best digital wallet for yourself with our top-notch solutions.

Echoinnovate IT can also deal with digital wallets and transactions. If you wish to add an e-wallet to your eCommerce store, contact our technical analyst right away.

FAQs

Why is E-wallet important?

A digital wallet securely stores all the payment information of users in a compact form. Therefore, it greatly reduces the need to carry physical wallets.

What is the future of digital wallets?

Digital wallets are close to becoming the most widely used method of payment in person. According to Worldpay’s Global Payments Report, by 2023, a digital wallet will account for more than half of all e-commerce transactions worldwide.

What is the importance of an e-wallet in a business transaction?

Digital wallets help you organize everything from credit cards, debit cards, customer loyalty cards, membership cards, to your VIP cards, and more in just the palm of your hands.

What is an e-wallet app and how is it changing payments in 2025?

An e-wallet app on Android or iOS securely stores payment information—credit cards, bank accounts, even digital IDs—and simplifies digital transactions. By combining mobile-first design with NFC, QR, and biometric authentication, e-wallet apps offer touchless, seamless checkout experiences that significantly enhance user convenience and drive digital adoption.

Why are e-wallet mobile apps becoming essential for users and businesses?

E-wallets eliminate the need to carry physical cash or cards, lessen transaction friction, and elevate security using encryption and tokenization. Businesses benefit from faster checkouts, improved conversion rates, and reduced cart abandonment—making mobile wallets indispensable tools in B2B and B2C digital ecosystems.

How are mobile e-wallets ensuring better security than traditional methods?

E-wallets protect sensitive data through secure encryption and tokenization, where unique identifiers replace real account details during transactions. Biometric features—like fingerprint, facial, and voice recognition—fortify authentication, providing security that’s both robust and user-friendly.

What additional assets can be managed in a modern e-wallet?

Beyond payment cards, 2025 e-wallets on Android and iOS can store digital assets such as boarding passes, insurance ID, cryptocurrency wallets, gift cards, loyalty points, and e-coupons. This multifunctionality transforms e-wallets into unified digital ecosystems for users.

How is AI personalization enhancing e-wallet experiences?

Artificial intelligence in e-wallets analyzes user spending to recommend budgeting tools, personalized savings prompts, targeted offers, and real-time spending alerts. These AI-driven insights help users make smarter financial decisions and engage more deeply with the app.

What are “super-apps” in the e-wallet space?

Super-apps are advanced digital wallets that integrate payments, loyalty programs, bill payments, micro-loans, insurance, travel bookings, and even digital IDs—all within one app. They serve as centralized hubs for consumers, enhancing loyalty and expanding revenue streams for businesses.

How does blockchain and DeFi integration benefit mobile wallets?

Blockchain enables secure, transparent, and cost-effective transactions, including cross-border transfers. DeFi features—like staking, earning interest, and in-app crypto trading—empower users to manage assets directly within their e-wallet, blurring the lines between payments and investments.