Gone are the days when cash ruled as the primary mode of exchange, making it essential to understand how to create a payment app that meets modern digital transaction needs. Today, payment app development has become a cornerstone of modern financial technology, enabling seamless, secure, and instant payments through methods like contactless payments, credit card, debit card, and digital wallet solutions such as Google Pay and Google Wallet.

From P2P payment app development for peer-to-peer transfers to mobile payment app development for eCommerce payment integration and retail, digital platforms now allow users to send and receive money effortlessly. Advanced wallet app features, tap to pay technology, and real-time payment processing are just a few of the innovations driving this space.

A well-designed mobile wallet app supports multiple use cases, including secure payment solutions, online transaction app capabilities, and custom payment app development for both iOS and Android. Whether integrating a payment gateway, enabling payment gateway integration, or ensuring compliance with terms and conditions and subject to credit approval disclosures, developers must prioritize both performance and compliance.

In this comprehensive guide, we’ll cover everything you need to know about digital wallet development—from essential features to technology stacks, monetization models, challenges, and real-world examples—ensuring your app stands out in the competitive world of fintech app development and online payments.

Digital payment industries are experiencing tremendous growth. Money is moving faster and easier than ever, from contactless transactions at local coffee shops to international remittances. Yet this growing landscape remains highly competitive: established giants and newcomers vie for user attention, making differentiation challenging in such an inflated marketplace. How do you create a payment app that stands out in this crowded landscape?

At its heart lies the difficulty in creating something beyond basic transaction functionality. Users today expect more than simply sending and receiving money; they require seamless experiences, ironclad security measures, and innovative features that simplify their financial lives. That is why this blog exists: to offer actionable insights for creating a payment app development guide that survives and thrives.

User expectations in today’s digital environment have grown increasingly ambitious; users expect instantaneous gratification, personalized services, and absolute trust from the businesses they use, but failure to do so often leads to user churn and missed opportunities. Therefore, understanding the features of a successful payment app that resonates with modern users is key to its success. Let’s delve in and discover ways this can be accomplished!

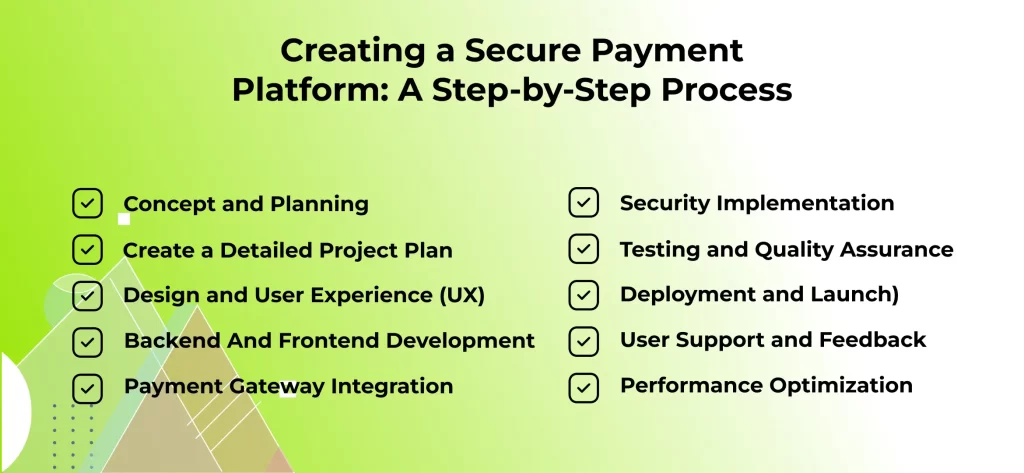

Building Your Payment App: A Step-by-Step Process

Building a payment app requires careful and structured execution. Below is an outline of its key stages:

1. Concept and Planning

The initial phase is crucial: define your app’s core purpose, target audience, unique value proposition and conduct comprehensive market research to identify gaps or opportunities; outline essential features/functionality as well as goals/objectives established – this phase sets up all other activities related to your project while guaranteeing that real user needs will be met by it.

2. Draft an Intricate Project Plan

Develop an in-depth project plan detailing timelines, milestones, resource allocation, and budget. Break your project down into manageable tasks and assign responsibilities; additionally, this plan should contain risk analysis and mitigation strategies to navigate any obstacles or hurdles along its journey effectively.

3. Designs to Enhance User Experience (UX)

Payment app user experience is essential, so its user experience should be intuitive and seamless to facilitate transactions. Utilize wireframes or prototypes to visualize user flows for maximum usability while taking note of visual aesthetics, navigation, and accessibility. This type of UX will increase user adoption of your service or app.

4. Backend and Frontend Developments

Develop a scalable backend infrastructure that handles transaction processing, data storage, and security for your app’s transactions and storage requirements. Select appropriate programming languages, frameworks, and databases based on app requirements before developing an engaging front that delivers user engagement across devices.

5. Payment Gateway Integration

Integrate reliable and secure payment gateways to ensure seamless transactions compatible with various payment methods such as credit/debit cards, mobile wallets, and bank transfers. Consider transaction fees, processing times, and security protocols of different gateways when choosing gateways for integration.

6. Security Implementation

Implement strong payment app security features to protect user data and prevent fraud, such as encryption, multi-factor authentication, and fraud detection systems. Adhere to industry standards like PCI DSS for transaction processing security while conducting regular security audits and penetration tests to monitor progress.

7. Testing and Quality Assurance (QA)

Perform thorough testing to locate and fix bugs while assuring optimal app performance on multiple devices and operating systems. Conduct unit, integration, and user acceptance testing (UAT). Test for compatibility and reliability before going live.

8. Deployment and Launch

Ensure an orderly deployment by configuring all systems correctly. Create an effective launch strategy that incorporates marketing and user acquisition plans for optimal success, then monitor its performance closely after launch while promptly responding to any potential issues.

9. User Support and Feedback

Utilize outstanding customer support to address user inquiries and resolve issues quickly and effectively. Establish feedback mechanisms to capture insights and suggestions from app users – then use this input to optimize and continuously increase user satisfaction with your app.

10. Performance Optimization Options Available Now

Constantly monitor and optimize the app’s performance by addressing any bottlenecks that slow loading times; scaling infrastructure as necessary to accommodate increasing user traffic; regularly upgrading with new features and enhancements for maximum competitive advantage.

Payment app compliance requirements are of utmost importance in their creation and deployment processes, so we must consult legal and financial professionals during development and deployment practices to meet all required regulations.

Essential Features

A secure and user-friendly payment app needs key features to protect users and enhance convenience. User authentication—including OTPs, biometrics, and multi-factor authentication—ensures only authorized access. Secure payment solutions like end-to-end encryption and AI-powered fraud detection safeguard financial data, while wallet app integration simplifies the ability to send and receive money using methods such as credit card, debit card, and digital wallet services like Google Pay and Google Wallet.

Transaction history provides transparency with detailed records, and push notifications keep users updated on online payments, balances, and important alerts in real time—essential for a seamless mobile payment app experience. This is particularly important in peer-to-peer payment app development, where real-time payment processing, security, and trust are critical. For apps that support contactless payments and tap to pay functionality, ensuring user privacy and safety is a top priority.

Compliance with terms and conditions and clarity around subject to credit approval requirements is also crucial for credibility, especially in regions with strict financial regulations.

Advanced Features

To improve functionality, security, and user experience, modern payment apps incorporate advanced features that streamline transactions, enhance global accessibility, and protect against fraud.

P2P Payment: Enables fast, secure peer-to-peer transactions for seamless money transfers through mobile wallet app development.

Multi-Currency Support: Expands reach by allowing users to transact in various currencies.

AI-Powered Fraud Detection: Strengthens security and protects online transaction app activity.

Rewards and Loyalty Programs: Boosts engagement with cashback, loyalty points, and promotional incentives.

eCommerce payment integration: Essential for businesses, enabling smooth payment gateway functionality and payment gateway integration for seamless online checkouts.

Custom payment app development: Tailors solutions to specific business models and niches, ensuring your payment app for iOS and Android stands out in a competitive fintech app development landscape.

Digital wallet development: Integrates secure, convenient payment options that cater to the demands of today’s users.

Conclusion

Creating an excellent payment app involves understanding your audience, prioritizing user experience, and welcoming innovation. We’ve examined every stage, from initial concept planning through ongoing performance optimization, with particular attention paid to robust security features like seamless integration and regulatory compliance requirements. Always think creatively while keeping user needs foremost – that way, your app will meet and surpass user expectations.

Digital payments are constantly shifting, which requires businesses to remain agile and adaptable in their approach, continually finding ways to strengthen their app’s value proposition. To stay successful in this space, one must remain nimble and constantly seek improvements that could add value for consumers.

Are you looking to transform your vision into reality? Navigating the complex world of mobile payment app development can be challenging. Still, Echoinnovate IT‘s expertise lies in crafting custom mobile payment solutions tailored specifically for each of its clientele’s specific needs – from initial concept development and design through secure gateway integration and post-launch support services – we guarantee its success and ensure its longevity!

Contact Echoinnovate IT now for a consultation, and let us help create a payment app that stands out in an increasingly competitive marketplace.

FAQs On Creating a Payment App That Stands Out

What features make a payment app truly stand out in today’s market?

A standout payment app should offer seamless user experience (UX), real-time transaction tracking, top-notch security (e.g., biometric login, end-to-end encryption), and multi-platform support. Integrating value-added features like budgeting tools, rewards, or crypto support can also give your app a competitive edge.

How important is UI/UX design in the success of a payment app?

UI/UX is critical. A smooth, intuitive design builds trust and keeps users engaged. Complex, clunky interfaces often drive users away—especially when dealing with something as sensitive as money. Clear navigation, responsive design, and user-centric features are key.

What security measures should be prioritized when developing a payment app?

Start with robust authentication (2FA, biometrics), encryption for data in transit and at rest, and secure APIs. Compliance with standards like PCI DSS and regular security audits are essential to ensure user trust and regulatory alignment.