Quick Summary

Are you intrigued by the idea of developing your own stock trading app, this detailed blog will help you navigate the process. The stock market has become more accessible than ever, thanks to the rise of stock trading app development. The powerful stock trading applications have revolutionized how people engage with financial markets.

The apps enable individuals to trade stocks, monitor portfolios, and make informed investment decisions with just a few taps on their smartphones. The blog covers the detailed stock market app development process with its benefits and cost.

Building a stock trading app involves a careful blend of cutting-edge technology, seamless user experience, and robust security measures. From ideation to development and deployment, each step requires meticulous planning and execution.

The blog covers the essential components and considerations to develop a trading app. Whether you’re an aspiring entrepreneur or a developer, this blog is for you to get started.

Online Trading Statistics

According to Statista, the global online trading market increases by 6.4% annually. It is expected to reach 13.3 billion U.S. dollars in 2026.

Why Should You Invest in Stock Trading Application Development?

Stock trading is in the trend, and these applications have a massive user base. Stock trading apps allow busy investors to check their portfolios and stay updated on the current status. App users are willing to pay for the premium plans to benefit from this convenience.

So, there is a huge scope for earning higher returns on investments from stock trading app development. This is the reason why businesses are investing in developing a stock trading app like Robinhood and E-Trade.

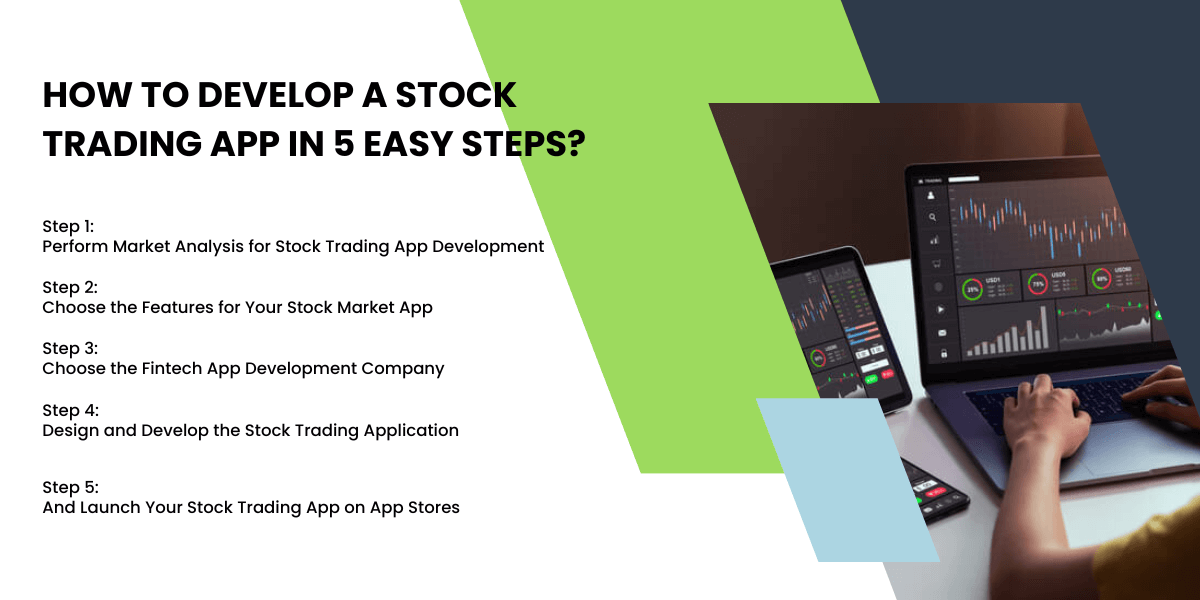

How to Develop a Stock Trading Mobile App in 5 Easy Steps?

Let’s quickly understand the different phases of trading app development in 5 simple steps.

Step 1: Perform Market Analysis for Stock Trading App Development

Before hiring a fintech application development company, ensure to conduct market research to understand current market trends and target audience pain points. At this stage you get the clarity of what you want to offer to your users and thus define your app requirements accordingly.

The next thing in the research stage is to identify the top competitors of your app. You can list the best stock trading apps available and choose your closest competitors.

Well, here again we have made your job easy as we have covered the list of best stock trading apps in India and USA. So, check that out and find your immediate competitors.

Another thing that can help you out is to check the reviews and ratings of the applications in the Play Store to see the loop-holes and where the applications are lacking.

Users share the challenges they faced with the apps in the feedback section. Thus, you can avoid those mistakes and plan for your online trading app development process in a better way.

Step 2: Choose the Features for Your Stock Market App

Once the research is done, the next step in development process of a stock trading app is to to choose the basic and advanced features for your stock trading application. The app’s key focus is to enable your users to track and manage their investments in stocks easily. If you want to know how to make a stock market app, choose from essential features.

Features to Include in Your Stock Market App For Investors:

- Predictive analysis tool

- Buy and sell crypto

- Push notifications

- Real-time market data

- Advanced charting tools

- Add to watchlist

- Online chat customer service

- Integration with other financial accounts

- Educational resources

Step 3: Choose the Fintech App Development Company

The next step is to hire dedicated app developers or a custom mobile app development company to turn your ideas into reality. Get your ideas validated by the experienced app development consulting company, and also know the cost and timeline to build a stock app for your business.

You can find stock market app developers for hire on Clutch, Upwork, and Toptal. Ensure to check their portfolios, work experience, reviews, and client feedback before starting trading mobile app development process. Again, Echoinnovate IT can save your efforts and time by providing the best trading app developers.

Step 4: Design and Develop the Stock Trading Application

The hired fintech software development services company will design and develop the solution based on your project needs. They first create the wireframe for the app to get your suggestions and final approval after the requested edits, if any. Next, they choose the relevant technology stack to build a powerful stock trading application.

Next, the fintech app development team starts writing the codes based on requirements. They also take care of the required third-party integrations while following the best industry practices.

Step 5: and Launch Your Stock Trading App on App Stores

The testing of the stock trading app goes hand in hand with finding the bugs or loopholes at an early stage. The quality assurance engineers test all aspects of the custom application to find software glitches, data leakages, security patches, or other bugs.

Both automated and manual tests help check the app completely and make it ready for launch on app stores.

The Fintech app developers team launches the application on Google Play Store or Apple Stores to be available for end users.

Next, the fintech app development team starts writing the codes based on requirements. They also take care of the required third-party integrations while following the best industry practices.

Best Stock Trading Apps in India

1. Upstox

Upstox is one of the most popular Stock trading platforms in India. Headquartered in Mumbai, the app is backed by prominent investors like Mr. Ratan Tata.

Upstox provides price alerts and extensive charts/analytics enabling users to track the status of their portfolios. Upstox provides helpful news updates relevant to user investments. The app offers a user-friendly interface with multiple stock trading options.

Features:

- Help you make wise investments.

- Notifies about the prices of user's favorite stocks.

Android Ratings: 4.4/5 stars

Android Downloads: 1 Crore +

iOS Ratings: 4.2/5 stars

2. Groww

Groww is one of India’s highest-rated online stock market business apps. It enables people to open their trading accounts for free.

Groww app enables users to trade in gold, fixed deposits, and others besides conventional stock trading. The app does not charge any commission to use the services, making it hugely popular. Users can directly invest in mutual funds, track invested mutual funds, or do SIP (Systematic Investment Plans) for free with zero commissions.

Features:

- Invest in Gold, FDs, domestic and US stocks, Mutual Funds, and F&Os

- Learning resources

- Self-directed trading

- Advanced charts to study market trends

Android Ratings: 4.5

Android Downloads: 1 Crore +

iOS Ratings: 4.2/5 stars

3. 5 Paisa

5Paisa Mobile Trading App is known for its user-friendly interfaces and easy-to-use trading application. The app is available for both iOS and Android and offers a wide variety of features for smart mobile trading.

Features:

- Real-time screening of quotes

- Invest in SIP

- A fully automated investor advisory system

- Investment in mutual funds

- Stock trading in equity, intraday & F&O segments

- Best Known for Auto Investing

Android Ratings: 4.2/5 stars

Android Downloads: 50 Lakh +

iOS Ratings: 4/5 stars

4. Paytm Money

Paytm Money is a trading platform offering investors a seamless trading experience. The app is safe and secure and is a pioneer in low-cost investing. The app has a strong customer base of 60+ lakh users as of Dec 2020.

Features:

- Free Equity Delivery trading

- Zero commission direct mutual funds

- Zero maintenance charges

- Fully digital account opening

Android Ratings: 3.7*

Android Downloads: 10M+

Best Stock Trading Apps in USA

1. Fidelity Investments

Fidelity Investments is one of the best stock trading apps in the USA, and it offers a wide range of accounts & investments to meet the needs of all investors.

The app is great for those looking to buy and hold for long-term goals like retirement, as it offers a wide range of investment products, including fractional shares. Fidelity is best for beginners but also suits other active traders and long-term-focused investors.

2. Interactive Brokers

Interactive Brokers is a great choice for expert traders. The app offers multiple types of accounts for retail investors, professional and institutional investors. Interactive Brokers’ mobile app is a fully-functioning investment platform with advanced trading tools.

3. TDAmeritrade

TD Ameritrade, mobile trading app, is a dynamic and powerful alternative to the full desktop version. The app offers a simple and user-friendly experience with neat trading features. Users can easily invest, trade, and maintain portfolios on the app.

4. E*Trade

E-Trade is a leading stock trading app for retail investors. The app provides investors access to educational resources to assist users in conducting investments, and analyzing and diversifying their portfolios.

E*Trade offers zero-commission stock, ETF, and options trading. E*Trade offers two free platforms having web and mobile versions.

How do Stock Trading Apps Work?

A stock trading app is an end-user platform where people sell and buy stocks. The app enables users to handle, borrow, save, and invest money. With online stock trading apps, users get complete access to the market. They can monitor changes in market activities, get real-time stock quotes, and check their portfolios.

Tools and Technologies Required for Building a Stock Trading App

The fintech app development company chooses the most relevant technology stack for each client based on their unique business needs.

The tech stack consists of both backend and frontend technologies. The most popular technologies used in frontend development are Angular and ReactJs.

The backend technologies include DotNet and Java. These technologies are ideal for developing a stock trading mobile app. These languages support complex functionalities and multiple processes.

| Categories | Technologies |

|---|---|

| Programming Languages | Flutter ReactNative Android (Kotlin/Java) iOS (Swift/Objective-C) |

| Database | MongoDB PostgreSQL MySQL |

| Backend | Python Laravel Nodejs Ruby on Rails |

| Utilities | Google Analytics |

| Version Controls | Git Apache SVN |

| Business Tools | Slack G-suite Asana Jera Trello |

| Volume Testing | Verified if the web app can handle large volumes of data. |

| Payment Gateway | Stripe PayPal 2Checkout Moneris |

Want to Hire Developers for any technology?

Call us now to discuss your project requirements and hire from the top 1% of talented Flutter engineers.

What Are The Benefits Of Stock Trading Apps?

Provides competitive advantage

Gain a competitive advantage for your business by giving your users a better experience.

Increases accessibility

Enables users to easily access their investment portfolio and track the performance of their stocks with a phone or tablet.

Improves customer retention

The app improves customer retention rates by providing convenient and quality services.

Opens new revenue streams

Businesses can generate revenue through various methods, such as charging a fee for downloads, monetizing through advertising, or offering in-app purchases.

Increases brand awareness

The stock trading app helps increase your brand’s visibility and reach. It also helps drive more traffic to your website.

Benefits Of Hiring Mobile App Developers

Experienced developers

Developers specializing in building financial apps have the right technical skills and expertise to build reliable apps.

Required Customization

A custom cryptocurrency app development company builds custom stock trading apps tailored to specific needs and requirements.

Ensure scalability

The hired developers take care to use technologies that make an app scalable and reliable for the long term.

Ongoing support

When you hire developers, you can access ongoing support and maintenance. It helps in future updates.

Time and cost savings

Building a stock trading app from scratch is complex and time-consuming. Hiring offshore developers help reduce development costs up to 60%.

Need a budget estimate for your project?

How Much Does it Cost to Build a Trading Platform?

The cost of developing a stock trading app ranges between $25,000 to $1,50,000. The cost varies significantly because of different factors in the app development life cycle.

These factors include the complexity of the app, the number of features, the app development platform (iOS, Android), and the location and experience of the development team.

As a top custom mobile app development company, we have curated the cost of developing the stock trading app based on the development stage, features, and location.

Stock Trading App Development Cost based on Development Stages

How much does the app cost based on different app development stages? The following cost is for medium-level stock applications.

| Stock App Development Stage | Estimated Cost |

|---|---|

| Planning and Prototyping | $2,800 – $3,500 |

| Designing and Coding | $21,000 – $22,400 |

| Stock App Testing | $3,150 – $3,500 |

Stock Trading App Development Cost based on App Complexity

The app’s complexity depends on its number of features and third-party integrations. The more features, the more it will cost you to build a stock trading platform.

Let us see the cost and features of a simple stock app.

Simple Stock App Starts from $35,000

Features:

- Real-time market data

- Portfolio tracking

- Market insights and analysis

- Customizable dashboards

- Charting and risk management tools

- Educational resources

Complex Stock App Starts from $50,000

Conclusion

Stock trading apps are gaining huge popularity. Creating a stock trading mobile app like Robinhood and E-Trade, businesses stand a good chance of earning massive returns on investments.

Partnering with a top mobile App Development Company will help build a custom stock trading application according to your custom app. You can hire mobile app developers with us to get your app developed. Contact us today.

FAQs

How To Monetize A Stock Trading App?

You can monetize the stock trading app in many ways-

- Charging a fee for downloads

- Monetizing through advertising

- In-app purchases such as additional features or educational materials

Which Are The Third-Party APIs To Integrate Into The Online Trading Apps?

You can integrate several third-party APIs in the stock trading app to enhance functionalities.

- DriveWealth

- Alpaca

- Bloomberg API

- Alpha Vantage

What Kind Of Support Do I Get From Your Company After Development?

We provide full after-development support to our clients. You’ll get updates, modifications, new features, and technical support to keep your app running smoothly and adapting to your business’s demands.

What Is The Cost Of Building A Stock Trading App?

The cost of building a stock trading app depends on the factors of the app development lifecycle. The factors include-

- App size

- App complexity

- UI/UX design complexity

- Developer Rate

- Development Hours

- Third-party integrations

As the leading mobile app development company, we can offer you an exact cost quote. Contact us with your detailed requirements.

Are There Any Legal Challenges Or Issues In Stock Trading App Development?

Take care of the following legal considerations while building a stock trading app-

- Compliance with financial regulations

- Intellectual property issues

- Data privacy laws

Consult with a lawyer to ensure you comply with all relevant laws and regulations.