In 2025, mobile banking apps have become an essential part of financial life in the United States. With the rise of fintech innovations, AI-powered financial apps, and digital payment platforms, customers now expect seamless, secure, and personalized banking experiences directly from their smartphones.

From everyday money transfers to investments and loan management, mobile banking applications for Android and iOS are reshaping how consumers interact with their banks. Whether you’re a financial institution or a fintech startup, building a powerful mobile banking app is now a necessity — not just an option.

This Ultimate Guide to Mobile Banking App Development in 2025 explores key features, trends, technologies, and business models that will dominate the U.S. mobile banking landscape in the years ahead.

Why Mobile Banking Apps Are the Future of Finance

The banking world has evolved far beyond traditional branches. In the U.S., over 85% of banking customers prefer using mobile banking apps to manage their accounts. The convenience, accessibility, and enhanced security of these apps make them the go-to financial tool for both personal and business banking.

Key Benefits of Mobile Banking Apps:

24/7 banking access from anywhere in the USA

Real-time fund transfers and digital payments

Secure login using biometric authentication (Face ID, fingerprint, or OTP)

Automated bill payments and spending insights

Integration with Apple Pay, Google Pay, and PayPal

AI-driven financial recommendations and investment tracking

As AI, blockchain, and 5G technology mature, mobile banking app development is driving a new era of digital financial transformation across the United States.

Must-Have Features in a 2025 Mobile Banking App

To stay competitive, your banking mobile app must combine cutting-edge technology, user experience, and compliance.

Core Features for Android & iOS Banking Apps

User Registration & Onboarding

Smooth sign-up with secure KYC verification and e-signature integration.Real-Time Notifications

AI-powered alerts for transactions, savings goals, and spending habits.Fund Transfers & Payments

Instant transfers, bill payments, and QR code-based transactions.Security & Authentication

End-to-end encryption, two-factor authentication (2FA), and biometric access.Budgeting & Analytics

Visual dashboards showing expense patterns and financial health.AI Chatbots

24/7 virtual assistants for customer support and financial insights.Multi-Currency & Crypto Integration

Support for USD and digital currencies for global customers.Card Management

Freeze, block, or manage cards directly within the app.Loan & Credit Management

Apply for loans, monitor EMIs, and track credit scores seamlessly.Customer Rewards & Cashback Programs

Encourage loyalty with gamified savings goals and rewards.

In 2025, mobile banking apps are powered by AI automation, machine learning algorithms, and API-based fintech integrations, giving users full control over their financial lives.

Latest Trends in Mobile Banking App Development (2025 Edition)

The mobile banking ecosystem is evolving rapidly in the U.S. Here are the top 2025 trends shaping fintech and digital banking:

AI-Powered Personalized Banking

Apps now use AI algorithms to recommend savings plans, investment opportunities, and customized offers.Voice Banking & Chatbots

With voice assistants like Siri and Alexa, users can check balances or make transactions using natural voice commands.Blockchain-Based Security

Blockchain enhances data transparency and prevents fraud in digital banking.Open Banking APIs

Banks are collaborating with fintechs to enable third-party integrations through secure open APIs.Sustainable & Ethical Banking Apps

Consumers prefer banks supporting eco-friendly initiatives and digital-only transactions to reduce paper waste.AR & VR in Mobile Finance

Some banks now use AR (Augmented Reality) to visualize savings or debt progress in real-time.Cross-Platform App Development

Fintech firms are opting for frameworks like Flutter or React Native to build apps that work seamlessly on Android, iOS, and the web.

How to Develop a Mobile Banking App Step-by-Step

Step 1: Market Research & Compliance

Understand U.S. banking laws, privacy regulations (like GDPR & CCPA), and target audience behavior.

Step 2: Choose the Right Tech Stack

Use React Native, Swift, or Kotlin for app development, and ensure backend scalability with Node.js or Python.

Step 3: UI/UX Design

Create a modern, minimal, and user-friendly interface with intuitive navigation and responsive layouts.

Step 4: Develop & Integrate APIs

Connect your app to payment gateways, bank APIs, and third-party fintech tools.

Step 5: Testing & Security Auditing

Perform rigorous QA testing, penetration testing, and compliance checks before launch.

Step 6: Launch & Marketing

Use App Store Optimization (ASO) and SEO-driven digital marketing to boost visibility.

Why Echo Innovate IT Is the Best Mobile Banking App Development Company in the USA

Echo Innovate IT is a trusted mobile app development company in the USA, specializing in fintech and banking applications. Our experts build secure, scalable, and feature-rich mobile banking apps for Android and iOS platforms.

Our Core Strengths:

Deep experience in U.S. banking regulations and compliance

AI & blockchain integration for secure transactions

Fintech-specific UI/UX design excellence

High-performance app architecture for Android & iPhone

Post-launch maintenance and optimization support

We help banks, credit unions, and fintech startups build apps that enhance customer engagement, reduce churn, and drive profitability.

SEO Tips for Fintech and Banking Websites in 2025

To rank your mobile banking or fintech website high on Google USA in 2025:

Use long-tail USA keywords like:

mobile banking app USA, best banking apps for Android 2025, iOS banking apps USA, digital banking software USA, fintech app development company USA, AI mobile banking solutions.

Optimize for voice search queries such as:

“Best banking app for iPhone in the USA”

“Secure mobile banking app for Android 2025”Publish E-E-A-T-friendly blogs that show experience and expertise.

Add FAQs, structured data markup, and mobile-friendly design for better rankings.

Focus on local SEO targeting U.S. states and major cities (California, New York, Texas, Florida).

Fintech (financial technology) is one of the most dynamic and rapidly growing technology sectors today. From mobile bank transactions to online shopping, users interact with finance mobile app development products daily. As mobile devices and mobile web access become more widespread, the demand for robust, user-friendly financial app development continues to rise.

With the total value of digital transactions projected to surpass $10.52 trillion by 2025, the importance of fintech mobile app development has never been more evident. This unprecedented growth has prompted startups and investors alike to seek finance software development services and partner with a reliable fintech software development company.

However, building a fintech app that truly stands out in today’s competitive marketplace requires more than just an idea. It involves expert knowledge of mobile application development, a strong development environment, and the ability to navigate between native development and cross platform development to deliver seamless experiences across various operating systems.

Whether you’re building a mobile app or complex web applications, the right software development strategy can make or break your project. With a growing number of web apps and mobile platforms, choosing the right approach—especially for fintech app development—is critical.

If you’re ready to dive into the world of app development and bring your vision to life on the app store, this guide is your starting point.

Mobile Banking App- One of the major beneficiaries of continuous digitalization is the finance industry. Consumers’ budgeting, investment, cryptocurrency trading, stock trading apps and other demands are already covered by fintech solutions.

Customers can manage their accounts and execute transactions remotely with the use of online banking services provided by banks. An account can be opened with only one visit to a bank location. Because of stronger user experiences and closely targeted USPs, digital-only financial institutions begin to outcompete traditional banks.

Consumers may use tablets, smartphones, and even smartwatches to manage their bank accounts and execute transactions. An online banking app development, it’s usually the next step for a bank. Because the majority of large banks now provide mobile banking apps, smaller banks must jump on board. At the same time, we’re seeing an increase in the number of mobile-first businesses, as well as partnerships, mergers, and acquisitions between traditional banks and mobile fintech startups. Hence, the future of fintech industry can be seen to be growing.

The pandemic boosted demand for remote banking services even more. Cashless and contactless transactions are becoming increasingly popular. The number of new mobile banking users increased by 200 percent in early 2020.

The mobile banking industry is expected to grow at a CAGR of 12.2 percent from 2019 to 2026, reaching $1,824.7 million. Nearly a third of the world’s population is said to use banking apps. This implies that 23% of the population is still untouched, therefore banking mobile app development financial services have a lot of potential.

This post is for you if you’re thinking about mobile banking app development for yourself. If you doubt the feasibility of such solutions, let’s have a look at the following features and benefits of mobile banking apps.

Why Prefer A Mobile Banking App?

When the coronavirus pandemic hit, mobile banking was already gaining momentum, but the disruptions and restrictions caused by COVID-19 rapidly transformed it from a convenience into a necessity. This shift fueled a surge in mobile application development, particularly in the area of finance mobile app development, as financial institutions raced to meet evolving customer needs.

The appeal of mobile apps for banking lies in their unmatched convenience. Since users carry their mobile devices everywhere, a well-designed financial app development solution acts like a bank in their pocket—empowering them to manage their finances anytime, anywhere. These apps, often available on both web apps and app store platforms, help users handle everything from transferring funds to tracking expenses with ease.

Amid reduced branch hours and limited customer service availability, the importance of fintech mobile app development has grown significantly. Businesses are investing heavily in software development that supports not only native development for specific operating systems but also cross platform development to ensure a seamless experience across all devices.

Behind every successful banking app is a powerful development environment and the strategic vision of a trusted fintech software development company. These companies specialize in creating secure and scalable solutions through fintech software development practices tailored to meet the high demands of today’s users.

From web applications to advanced fintech app development, the benefits of digital banking solutions are substantial—and in this article, we’ll explore why it’s essential to build fintech apps that meet modern financial needs through innovative finance software development services.

1. Digital Banking

Digital banking apps are revolutionizing the way people manage finances by eliminating the need to visit traditional bank branches. These apps offer nearly all the services of a physical bank—such as account opening, balance inquiries, fund transfers, payments, and loans—through a user-friendly mobile app interface.

Built using advanced mobile application development techniques, these digital banking solutions run smoothly across mobile devices and mobile web platforms. Leveraging both native development and cross platform development, developers ensure compatibility with major operating systems while delivering seamless performance.

For instance, N26 is a prime example of innovation in finance mobile app development. With its intuitive app development approach, N26 offers users complete control over their digital accounts via its mobile application, backed by biometric security, 3D Secure tech, and PIN authentication.

Such sophisticated apps are often developed by a fintech software development company using robust development environments and industry-leading software development practices. Regular push notifications, built-in alerts, and 24/7 accessibility enhance user engagement, making them indispensable financial app development tools in today’s mobile-first world.

2. Digital Payments

Digital payments are a cornerstone of the fintech app development revolution. Whether through e-wallets, contactless payments, or digital currencies, these solutions provide a fast, secure, and cashless method of transaction—especially valuable in a time when convenience and safety are paramount.

Businesses across industries now build fintech apps to handle everything from daily purchases to international transfers. These web applications and web apps are backed by secure APIs and integrate easily into existing finance software development services.

Take PayPal for example—a global leader in digital payment processing. It allows users to send and receive money securely, without revealing sensitive financial details. Thanks to its compatibility with net banking and major credit/debit cards, it exemplifies the future of fintech mobile app development.

Such platforms are crafted using expert software development techniques that ensure robust performance on both mobile web and app-based ecosystems and are often available on every major app store.

3. Digital Investment

The rise of digital investment platforms shows how fintech continues to democratize financial markets. These apps empower users to buy and sell stocks, ETFs, or even cryptocurrencies with just a few taps—removing traditional barriers to entry.

Apps like Robinhood and Invstr are built through advanced fintech software development methodologies. They combine smooth interfaces with real-time analytics and learning tools, enabling smarter investment decisions. With secure integrations to thousands of banks, they highlight the role of financial app development in delivering value to users.

Many of these apps are built using both native and cross platform development approaches to ensure broad device support and performance consistency across all major operating systems. Their success showcases the importance of choosing the right development environment and leveraging comprehensive finance software development services.

Whether through standalone web apps or hybrid solutions, the goal remains the same: to create secure, scalable, and engaging platforms that simplify the world of investments.

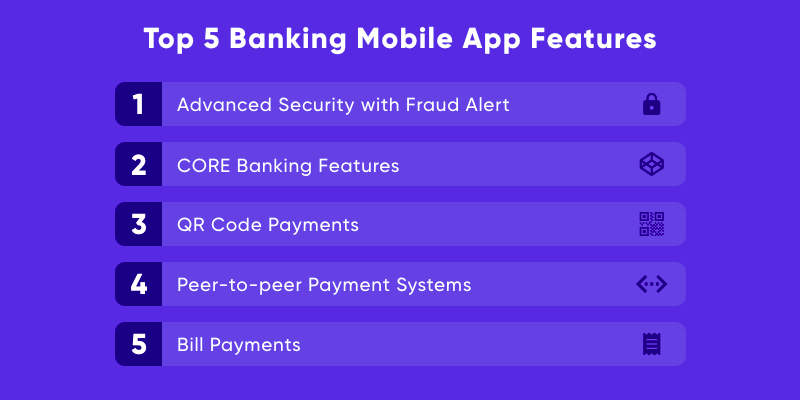

Top 5 Banking Mobile App Features

Advanced Security with Fraud Alert

These days, you can never be too careful. When it comes to sensitive data, users want the absolute best protection against hackers and cyber theft.

For banking app development to be successful, you must first include a secure sign-in feature. You want to make it so that logging into a user’s online banking account requires specific procedures, but not so many that it frustrates customers.

There’s a thin line between being careful and being paranoid. A good banking app ensures that the sign-in process is quick and simple while also safe, providing the user with peace of mind.

Multi-factor authentication, for example, is a very safe technology, but it takes a long time to set up. This feature isn’t the best choice for a banking app because anything that takes a long time is never attractive to the user.

Biometric authentication, on the other hand, verifies individuals by examining their physical metrics. This powerful technology, among other things, can distinguish a person’s typing rhythm, voice, and even physical gestures.

Additions such as touch ID or voice recognition are also feasible choices. You can even include many security settings to give the consumer a sense of variety. This allows you to customize your mobile banking app while maintaining the highest level of security.

Another important feature to include in a banking app is fraud alerts. App developers, engineers, and programmers are becoming savvier as fraudsters and hackers get cleverer.

To avoid fraud, systems monitor thousands of transactions each second. The user is the first to be notified of any suspicious behavior is noticed.

CORE Banking Features

CORE banking, or centralized online real-time exchange banking, is a back-end system that handles transactions and updates almost instantly.

All kinds of services are offered via multiple digital channels thanks to cutting-edge banking software.

CORE banking software can be customized to specialize in retail banking, wholesale banking, or securities trading. Here are a few examples of CORE banking capabilities that are service-oriented:

- Enrollment in new accounts and account management for existing accounts

- Withdrawals and deposits

- Loan management

- Calculation of the interest rate

- Customer relationship management (CRM)

- New financial products are introduced.

- Maintenance of records

- Is the intermittent fasting app free?

QR Code Payments

QR codes are becoming increasingly popular in mobile apps, allowing users to quickly and easily make purchases by scanning their code on a barcode reader.

Leading banks are already integrating QR code scanning technology into their applications, leveraging the QR code trend.

QR codes are an excellent option for both issuers and businesses looking to expand their customers’ mobile payment options.

Customers appreciate QR code payment solutions because they are simple to use, convenient, and give enhanced security.

Peer-to-peer Payment Systems

Peer-to-peer payments (also known as P2P) are an online technology that allows a user to transmit money straight from his or her bank account or credit card to another person.

The public’s acceptance of mobile payment options is beginning to explode. According to Jim Marous’ Digital Payment Report. If the banking industry does not want to lose its tech-savvy clientele, it must adapt to emerging trends in mobile payments.

While P2P payments have never been about making money, they are nevertheless one of the most effective ways to keep users engaged.

Organizations are increasing their investment in payment solutions in order to improve customer experience and experiment with new payment methods, such as peer-to-peer (P2P) payments.

Your consumers can use Peer-to-Peer payments to give or request money directly from one other using simply an app. It’s an almost instantaneous method (whereas transferring money to a bank account can take a few days). This gives the consumer a sense of independence by removing the need to rely on a larger institution to execute a money transfer.

PayPal dominated the market with this technology for more than a decade, but now more banks and credit card companies are willing to accept person-to-person payments.

Bill Payments

Paying bills via check is inconvenient, time-consuming, expensive, and harmful to the environment. It’s also not the most secure option.

Checks are lost or stolen in the mail system. They get misplaced and buried behind documents in the recipient’s mailbox.

Using a banking app to pay your bills also has plenty of advantages. Users can set up automatic bill-pay settings so that they never miss a payment. In addition to the ease of paying bills from anywhere at any time directly from their smartphone.

They can set up one-time or monthly payments, as well as customized email or SMS alerts to tell them when money is sent to them, account activity occurs, and more.

Users can pay as they go for varying amounts, such as utility bills, whenever their bill is due.

Setting up recurring payments with fixed installments for things like mortgages and car loans is the best way to go. When the bills are due, the cash will immediately be withdrawn from the user’s account, ensuring that they never miss a payment.

Top Benefits Of Mobile Banking App Development

Having access to the bank 24*7

Mobile banking, unlike a bank office, allows you to access your account at any time – with a few restrictions. Such as planned maintenance upgrades and unexpected outages.

You will save time as a result of the convenience of access. For example, mobile check deposit, which is available in most banking apps, allows you to deposit a check while on the move or from the comfort of your own home.

Consumers with pandemic-related health issues and other reservations about banking in person may benefit from mobile banking.

Getting the most out of your money

The finest mobile banking apps have evolved to make it easier for you to manage your money. Customers with checking accounts, for example, can use the Ally Bank app to manage their money digitally and maximize their savings potential. When the US Bank app’s algorithms detect money-saving opportunities or circumstances where an account is at risk of being overdrawn, consumers are notified. Varo, a federally chartered challenger bank, also offers automatic savings tools and ApexEdge, a third-party service that assists consumers in negotiating reduced bill payments. Another feature of the mobile banking app development that can help you save money is spending alerts.

Paying IOUs

IOU stands for ‘I Owe You’ which is a document that acknowledges the existence of a debt. It’s simple to repay someone you know while you’re connected to your mobile banking app.

Banks throughout the country have partnered with Zelle to allow you to send money to someone in minutes via the bank’s mobile app instead of paying with cash or a cheque.

To send money, you only need the recipients’ email addresses or phone numbers. If your bank does not offer Zelle, you can typically transfer money to another person’s bank account if you have their routing and account numbers.

Increasing Security

Banks are in the business of safeguarding your assets—including those accessed through mobile app transactions. In the world of finance mobile app development, ensuring security is a top priority. If you’re concerned about the safety of mobile banking, there are advanced measures powered by financial app development and modern software development practices that help protect your information.

Most mobile applications developed today, especially those from leading financial institutions, require a username and password at login, enhanced by additional layers of security such as multifactor authentication. This common feature in fintech app development combines two or more forms of verification—like entering credentials and confirming a numeric code sent via SMS—to ensure user identity.

Thanks to innovations in fintech mobile app development, many mobile devices and banking apps now support biometric authentication, such as facial recognition or fingerprint scanning. These advanced capabilities, supported by secure development environments and best practices in native development and cross platform development, enhance both convenience and protection.

To further combat fraud, your mobile banking app may include features to remotely lock or disable your device if it’s lost or stolen. Some apps even use geolocation services—enabled through web applications or mobile web access—to help detect suspicious activity.

Leading fintech software development companies implement these features as part of secure, scalable finance software development services, ensuring compliance with financial regulations across all operating systems. Whether listed on the app store or used as web apps, these solutions are developed with high standards in app development to help keep your assets safe in the digital age.

Providing added controls

Consider a mobile banking app to be your money’s remote control. The application lets you deposit checks and send money to anyone at any time.

These restrictions are becoming highly advanced. Some bank apps, for example, allow you to activate a new credit or debit card.

It isn’t the only way that banks allow users to manage their cards. An increasing number of banks, including Wells Fargo, Ally Bank, Chase, and Bank of America, offer Cryptocurrency Mobile Apps that allow you to disable your debit or credit card if it is lost or stolen. It’s a good feature that can make you feel more secure in a panic. It’s also not necessary to call a toll-free number to switch your card back on.

Providing transparency into where your financial data is going

Many people use services like Venmo and Mint to share their bank information. It can be difficult to remember which company has what bank data depending on how many outside apps you use. As a result, a number of banks are changing the way data is shared behind the scenes to help clients understand where it’s going.

Providing you with customized options

If you’re looking for a group of people who share your interests, mobile banking offers a choice of options to cater to specific demographics. For example, Daylight is a digital bank that focuses on financial concerns that LGBTQ communities face, such as decreased mortgage approval rates. Daylight has also collaborated with Visa to develop a debit card that displays account holders’ chosen names instead of their birth names, which may appeal to those who have transitioned their gender.

Top Benefits Of Mobile Banking App Development

- Chase

- PNC

- Capital One

- Varo Bank

Conclusion

Most financial companies are well aware that they will not be able to stay up with the competition or grow unless they develop apps for banks and other digital solutions. It’s become the standard strategy for financial app developers to provide services aimed at younger generations.

The current state of mobile banking gives plenty of room for creative solutions. It’s time to share your most ambitious ideas with your app developers or a trusted outsourcing partner if you’re a fintech startup.

If you’re looking for fintech app developers, Echoinnovate IT should be an ideal choice. Banking app development or its mobile version from scratch we offer provides you with a cross-functional dedicated team to bring your idea to life from start to finish, as well as maintain and perfect your web and mobile banking apps for years to come.

FAQs

What is the cost of developing a mobile banking app?

The cost of developing an app for a bank varies between $100,000–$500,000.

What should be my priority when building a mobile banking app?

If you are a tech company looking to build such a product, focus on regulations and compliance. There are over 120 of those you need to comply with if you want to become a bank.

What are AI SEO tools?

The 2025 update prioritizes helpful, user-centered, and experience-based content.

How can fintech websites rank higher on Google in 2025?

Focus on E-E-A-T signals, voice search optimization, and high-quality backlinks from U.S.-based sites.

What are the latest SEO ranking factors?

Page experience, content depth, backlinks, AI integration, and local SEO.

What are AI SEO tools?

Tools like Jasper, SurferSEO, and Semrush AI help automate keyword research, meta writing, and ranking analysis.