The rise of banking-as-a-service (BaaS) tools has dramatically lowered the barriers for entrepreneurs looking to launch fintech startups or for existing businesses aiming to embed financial services into their offerings. These innovative solutions enable companies to seamlessly integrate financial services into their product experiences, significantly reducing development efforts, product complexity, and regulatory challenges associated with providing loans, financial accounts, and card products.

As technology continues to simplify the process of starting a fintech company, we’ve witnessed a surge of new entrants into the financial services industry, each striving to deliver tailored financial solutions to diverse user needs. However, while BaaS has streamlined the operational aspects of launching a fintech, founders must also navigate critical components such as product-market fit, monetization strategies, customer acquisition, and effective fintech marketing.

This guide outlines essential steps and best practices for building a successful fintech, particularly focusing on startups that provide financial accounts and card products. We combine our expertise with insights from leading fintech companies and financial communications agencies to help you design, build, and grow your business effectively. Additionally, consider participating in financial services industry conferences to network and enhance your fintech marketing strategy.

The fintech business is expanding at an unprecedented rate, transforming traditional financial services with innovative technological solutions. Fintech is changing how people and organizations handle their finances, from payments and loans to wealth management and insurance. This rapid evolution opens up the potential for budding entrepreneurs to develop ground-breaking solutions.

Launching a fintech startup is an excellent choice if you want to establish a business and work in the financial services industry. Traditional financial institutions are progressively losing ground to technologically advanced and inventive entrepreneurs, making fintech an exciting new area to explore.

This guide is intended for entrepreneurs with a passion for finance and technology who are considering starting their own fintech business. We will also offer vital information to investors seeking emerging fintech firms.

Hire services from a top Web app development company. Get a quote for your project!

What are Fintech Companies

Understanding Fintech: A Comprehensive Overview

A fintech is a business that provides a range of financial services—such as financial accounts, cards, or loans—delivered through software solutions. This term can refer to a “pure play” fintech company, where the core product is a financial service, such as a fintech that specializes in offering loans to small businesses. Alternatively, it can describe businesses that embed financial services within their platforms to enhance their primary offerings, like an appointment scheduling tool for salons that integrates online payment solutions and enables salon owners to process payments using a payment API for their websites.

With the rapid growth of the fintech industry, identifying a company as a fintech is increasingly complex. Many businesses now incorporate financial services into their core strategies, making it challenging to draw clear distinctions. As a result, more companies today can be classified as fintechs, highlighting the need for targeted B2B fintech marketing and collaboration with a fintech marketing agency to effectively communicate their value. For those seeking fintech software development, the variety of fintech software solutions available allows for tailored integration of financial services into diverse business models.

Fintech encompasses more than just convenient and accessible digital payment options. Innovative-driven businesses increase financial data and customer security with strong fraud protection measures. All of this helps financial organizations gain the trust of their customers. Even now, the fintech market is booming. Therefore, we will see many more wonderful features, such as eco-friendly solutions.

Key Sectors in Fintech

- Payments: As the number of digital transactions has increased, this sector has grown rapidly. Fintech businesses are transforming the way we pay with innovations such as mobile payments, peer-to-peer transfers, digital wallets, and cryptocurrency payments.

- Lending: Fintech challenges traditional lending patterns by making loans faster and more accessible. This encompasses peer-to-peer lending, crowdfunding, and alternative lending systems.

- Wealth Management: Fintech companies use technology to democratize wealth management services. Robo-advisors, investment platforms, and fractional investing are changing how people invest and manage their money.

- Insurtech: This industry applies technology to better insurance products and services. From claims processing to risk assessment, insurtech is improving the consumer experience.

- Regtech: firms focus on regulatory compliance and provide technological solutions to assist financial institutions in efficiently meeting regulatory obligations.

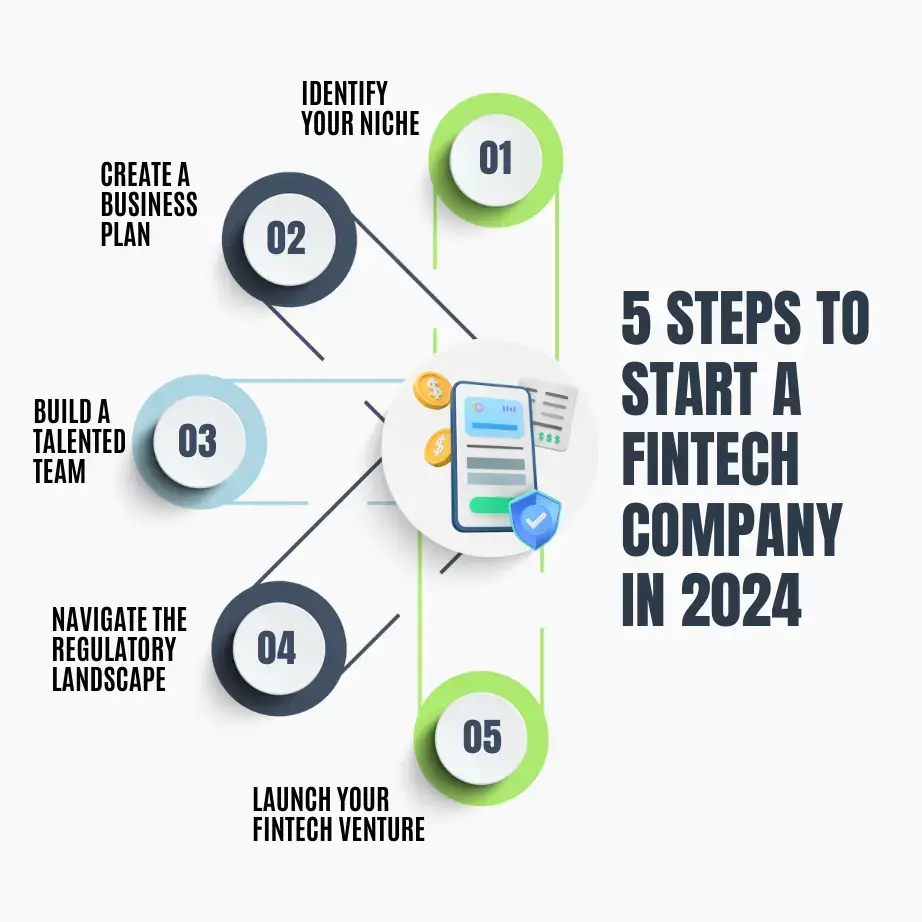

5 Steps to Start a Fintech Company

Starting a financial company is exciting, but it demands meticulous planning and execution. Here are five key stages to guide you:

- Identify your niche and create a strong value proposition

Analyze the fintech environment to find untapped markets or opportunities. Identify a specific financial issue that your target audience faces. Create a unique value proposition that distinguishes your financial company. Understand your competitors and how to outperform them.

Create a Solid Business Plan

Define your target market, client needs, and the competition landscape. Create detailed financial estimates for sales, expenses, and profitability. Outline your company’s activities, personnel structure, and important milestones. Determine your finance needs and prospective sources (bootstrapped, angel investors, venture capital).

Build a talented team

Hire people with experience in finance, technology, and business. Create a team with diverse abilities to foster innovation and problem-solving. Develop a collaborative and entrepreneurial corporate culture.

Navigate the regulatory landscape

Recognize the regulatory obligations of your fintech firm. Seek legal guidance to ensure compliance and reduce risks. Obtain the required licenses and permits to operate legally. Implement strong data security procedures to safeguard consumer information.

Secure Funding and Launch Your Fintech Venture

Create a captivating pitch to attract investment. As your business grows, consider different funding choices (seed, Series A, and Series B). Create a simple version of your product to gauge consumer response. Continuously collect client input and improve your product.

Latest Fintech Market Trends

The fintech market is expanding rapidly, owing to technological advancements and changing consumer behaviour. Among the key trends are open banking, embedded finance, artificial intelligence and machine learning, net banking, and BNPL. These trends are reshaping the financial landscape, creating opportunities for innovation and disruption. Analyzing market trends reveals a surge in digital payments, personalized financial services, and increased focus on financial inclusion.

Opportunities lie in developing solutions for underserved markets, leveraging AI for risk assessment and fraud prevention, and exploring blockchain for secure transactions. Collaborations between fintechs and traditional financial institutions are also promising avenues for growth. A deep understanding of consumer needs, regulatory environment, and emerging technologies is essential to fully capitalize on these trends. Below given are some of the popular Fintech trends in 2024:

- Cross-border payment transformation

Fintech aims to optimize corporate processes and cut costs. Financial institutions are adopting new business models to make cross-border payments faster and cheaper. This trend is intended to address the needs of customers who make purchases from overseas shops, and it is being driven by e-commerce, which necessitates international money transfers.

- Payment System Innovations

Fintech is based on cutting-edge technologies. One of the fintech trends in 2024 will be the need to remain competitive, and firms must embrace new payment options such as cryptocurrency to do so. They will need to develop new payment systems and goods focusing on customers. The popularity of cryptocurrencies and blockchain systems is expanding, and you can use these technologies to keep up with the latest innovative firms. Not all countries support cryptocurrency payments and strive to regulate the industry to make it more open and secure.

- Customer and payment security

Digital payments necessitate additional security measures and online fraud prevention. According to Statista, the e-commerce business would lose more than $41 billion to criminals in 2022, with an additional $48 billion at stake in the coming years. As customers migrate away from cash and make more purchases online, businesses must take extra precautions to stay secure while adhering to local laws and employing new security measures.

- Transparency of payments

Fintech companies want to stay transparent because it draws users and builds trust. The tendency in 2024 will be to retain the current level of transparency while also making loan pricing more transparent to consumers. Because of the macroeconomic situation, credit and lending are popular right now. Thus, offering technology that keeps individuals out of bad debt is becoming increasingly vital. Fintech enterprises will face obstacles such as inflation and the cost-of-living crises; they need to focus on transparent processes and technology to earn trust.

Conclusion

The fintech landscape is changing dramatically, with trends like open banking, embedded finance, AI, and neobanking emerging as key drivers of innovation. These developments create unparalleled opportunities for disruption within the financial services industry. By leveraging digital payments, personalized services, and promoting financial inclusion, businesses can capture significant market share. Perseverance and adaptability are essential for success in this fast-paced environment, as the fintech industry is characterized by rapid change, compelling organizations to respond to evolving customer needs and technological advancements.

To flourish, fintech startups must cultivate an innovative culture, form strategic alliances, and prioritize the consumer experience. A robust fintech marketing strategy can help businesses position themselves for long-term success by understanding underlying trends and responsibly utilizing emerging technologies. Participating in financial services industry conferences can also provide valuable insights and networking opportunities. The future of fintech is undeniably bright, but it will reward those who can navigate obstacles, seize opportunities, and deliver outstanding value.

Looking for the best fintech companies to collaborate with or outstanding Cross-Platform Developers for your startup? Hire our services!

FAQs

What is the first step in starting a fintech company in 2024?

The first step is identifying a specific niche or problem within the financial sector that you want to solve, such as payments, lending, or personal finance management.

How important is regulatory compliance for a fintech startup in 2024?

Regulatory compliance is crucial; fintech companies must navigate complex regulations to ensure they operate legally and avoid penalties. Understanding local and international financial laws is essential.

What role does technology play in building a fintech company?

Technology is the backbone of any fintech company. Using the latest technologies like AI, blockchain, and cloud computing is vital for creating secure, scalable, and innovative financial products.

How can a fintech startup secure funding in 2024?

Fintech startups can secure funding through venture capital, angel investors, crowdfunding, or strategic partnerships. A solid business plan and a clear value proposition are key to attracting investors.