Risks are undeniable and everyone needs insurance for different purposes. During a time of heavy loss or personal damage, simply nobody sits at home and watches what is going to happen next. Thus it’s a mutual benefit for both: Insurance providers and policyholders to share a common medium of Insurance Mobile App Development. Policyholders are always looking for premium insurance services right from their homes, meanwhile, insurance providers want to optimize their insurance business and reach maximum customers. Thus there’s no doubt that we need to develop more INSURANCE APPS!

According to statistical data, it is predicted that the insurance market will grow at a compound rate of around nine percent per year, reaching almost 8.4 trillion U.S. dollars in 2026.

Now, you might be wondering why these digital insurance applications are so famous among the population and how these companies have benefited from Insurance Mobile App Development. Well, this is what we are going to discuss today. Furthermore, we’ll also learn a few simple steps by which you can build your own Insurance App and expand your business digitally.

So let’s begin..

Why Do Insurance Companies Need To Invest In Mobile App Development?

Do you know that out of 100 top Insurance Companies, only 49% have their own mobile applications? This simply proves that companies need to focus on building their own mobile apps with providing premium and unique services to flourish in the insurance market. Today, the only medium that can connect customers directly with their favored companies is SMART PHONES. Therefore, many firms that serve both individual customers and companies in the insurance industry are focusing on “mobile-first approach.” And with this, Insurance Mobile App Development comes as a savior!

Invest in Mobile Insurance Apps: Key Reasons

Shifting Expectations And Behavior Of Consumers

Customers expect accessibility and ease in the digital environment we live in. And so, policyholders can communicate directly and conveniently with their insurance providers using mobile apps. They can simply file claims, obtain policy information, and get real-time updates. To sum up, higher levels of client satisfaction and loyalty are the result of this improved involvement.

Convenience And Accessibility For Policyholders

Insurance companies can provide their clients with individualized experiences through mobile apps. Insurers can customize policy recommendations, offer discounts or promotions, and provide pertinent information by using data analysis and user profiling. In addition to increasing client pleasure, customisation also increases potential for cross-selling and upselling.

Simplifying Insurance Procedures To Increase Productivity

Insurance businesses can speed up a number of internal procedures with the use of mobile apps. Automation and digitalization save manual labor, minimize errors, and increase overall operational efficiency in a variety of processes, including underwriting, claims processing, and policy management. As a result, customers can expect faster delivery service and cost friendly output from this.

Also Check:

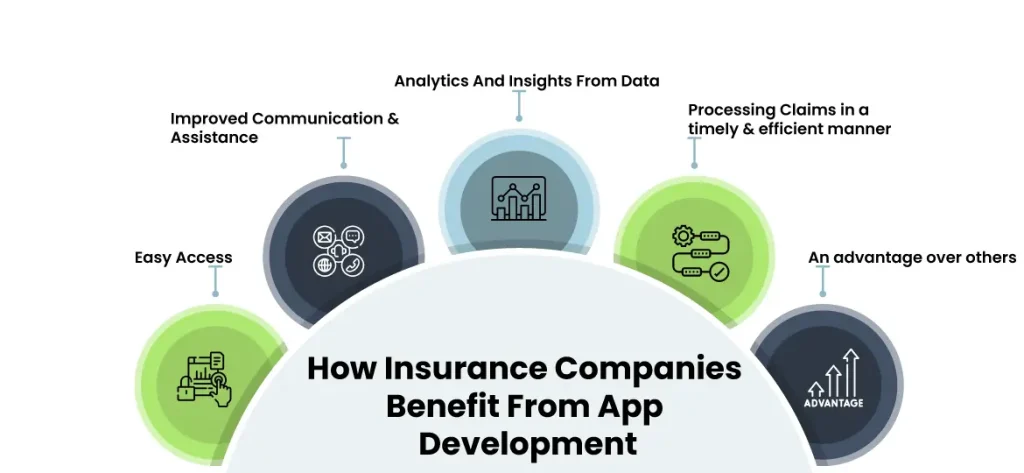

How Insurance Companies Have Benefitted From Building Digital Insurance Apps?

Insurance companies can highly benefit from developing their own mobile apps. As they can customize their app features in accordance with customer needs and expectations. Apart from this, they can gain insights, ask customer feedback, enhance communication, and make the whole process easy and accessible.

Check out some of the advantages below :

Easy Access

Policyholders can easily access their insurance information, policies, and documents from anywhere at any time with the help of a mobile app. With only a few touches on their mobile devices, users can examine coverage details, submit claims, make payments, and access policy information. Also, thanks to self-service features, now customers have the opportunity to take control of their own needs.

Without contacting customer service or going to physical offices, they can manage policies, update personal data, add or remove coverage, and start policy adjustments. Thus, this self-service feature is entirely a game changer giving independence, saving time for users, and helping them to get rid of office visits and doing paperwork.

Improved Communication And Assistance

Thanks to mobile apps! Customers and insurance providers can communicate directly with each other. Through chat or messaging tools, customers may simply contact customer service, submit inquiries, and get immediate responses. Additionally, push notifications improve communication and engagement by informing clients about important information, policy modifications, and reminders for insurance renewals.

Now clients can access instructional materials and information to enhance their understanding of insurance concepts, coverage choices, and risk management techniques. The app’s articles, tutorials, and interactive features can help users maximize their insurance coverage, make educated decisions, and find the answers to their questions.

Analytics And Insights From Data

Insurance businesses can obtain useful data and insights from mobile apps. To better understand consumer demands, spot trends, and develop products and services that meet those needs, analysis of app usage statistics, user behavior, and preferences is possible. Moreover, providing tailored policy recommendations based on unique requirements and preferences is made possible by utilizing consumer data and analytics.

The app can improve users’ entire experience by suggesting coverage alternatives and highlighting special services and discounts that meet their needs by studying user profiles and behavior.

Processing Claims In A Timely And Efficient Manner

Customers can report and track claims conveniently with the use of mobile apps, which ease the insurance claims procedure. Through the app, policyholders can instantly submit images, videos, and other essential documents, which speeds up the processing of claims and minimizes the amount of tedious paperwork. Customers are kept informed and given transparency throughout the process with real-time claim progress updates.

What’s more? Customers can renew their policies straight from their mobile devices with the use of Mobile Insurance Applications, making the process easy by providing reminders. The software also allows users to simply and securely pay insurance premiums, doing away with the necessity for manual payment methods.

An Advantage Over Others

Insurance firms that have a feature-rich and easy-to-use mobile app have an advantage over their competitors in the modern digital world. Likewise, an attractive app may draw in and keep users, set a business apart from rivals, and increase client happiness and loyalty. Not to mention, insurance applications give users a place to grade services, leave reviews, and discuss their experiences.

The feedback provided by customers can assist insurance firms in better understanding their requirements and expectations, pointing out areas for development, and improving their insurance services. In this way, insurers can gain an advantage over competitors in the tough market.

Insurance businesses should make strategic investments in mobile app development to stay competitive, improve customer satisfaction, streamline operations, and take full advantage of the industry’s digital future. We provide customized mobile app development services for insurance companies to benefit most from their mobile applications.

Basic Features In Insurance Apps

What are some basic features you can find in a mobile insurance app? A successful app is not simply loaded with added features but includes a combination of customer feedback and experienced dedicated developers. Particular design elements with the integration of focused feature sets might decide the fate of your insurance apps.

Though below are some basic features that every insurance app developer might be adding at the initial developmental stage :

Management Of User Profiles And Registration

This is the introduction page where the insured person’s basic details are shown. Make sure the call-to-action buttons are visible and the design is organized and minimal. Secure user information, payment methods, assistance policies, and switch policies must all be shown on the profile page in an easy-to-understand manner.

Choosing, Browsing, And Customizing Policies

The specifics of the policy, how it works, and how much you can gain from it are all displayed on this page. It needs to showcase the various policies offered by your organization, each of which a single user may sign up for—for example, a car policy, a bike policy, and so on.

Enhanced Billing And Payment Features

For the development of any kind of mobile insurance app, payment gateway integration is absolutely essential. Payments from all major network providers, including Visa, Master Card, and others, should be accepted via the gateway. Offering EMI billing automation or a one-click payment method is essential for creating an insurance software that appeals to a wide user base.

Processing Claims And Monitoring Their Status

The most important step in Insurance Mobile App Development is including a section for filing claims. Now the days of waiting around to file a claim are over. Uploading proofs ought to be as easy as snapping a photo using the phone’s camera or the app’s scanner. Better still, if the procedure can be completed entirely on one page.

Sending Policyholder Notifications And Alerts

The most important step in developing an insurance web app is including a section for filing claims. Now the days of waiting around to file a claim are over. Uploading proofs ought to be as easy as snapping a photo using the phone’s camera or the app’s scanner. Better still, if the procedure can be completed entirely on one page.

Client Support

Chatbots are becoming commonplace. For most of the common questions, automated answers serve as a convenient solution. However, what about unintentional events? A user who is stuck with a broken car cannot be expected to rely on pre-feeded responses.

Therefore, don’t forget to include a Request a Callback or Connect with a Representative option in your Insurance Mobile App Development process. One of the most desired insurance app features is in-app call capability, which will help to transform the app into the disaster-avoidance, fast response tool that it truly is.

Also Check:

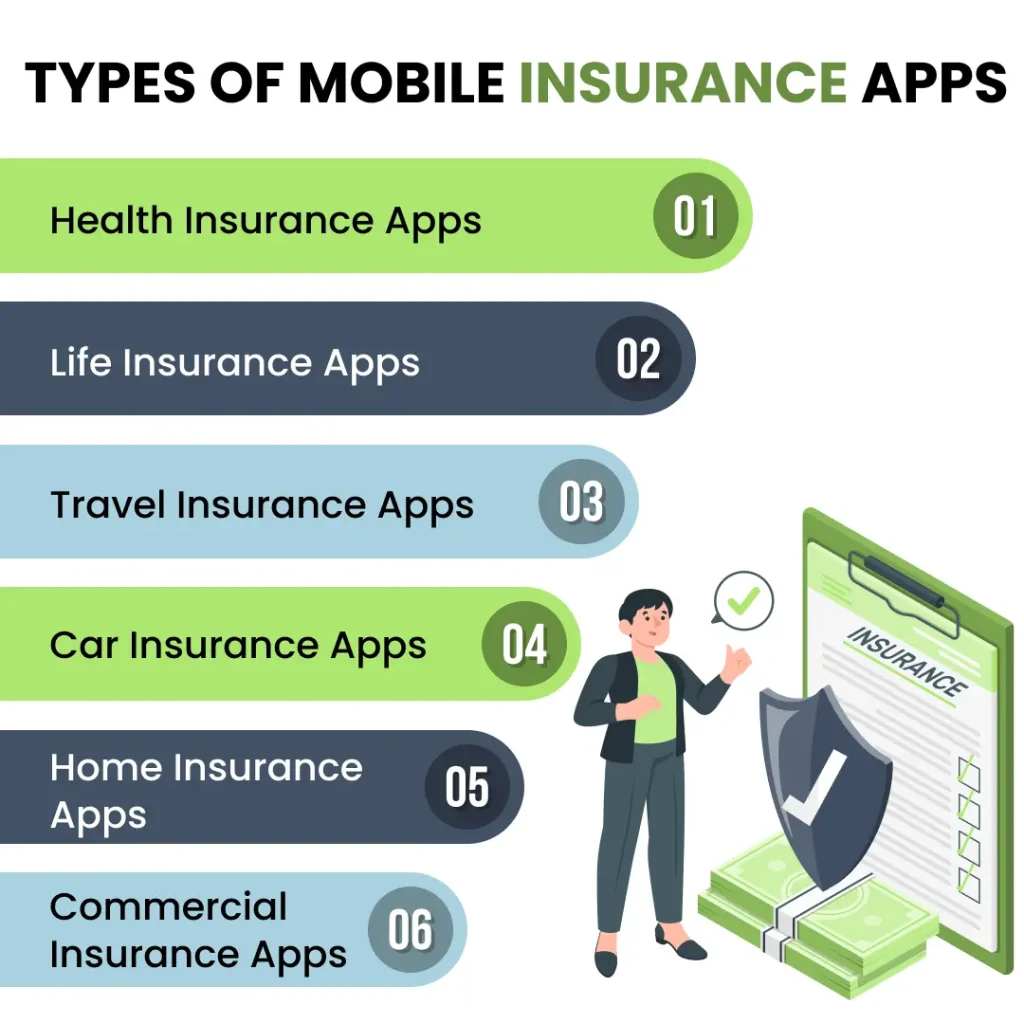

Types Of Mobile Insurance Apps Consumers Are Looking For

There are several types of Insurance apps and most probably these six are the most common type of insurance services consumers are looking for. Thus, your entire app development process depends upon the type of insurance app you are planning to build. Your company might excel in providing car or bike insurance or others in providing health or life insurance to their customers.

Below are some common insurance apps consumers are looking for :

Health Insurance Apps - For Better Healthcare Needs

Users may easily access vital healthcare and insurance information with the help of mobile health insurance apps. With this degree of accessibility, consumers may locate in-network providers, compare insurance plans, rapidly assess their coverage, and access their insurance information from any location at any time. They can be useful apps for patients, healthcare providers, insurance companies, and so on.

Some excellent examples of health insurance apps are Care Health, My Humana, myCigna, etc.

Life Insurance Apps - An Investment For A Safe And Secure Life

Purchasing a life insurance policy is an investment you make in your future financial security and well-being. It affects your loved ones’ futures profoundly and lasts for decades. You purchase life insurance to ensure that your loved ones are taken care of even in your absence. You should therefore be aware of how to purchase a life insurance policy.

HDFC Life Insurance App, Max Life Insurance, and Aetna Health are some of the popular examples.

Travel Insurance Apps - For Those Who Love To Travel But Safely

One kind of insurance policy that protects against the dangers involved with traveling is travel insurance. It can pay for lost luggage, medical fees, travel cancellations, and other losses. It may be for misplaced items from local or foreign travel. With the payment of an additional fee, several travel insurance plans provide additional risk coverage. Certain travel insurance plans are tailored to the individual traveler or the location they are visiting.

My Travel Insurance, Allianz TravelSmart, and Travel Insured are some of the examples.

Car Insurance Apps - To Ensure Your Car’s Safety

Car insurance apps are mobile apps providing automatic insurance via scheduled and controlled insurance applications. Although features vary with vehicle insurance applications, you can basically use your phone to fill out all of your information and receive a price in a matter of minutes. Even faster identification verification is possible if you use the phone’s camera to scan your driver’s license.

A few well-known apps are The General Auto Insurance App, Root, Policybazaar, etc.

Home Insurance Apps - To Protect Your Home From Dangers

An insurance policy that covers expenses and damage to your house or any other insured property is known as home insurance. It is one of the various categories of general insurance products and a sort of property insurance.

Hippo Home, Lemonade Insurance, Luko – N°1 Neo-insurance are some of them.

Commercial Insurance Apps - To Safeguard Your Valued Business

Often referred to as business insurance, commercial insurance shields companies from financial losses brought on by unforeseen circumstances that arise during regular business operations, such as accidents, natural catastrophes, or lawsuits. Commercial insurance comes in a variety of forms for companies, covering risks connected to employees, property damage, and legal responsibility, among other things

PandaDoc, RingCentral, Formstack are some of the popular choices.

Our app development company specializes in creating personalized mobile applications that are suited to the particular requirements of various sectors. Using our knowledge, we develop cutting-edge solutions that improve user experiences and propel corporate success in a variety of industries.

Also Check:

4 Essential Steps For Seamless Insurance Mobile App Development

Building your own insurance application is not as difficult as you think! With the right amount of design and content strategizing with hiring dedicated developers from EchoInnovate IT can help your company to flourish digitally. Here are four simple steps with which you can develop your own custom mobile insurance app easily.

Check them out!

1. Step Of Discovery

In the initial stage of discovery, a thorough analysis of the insurance market is carried out to clarify the entire development process. The development team initially establishes the development milestones, drafts a plan of action for the development process, and lists the main elements of the app that need to be incorporated.

2. Step Of Design

Second comes the design phase in your insurance app which will provide you with a realistic notion of how the app will work and assist you in understanding how it will appear once it is finished. It is advised that you begin by creating a design prototype, which will enable you to modify the user flows. Furthermore, a product prototype can serve as a helpful guide during the development process and serve as an elevator presentation for potential investors.

3. Step Of Development And Testing

In this stage, a functioning mobile app will be created using the working UI/UX design that was obtained during the design process. Both front-end and back-end programmers contribute to the process.

In addition, it is advised that a project manager supervise the development process and set the milestones to make sure the developers follow the stringent instructions and deliver the product on time. This will guarantee that all objectives are accomplished within the allotted time and help to keep the project on course.

Also Check:

4. Step of App Launch And Post Maintenance

Lastly, you can release your platform on Google Play and the Apple App Store as the next stage of the development process. Prioritizing customer feedback as soon as the product launches is essential. You can guarantee quick updates and changes as needed by examining and implementing customer feedback.

The major goal is to have more users since they will provide more input, which will help us enhance the platform and insurance products we offer. You can use ongoing input to address concerns and make improvements to your product.

Echoinnovate IT, an on-demand app development company will help you right from the initial stage from idea formation, designing your application, required tech stacks, testing, and launching process so that your insurance business can expand strongly in the competitive market today. Get additional post-maintenance support from us and launch your app with ease!

Tech Stack You Need To Build An Insurance App

Below mentioned are the following teck stack you can refer for developing a robust insurance app as per your needs :

- For Android Applications

Kotlin - For iOS Applications

Swift - For Cross-Platform Applications

React Native - For Backend Applications

Ruby – Node.js

Also Check:

How Much Time And Cost It Will Take To Design A Custom Insurance Mobile App?

The cost of Insurance Mobile App Development will roughly take between $30,000 – $300,000, although it may vary in terms of location, region, design elements, tech stack, and the overall development process.

Based on the complexity of your application, it may take roughly 4 to 7 months or even 10 months in developing an outstanding insurance app.

“Get a quote” today. (The final cost might surprise you!)

Conclusion

Finally wrapping up today’s blog on Insurance Mobile App Development! We hope we provided you with the essential things that need to be known about Insurance Apps. Developing An Insurance App might not be easy as we described above. But choosing EchoInnovate IT, might change your perspectives!

Why Choose Echoinnovate For Developing An Insurance App?

- Hire a dedicated and creative team available at on-site and off-site locations

- Sit back and relax as we design your Custom Insurance App from start to end process

- Get quick support and assistance from the entire team

- Customize your needs accordingly

NO INSURANCE NEEDED! Develop your Insurance Application with us while we at Echoinnovate IT provide you with insurance services without any real insurance policy!

Contact Us today.

FAQs

What role does user experience (UX) play in insurance app success?

A positive and intuitive UX is essential for user adoption and satisfaction. Clear navigation, minimalistic design, and user-friendly interfaces contribute to app success.

How can insurance companies promote their mobile apps?

Promotional strategies include social media campaigns, in-app promotions, partnerships, and offering incentives such as discounts or exclusive services for app users.

What post-launch considerations are important for insurance mobile apps?

Regular updates, user feedback analysis, bug fixes, and staying abreast of technological advancements are vital for the sustained success of an insurance mobile app.